FDIC’s Ridiculous Ad to Stop Bank Runs Is Sending the Opposite Signal

FDIC Chairman Jelena McWilliams politely advises Americans against a bank run. | Source: Screenshot/FDIC video

- The FDIC released a video discouraging people from withdrawing their money from banks.

- The ad comes at a time when the reserve requirements of the Federal Reserve drops to zero.

- Virtually no one is buying FDIC’s latest antics.

The Federal Reserve Insurance Corporation (FDIC) released a one-minute video encouraging people to keep their money in banks.

In the video, Chairman Jelena McWilliams emphasizes that hoarding cash in mattresses “didn’t pan out well for so many people.” The video is intended to discourage a bank run.

It seems that nobody is buying the ad. On the contrary, it’s encouraging people to do the exact opposite.

Fed’s Reserve Requirement Ratio to Drop to Zero

FDIC’s anti-bank run ad comes at a time when the Federal Reserve’s reserve requirement ratios dropped to zero in two days . On Mar. 15, the Fed announced:

the Board reduced reserve requirement ratios to zero percent effective March 26, 2020. This action eliminated reserve requirements for all depository institutions.

Prior to this ruling, the fractional reserve system allows banks to lend 90 cents for every dollar deposited. Once the ruling takes effect, banks can lend all of your money.

In this time when financial institutions are scrambling for liquidity, it’s interesting that the FDIC released an ad that discourages people from withdrawing their money. Connect the dots and you’ll see that they plan to source liquidity using your deposits.

Jelena McWilliams is right about one thing. We are indeed living in unprecedented times.

FDIC Can Only Cover a Fraction of the Deposits

In the video, McWilliams stressed with conviction that no depositor has lost money of their insured deposits since the 1930s. That sounds encouraging except that the FDIC has reserves to cover 2% default on deposits.

What happens to the 98% in times of a pandemic or financial crisis? The FDIC simply doesn’t have the reserve to meet the demand, hence the ad to stop you from a bank run.

No One’s Buying FDIC’s Ridiculous Ad

After scouring through the comments section of the ad I see that virtually no one believes FDIC. On the contrary, many see the video as a sign to immediately head to the banks.

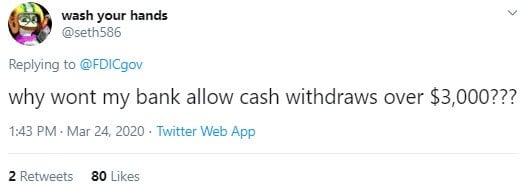

One pseudonymous account named ‘wash your hands’ said something very troubling. He replied that banks won’t allow him to withdraw over $3,000 of his own money.

Others are encouraging people to invest their money in safe-haven assets like gold or bitcoin instead of keeping money in banks.

We are living in unprecedented times. Why keep your money in institutions that led us here?

Disclaimer: The opinions expressed in this article do not necessarily reflect the views of CCN.com.