Vive La France! Facebook, Google, and Amazon Face $452 Million Tax Bill

Facebook's crypto project could be outshined by a surprised challenge from Nike. | Source: Shutterstock

France expects to collect $452 million in 2019 through a new digital tax that targets 30 Big Tech companies, including Facebook, Google, Amazon, and Apple.

On March 6, the French government introduced a 3% digital-services tax on tech giants that earn hefty revenues in France through targeted ads or digital marketplaces.

The tax will apply to tech companies whose annual global revenues top $850 million, and at least $28 million in France. The new tax applies retroactively going back to January, according to the Wall Street Journal.

The measure comes up for debate in April but is expected to pass easily because President Emmanuel Macron’s tax-happy party controls the majority in the French Parliament.

Europe Wants Its Cut of Silicon Valley Profits

France’s digital tax is part of a broader movement by European countries to profit from the revenue windfall that tech juggernauts like Facebook, Google, Apple, and Amazon earn in their countries as economic activity increasingly moves online.

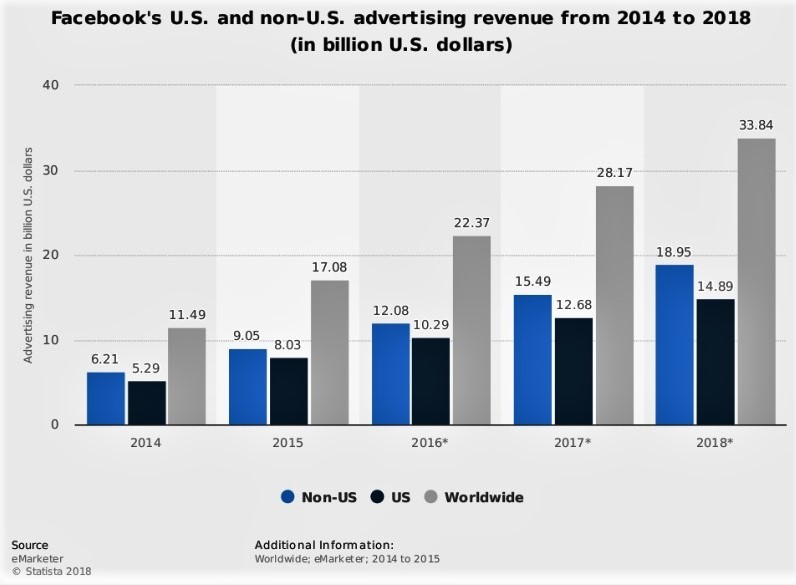

As CCN.com reported, Facebook’s ad revenue from 2018 alone topped $33.8 billion. So it’s no surprise that European nations — whose economies are flailing this year — want their share of that money.

France: It Is Time to Impose Digital Taxes

French finance minister Bruno Le Maire says it’s only fair that France collects taxes from these mammoth corporations because they make truckloads of cash by exploiting French consumers’ personal data.

Le Maire took a veiled shot at Facebook, which has been under fire for allegedly selling users’ personal data to third parties without their consent for years. Facebook faces a potential “record-setting fine” by the U.S. Federal Trade Commission for the epic data breach.

“These giants [like Facebook] use your personal data and make significant profit from it, without paying their fair share of tax.

They pour their products onto markets without even paying value-added tax, or hardly any other tax at all. It is intolerable.

A taxation system for the 21st century has to built on what has value today, and that is data.”

Germany, Spain and UK Mull New Taxes

Bruno Le Maire has been lobbying other European countries to impose digital taxes on Silicon Valley tech giants that profit from the European market, UPI reported .

Germany, Spain, and the United Kingdom are also considering introducing their own digital taxes to collect money from Silicon Valley’s mega-corporations.

Le Maire says it’s time for all countries to impose digital taxes because today’s taxation system is outdated and has not kept up with the meteoric spike in the massive, multi-national internet economy.

“Countries across the planet now understand they must impose a digital tax. It is a question of fairness.”

U.S. Tech Lobbyists Clap Back

Amazon and Apple have not commented on the forthcoming French digital tax. However, Google and Facebook say they will pay any taxes they owe in every country they operate in.

Not surprisingly, tech lobbyists are pushing back. The Computer & Communications Industry Association (CCIA) is a US-based lobby group that represents Facebook, Amazon, Google, and other tech companies.

Christian Borggreen, CCIA’s vice president for Europe, slammed the proposed French digital tax, saying it discriminates against tech companies. Moreover, he claims that levying the tax will ultimately hurt consumers because the companies will be forced to raise prices on their goods to offset any new taxes.

“France should lead efforts to achieve international tax reform, rather than taking unilateral actions that risk undermining global efforts.”