Hedge Fund Bitcoin Buying Spree Accelerated 2400% in Q1: Grayscale

Grayscale tried to sell hedge funds a bevy of altcoin products. Instead, they just want to buy bitcoin, following the advice of this Janet Yellen photo-bomber from a 2017 Senate hearing. | Source: C-SPAN via Wikimedia Commons

By CCN.com: The bitcoin price enjoyed a wildly-bullish start to 2019, and the flagship cryptocurrency’s winning streak shows no signs of letting up anytime soon.

Hedge Funds Headline 42% Increase in Grayscale Inflows

While cryptocurrency remains a retail-dominated market, data from investment firm Grayscale reveals that institutional investors continue to ramp up their exposure to the asset class. And according to the firm’s newly-published first-quarter Digital Asset Investment Report , last quarter saw a massive surge in investments from one particular type of institutional investor: hedge funds.

During Q4 2018, hedge funds invested less than $1 million in Grayscale products, including the publicly-quoted Bitcoin Investment Trust (GBTC). During Q1 2019, hedge fund inflows jumped to $24 million for an eye-popping increase of more than 2,400%. In fact, hedge fund inflows accounted for 56% of all Grayscale investments for the quarter and helped power a 42% quarter-over-quarter increase in product inflows to $42.7 million.

“Grayscale experienced a 42% uptick in product inflows quarter-over-quarter, from $30.1 million in 4Q18 to $42.7 million in 1Q19. Notably, hedge funds ramped up their investments substantially, from less than $1 million in 4Q18 to approximately $24 million in 1Q19.”

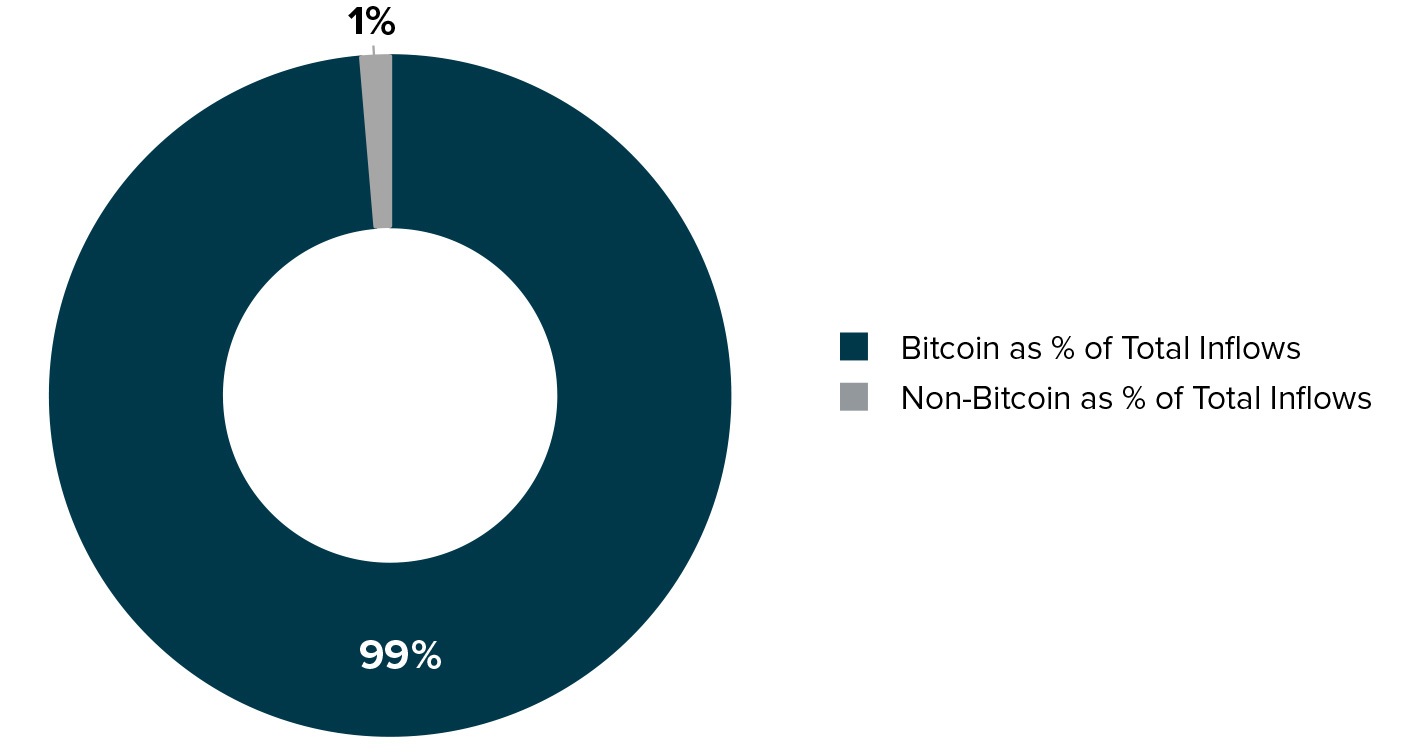

Bitcoin Absolutely Dominates Grayscale’s Investments

So where did Grayscale clients – which skew institutional due to accreditation restrictions and high investment minimums – direct their funds? The answer was pretty much the same as their retail counterparts: bitcoin.

According to Grayscale, a staggering 99% of all client inflows made their way into the Bitcoin Investment Trust rather than the firm’s bevy of other products that offer exposure to major altcoins.

“Nearly all inflows in Q1 were into Grayscale Bitcoin Trust (99%). One possible explanation for this is that Bitcoin found a ‘sweet spot’ with respect to relative risk and return expectations versus other digital assets.”

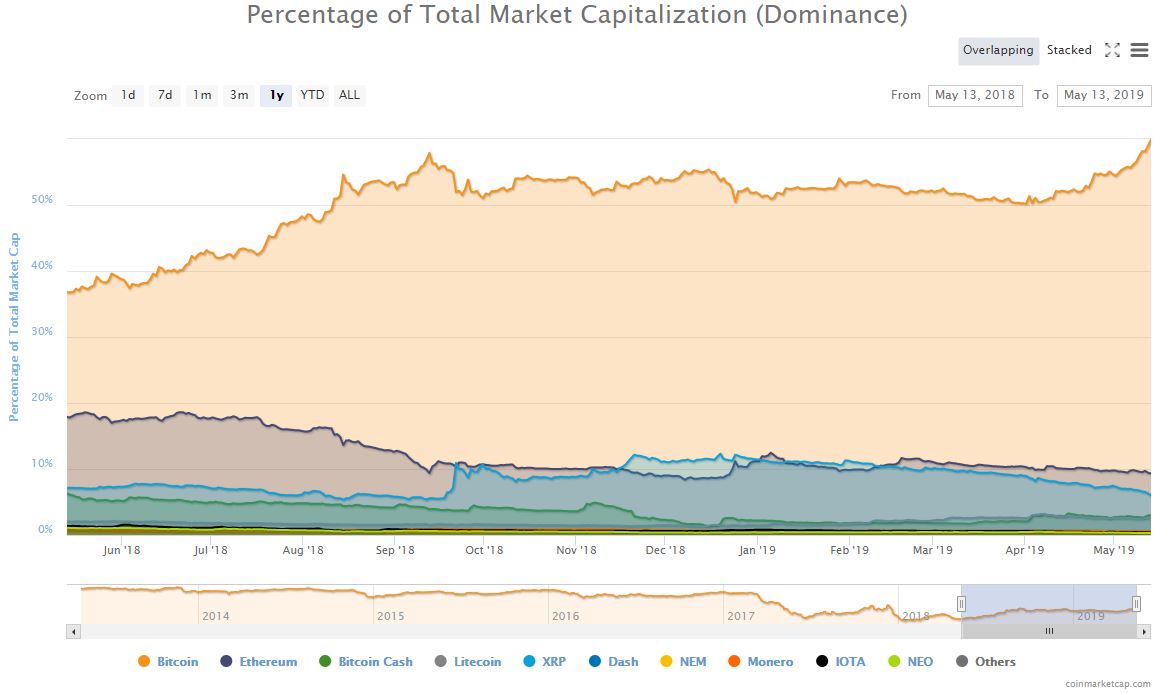

Bitcoin has outshined its competitors throughout the 2019 cryptocurrency recovery, enabling BTC to surge to its most dominant market position since December 2017. As of the time of writing, bitcoin and its $137.1 billion valuation retained a 60% strangehold on the entire crypto market cap.

But institutional investors’ seeming reluctance to invest in anything other than BTC is unprecedented. That has to be frustrating for Grayscale, which rolled out more than half-a-dozen altcoin-specific and cryptocurrency index funds in 2018 in the expectation that sophisticated investors would desire to diversify their exposure to the nascent asset class.

Instead, they just seem to want to buy bitcoin.