Grayscale Moves Clients’ Crypto to Coinbase Custody, Paves Way for Big Investors

Grayscale Investments is poised to move close to $3 billion in crypto assets across major coins to Coinbase Custody today. | Source: Shutterstock

Grayscale Investments, which at last check boasts approximately $2.7 billion in assets under management, is putting its money where its mouth is, so to speak. The crypto investment firm is poised to move “the assets for each of its products” to Coinbase Custody, the independent custodial arm of the U.S.-based crypto exchange, today. In doing so, they are sending a message to other big investors to come on in, the water is fine.

That’s nearly $3 billion in crypto assets across major coins including bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic, Litecoin, Stellar Lumens, XRP, and Zcash. Coinbase Custody will also hold the assets from Grayscale’s trio of investment trust products: Grayscale Bitcoin Trust, Grayscale Ethereum Trust, and Grayscale Ethereum Classic Trust as well as the Grayscale Digital Large Cap Fund.

$1 Billion in Crypto Already Held on Coinbase Custody

According to Bloomberg , Coinbase Custody had already attracted $1 billion-plus in cryptocurrencies on its platform, as of May 31. The addition of Grayscale’s crypto assets will bolster the size of assets by nearly threefold and has the potential to attract more institutional investors to the platform. When other big investors including hedge funds and the like see that Grayscale is moving billions of dollars’ worth of the underlying crypto assets in its investment products to Coinbase Custody, they may be more inclined to do the same thing. Custody has been one of the sticking points keeping institutional capital sidelined, but the regulated nature of Grayscale and Coinbase stands to change that.

According to Coinbase Custody CEO Sam McIngvale in a press release :

“Grayscale and Coinbase have led the way in providing safe, secure, trustworthy, and regulated access to digital assets. Grayscale is an established, trusted, and valuable partner to its clients and its service providers should be the same. As a NY State-chartered trust company, Coinbase Custody is held to the same fiduciary standards as national banks. We also offer some of the broadest and deepest insurance coverage in the crypto industry.”

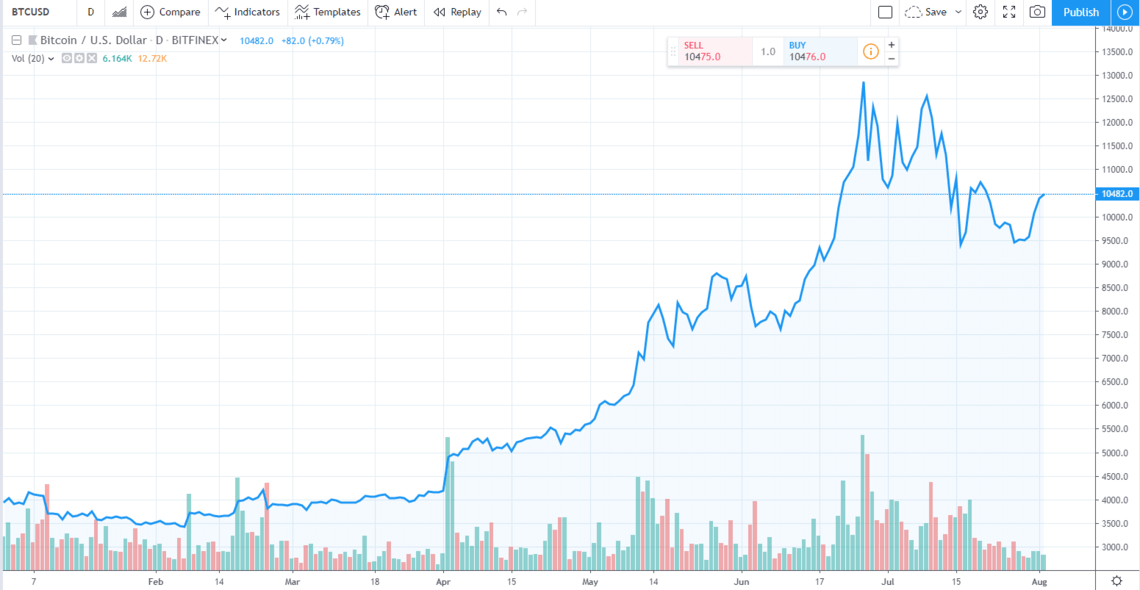

Bitcoin Trading Above $10,000 Once Again

The timing is seemingly too perfect for it to be a coincidence with the bitcoin bulls back in charge and Grayscale in the spotlight on Wall Street and in the mainstream financial media. According to Grayscale CEO Barry Silbert, the company’s “Drop Gold” campaign is set to air on both CNBC and Bloomberg TV next week. As a result, Wall Street will be reminded about bitcoin as the asset continues its bullish trend trading above the key $10,500 level.

This is sure to capture the attention of more institutions as the pieces of the crypto puzzle begin to fit together.