Hedge Fund Manager: Floored Bitcoin Price is Under-Owned

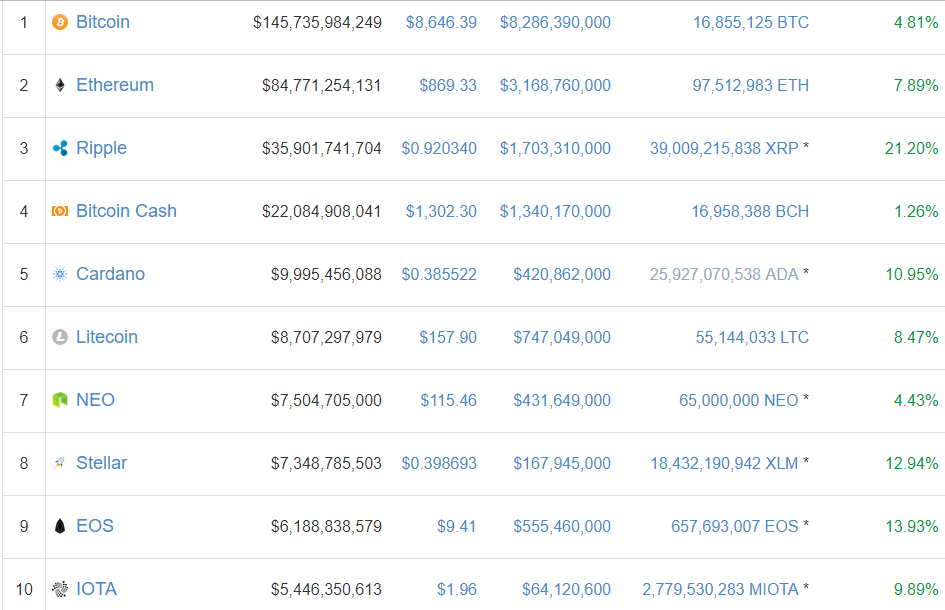

Bitcoin and the other leading digital coins are trading in the green on Friday. The bounce doesn’t surprise Dan Morehead, head of Pantera Capital, a $1 billion long/short cryptocurrency and blockchain hedge fund, who as an early bitcoin investor has seen this movie before, telling CNBC that bitcoin in recent days had reached a bottom. Bitcoin closed below $7,000 on Feb. 5, but it’s been mostly recovering ground since then, with the top cryptocurrency perched above $8,600 on Feb. 9. Meanwhile, institutional investor exposure to bitcoin hasn’t even scratched the surface.

Institutional Interest

Morehead’s bullish position on bitcoin seems to be predicated, at least somewhat, on his knowledge of his institutional peers, where he says “there’s such an appetite to get exposure to this,” adding that it’s a $500 billion asset class that “nobody owns.” With most hedge funds, pensions, private equity, etc. on the sidelines, the bitcoin price continues to march to its own drummer.

But a sign that the hedge fund industry’s interest is piqued is reflected in the data. HFR, which is the most widely cited hedge fund AUM and performance data for the industry, also oversees blockchain composite and cryptocurrency indexes. Meanwhile, those hedge funds with exposure to digital coins shed 10% in January, as per HFR data , but that was one in only a handful of months in which hedge funds with exposure to cryptocurrencies suffered declines.

Pantera’s Morehead has owned bitcoin since it was trading at $72 in a portfolio that also extends to Ethereum and XRP. In December, when the bitcoin price was nearing $20,000, he warned that the digital coin would shed 50% of its value before rallying again. “It’s volatile on the upside. It can be volatile on the downside,” he told CNBC.

It wasn’t the first bear market for Morehead, a former Wall Street trader, and he’s using tools from his MBS days to help navigate the tricky cryptocurrency markets. While there aren’t any guarantees, he does recognize a pattern. Based on the average cryptocurrency bear market cycle of slightly more than two months (71 days), the market will normalize within a couple of weeks. At that point, bitcoin will be poised to gain new territory.

Meanwhile, he touts bitcoin for its low 0.1% correlation to the broader financial markets, such as stocks, which he says is difficult to achieve in other asset classes. And while he’s got exposure to the main digital coins, he likens the digital tokens being issued in upcoming ICOs to small-cap stocks — high growth potential coupled with high risk — making them an interesting way to play the cryptocurrency markets.

That’s not too surprising, considering Pantera has tested the ICO waters itself, having launched a token sale last year. At its peak, the hedge fund was up 2,922%, boasted $2 billion-plus in AUM and had to disincentivize investors with higher fees to slow the pace of investments.

Featured image from Shutterstock.