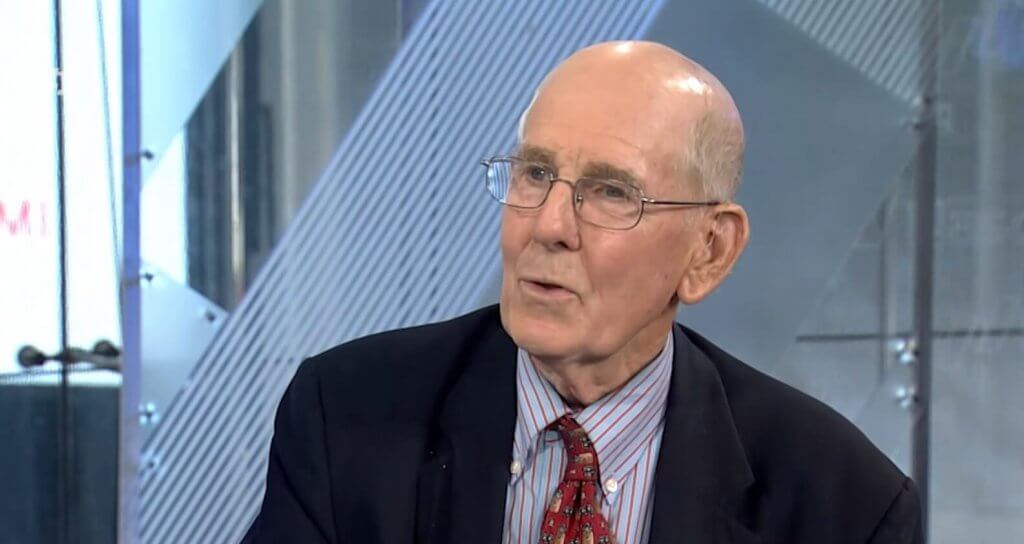

Financial Analyst Gary Shilling Shorts Bitcoin: It’s a ‘Grand Ponzi Scheme’

Financial analyst Gary Shilling said his eponymous New Jersey investment firm, A. Gary Shilling & Co., is shorting bitcoin because it’s “some kind of a grand Ponzi scheme.”

Shilling told CNBC that he’s troubled by the opaque nature of the crypto industry. Specifically, he’s concerned that the identity of Satoshi Nakamoto — the inventor of bitcoin — has never been revealed.

The veteran investor is also skeptical of the claim that there’s a fixed supply of the cryptocurrency. “There’s supposedly a limit on there, but where is it written in stone that that can’t increase?” Shilling wondered.

“And of course, the electricity that’s churned out by the miners trying to solve these algorithms is just extraordinary.”

‘I’m Not a Believer In Black Boxes’

Shilling is a notorious crypto skeptic, as CCN.com has reported. In October 2017, he admitted that he does not understand bitcoin and dismissed it as a “black box” (i.e., a complex investment model).

“I’m just very suspicious of things that are not transparent,” Shilling said at the time (see video). “If I can’t understand it, I don’t want to invest in it.”

Gary Shilling has not changed his mind and is resolute in his belief that crypto is a scam that won’t amount to much in the long run.

Shilling said bitcoin fails as a currency because it lacks three fundamental requirements of a legitimate currency:

- It’s not a store of value.

- It’s not a medium of exchange.

- It’s not universally accepted.

“We looked at this and said, ‘Let’s look at bitcoin compared to the requirements of a currency,'” he reasoned. “A currency has to have a store of value. With the volatility in bitcoin prices, I don’t think it has a store of value.”

Warren Buffett, Bill Gates Are Also Crypto Bears

Shilling also said that BTC fails as a medium of exchange. “If you want to get to the head of the line in bitcoin trading, you have to pay up,” he said.

Finally, he said bitcoin is not universally accepted, so to him, the only purpose for bitcoin is nefarious dealings like money-laundering.

“All the requirements that you normally have for a currency, it just doesn’t have,” Shilling said. “The only legitimate use I can think of in bitcoin is off-the-books kinds of transactions, underworld transactions. I just don’t see a legitimate use. It is a game.”

Shilling echoed the anti-crypto sentiments of billionaires Warren Buffett and Bill Gates, who expressed similar skepticism of virtual currencies.

In May 2018, Buffett blasted bitcoin as “rat poison squared” that only attract “charlatans.” Similarly, Gates said crypto is crazy, speculative gambling.

Next-Gen Billionaires Are Bullish

In contrast, a younger generation of tech billionaires like Twitter CEO Jack Dorsey, PayPal co-founder Peter Thiel, and tech venture capitalist Tim Draper are confident that bitcoin will ultimately displace all other currencies.

In fact, Draper is so bullish that he has set a $250,000 bitcoin price target for 2022, as CCN.com has reported. Despite the recent market slump, Draper stands by his exuberant prediction.

Draper — an early investor in Skype, Tesla, and Hotmail — believes that bitcoin will be bigger than all three combined because he says it’s a revolution that surpasses the Internet.

“This is bigger than the internet,” Draper said. “It’s bigger than the Iron Age, the Renaissance. It’s bigger than the Industrial Revolution. This affects the entire world and it’s going to be affected in a faster and more prevalent way than you ever imagined.”

Featured image from Youtube.