U.S. Housing Market Rebounds as Pending Home Sales Post Record Surge in May

Has the U.S. housing market already turned a corner? One indicator says yes. | Image: AP Photo/Rogelio V. Solis, File

- The U.S. housing market witnessed a record 44.3% surge in pending home sales in May, signaling a broader economic recovery.

- All-time low mortgage rates have spurred the record rise, as well as improving consumer confidence.

- Rising house prices are likely to spur more consumer spending, which will boost the U.S. economy in the longer term.

U.S. pending home sales surged by a record 44.3% in May, according to new data from the National Association of Realtors . Having slumped by 22% in April, pending sales signal a remarkable recovery for the housing market.

All-time low mortgage rates helped spur the considerable rebound. Meanwhile, the Mortgage Bankers Association (MBA) had previously reported an 11-year high in home loan applications.

A recovering housing market will boost consumer spending and help the broader U.S. economy recover from the pandemic. However, a possible second wave may dampen house sales once again in the coming months, housing market analysts warn.

A Record Month For The U.S. Housing Market

May’s 44.3% increase is the largest monthly gain since the NAR began surveying sales in 2001. Not only that, but it beat forecasts of a more modest 15% increase.

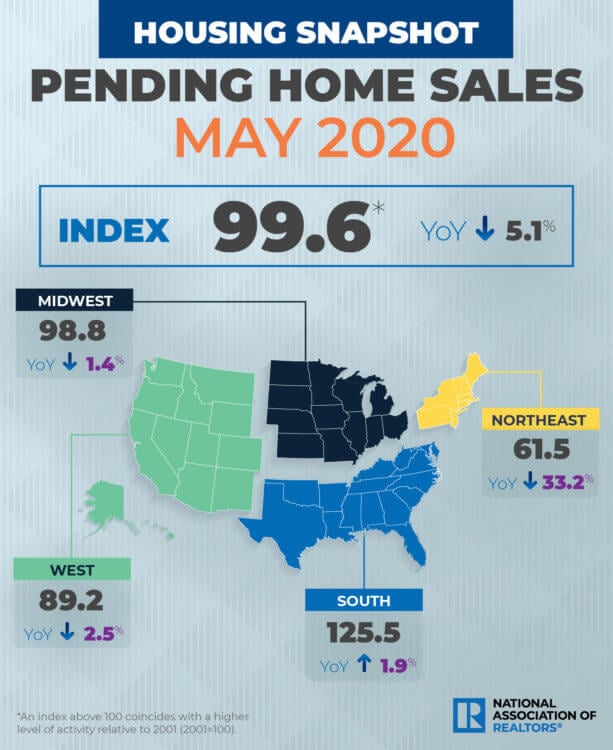

The 44% rise pushed the Pending Home Sales Index to 99.6. The index is still 5.1% lower compared with May 2019.

Nonetheless, the NAR’s chief economist Lawrence Yun affirmed just how surprisingly strong the figures are:

This has been a spectacular recovery for contract signings, and goes to show the resiliency of American consumers and their evergreen desire for homeownership.

He also highlighted that the housing market is a bellwether for the broader U.S. economy:

This bounce back also speaks to how the housing sector could lead the way for a broader economic recovery.

If nothing else, the strong figures vindicate the Federal Reserve’s decision in March to cut the base interest rate to zero . As a result of its move, U.S. mortgage rates hit a record low of 3.30% in June .

According to the MBA, record rates caused home loan applications to hit an 11-year high in the week ending June 12 . MBA’s Joel Kan said applications had risen for the “ninth consecutive week.”

The housing market continues to experience … a gradual improvement in consumer confidence.

Economic Recovery

A rebounding housing market will provide a broader boost to the U.S. economy. As the Bank of England notes :

When house prices go up, homeowners become better off and feel more confident. Some people will borrow more against the value of their home, either to spend on goods and services … or pay off other debt.

With sales rising, house prices in the U.S. have also continued to grow, despite the pandemic. According to the latest CoreLogic Home Price Index Report , U.S. house prices saw an annual increase of 5.4% in April.

Given that pending home sales spiked by 44% in May, and that applications hit an 11-year high in June, it’s likely that home values will also rise during these months. As such, homeowners will spend more, boosting the broader U.S. economy.

Several economists are predicting a deep depression for the U.S. and global economies. However, increased spending buoyed by the housing market could lessen the longer-term impact of the pandemic.

That said, with signs of a second wave in the U.S. , increased house sales could turn into decreased sales after June.

“Emerging virus hot spots in the South and West could derail the improving trend,” realtor.com chief economist Danielle Hale told CNBC .

In other words, all bets are still off when it comes to the housing market.

Disclaimer: The opinions expressed in this article do not necessarily reflect the views of CCN.com.