Famous Economist: Trade War Could Be Trump’s Shining Reagan Moment

President Trump's trade war is a risky strategy, but he's setting himself up for a shining global moment that can only be compared to that of Ronald Reagan. | Source: REUTERS / Shannon Stapleton

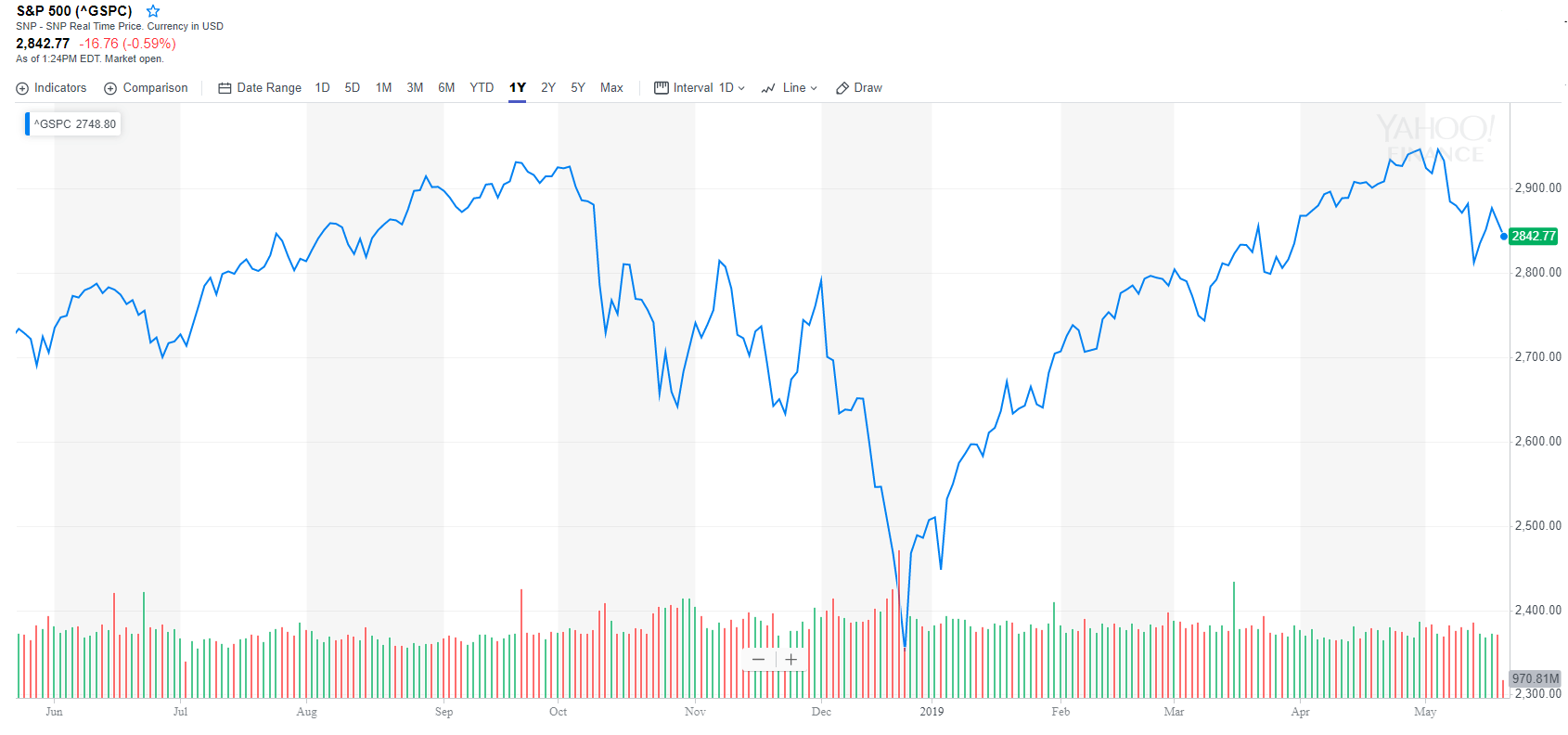

By CCN.com: President Trump has at least one renowned economist in his corner. Mohamed El-Erian is placing Donald Trump in the same category as America’s beloved Ronald Reagan. In an interview with CNBC, El-Erian, who is among the more open-minded economists out there, approached the trade war from a different vantage point. He said that China stands to lose the most in the trade war ignited by Donald Trump and Xi Jinping. Consider the S&P 500, which is miraculously unchanged over the last politically tumultuous month while emerging market stocks have tanked.

Clearly, the trade war is an extremely fluid situation, but the U.S. is in a stronger position. Tensions may not end overnight. But if you ask El-Erian, this momentary setback is increasingly looking like a setup for Trump’s shining moment.

“Remember we win a relative trade war. In absolute terms, we suffer, but we win relative to others. So I think the markets have understood that the U.S. is in a better place than the rest of the world. The question is can we stay there?”

He went on to say:

“I think we shouldn’t underestimate getting something Reaganesque. … If the U.S. goes full blown [trade war] – this is about national security it can actually change the global economics on a global scale.”

Back to 1980: “Reagonomics” and Trump’s Economy

While El-Erian didn’t go into many details about the Trump/Reagan comparison on CNBC, he previously opined :

“In the 1980s, U.S. President Ronald Reagan initiated a military spending race with the Soviet Union that ended up altering the global balance of power in ways that affected many countries worldwide. Today, Trump has launched a tariff race with China, an economic superpower, perhaps with similarly far-reaching potential consequences. Like under Reagan, the US is better placed to win the current competition with China – but the risks are sizable.”

Both Ronald Reagan and Donald Trump have displayed big kahunas for taking things so far. It paid off for Reagan.

Despite those risks, the pendulum has also swung further in Trump’s direction. If you have any doubt, just look at how tech leader Google has responded to Chinese tech play Huawei by suspending some business on Android. According to El-Erian, Google may be getting the most attention from the decision but it’s not the only company responding to the U.S. government’s blacklisting.

Meanwhile, the U.S. is in a stronger position for a myriad of reasons, including the following cited by El-Erian:

- “Relatively less dependent on foreign markets”

- “Possesses deeper domestic markets”

- “Generally more economically resilient than other countries”

As for China, the trade war has already taken a toll on its financial markets. Despite modest declines in the broader indices, the U.S. stock market is not doing too shabby.