Facebook’s Crypto Wallet ‘Calibra’ is Coming to WhatsApp in 2020

Libra website homepage

By CCN.com: The whitepaper of Libra, a crypto asset created by a non-profit organization in Libra Association led by Facebook has been formally released, disclosing key details of the digital asset and the blockchain protocol that supports it.

As speculated, Libra will operate as a stablecoin backed by the Libra Reserve and will represent the value of existing assets such as reserve currencies.

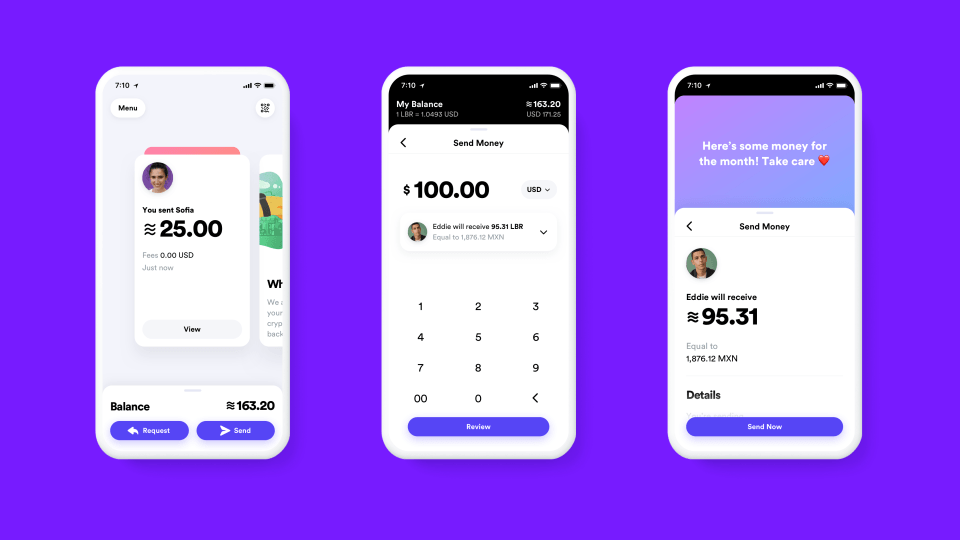

Facebook officially announced that Calibra, the first product built on top of Libra, will come to Messenger and WhatsApp as early as 2020, enabling users to send, receive, and store the crypto asset.

Following the footsteps of Samsung in creating a crypto wallet

In its whitepaper, Libra Association clearly indicated that it aims to decentralize the Libra blockchain network and evolve it into a proper cryptocurrency.

Libra Association expects the crypto asset to garner mainstream adoption and secure billions of active users in the long term, powered by dominant applications like Messenger and WhatsApp.

“The first product Calibra will introduce is a digital wallet for Libra, a new global currency powered by blockchain technology. The wallet will be available in Messenger, WhatsApp and as a standalone app — and we expect to launch in 2020,” said Facebook.

For Libra to support billions of users and achieve the level of adoption which cryptocurrencies have struggled to achieve in the past several years, it would need to demonstrate a relatively high level of decentralization and geographical distribution.

It is difficult to characterize Libra as Facebook’s crypto asset as it is operated by a non-profit organization with 28 founding members including the likes of Visa, Mastercard, and Uber. The whitepaper emphasized that the association intends to make the process of using Libra as easy as sending a message and it intends to evolve into a permissionless blockchain network over time.

Facebook added:

From the beginning, Calibra will let you send Libra to almost anyone with a smartphone, as easily and instantly as you might send a text message and at low to no cost. And, in time, we hope to offer additional services for people and businesses, like paying bills with the push of a button, buying a cup of coffee with the scan of a code or riding your local public transit without needing to carry cash or a metro pass.

With companies like Samsung, Fidelity, and TD Ameritrade operating various services like cryptocurrency wallets and crypto custody to help users store digital assets, analysts anticipate that Libra would contribute to the increase in the adoption of cryptocurrencies.

Being a stablecoin is crucial

According to the official whitepaper, the decision to maintain the value of Libra stable with a reserve of real assets was made to create a better environment for merchants and users, in general, to send, receive, and use the cryptocurrency.

The founding members of Libra include merchants like Spotify, Uber, Lyft, and Booking Holdings would prefer to accept a crypto asset that has low volatility and that is easy to process for users.

Targeting remittance, merchant adoption, and global financial inclusion, the Libra Association emphasized that the focus of the development of the cryptocurrency would be on usability, scalability, and transferability.

The whitepaper added:

Libra is indeed a cryptocurrency, though, and by virtue of that, it inherits several attractive properties of these new digital currencies: the ability to send money quickly, the security of cryptography, and the freedom to easily transmit funds across borders. Just as people can use their phones to message friends anywhere in the world today, with Libra, the same can be done with money — instantly, securely, and at low cost.