Europe’s Biggest Financiers Brace for Post-Pandemic Stock Market Plunge

The European Central Bank's monetary stiumlus program is being challenged but ECB president Christine Lagarde wants to do more than its $2.9 trillion asset-purchase program. | Source: Shutterstock.com

- Europe’s central bank is pushing for more stimulus as European stock markets recover.

- ECB faces opposition from Germany but intends to push forward with its plans.

- The aggressive stance of ECB may signal that they foresee a strong economic downturn coming.

European stock markets are bouncing back after the pandemic plunge. But, the European Central Bank (ECB) is pushing for additional stimulus , despite resistance from the region’s courts. It suggests top financiers foresee an economic slump in the latter half of 2020.

The Dow Jones Industrial Average (DJIA) is up 30.8% from its bottom at 18,591 points on March 23, 2020. The FTSE 100, which represents top 100 companies in the U.K., increased by 18.8% in the same period.

ECB is Concerned About the Stock Market Post-Coronavirus

Currently, the sentiment around the stock market primarily revolves around the state of the coronavirus pandemic.

U.S. and European stocks increased due to the anticipation of reopening the economy. Despite low earnings of major conglomerates, which even affected giants like Apple, the stock market continued to surge.

Scientists generally believe that the “epicenters” of coronavirus outside of China such as Italy, the U.K., U.S., and Spain surpassed the COVID-19 peak.

The optimism around the decline in new coronavirus cases further fueled irrational positivity among retail investors.

But, an important question still remains: what happens to the stock market after the coronavirus pandemic passes?

After the global economy stabilizes to a certain extent from COVID-19, the trend of the stock market will move based on the actual figures of public companies.

Economists worry that the potential disruption in supply chains in the upcoming months may rattle large-scale corporations in the short to medium-term.

Joseph E. Stiglitz, Nobel-winning Economist professor at Columbia University, wrote :

We should have learned the lesson of resilience from the 2008 financial crisis.

There are many variables that can spoil the rally of the U.S. and European stock market in the near future.

Coronavirus could come back in Winter , the U.S.-China trade deal may fall off, and disrupted supply chains may cause a significant decline in business productivity.

Based on such numbers, the ECB is gearing towards a fresh stimulus package.

Christine Lagarde, President of the ECB and former International Monetary Fund (IMF) managing director, said that the central bank is going ahead with its proposed $2.9 trillion asset-purchase initiative.

Still, the ECB has a long way to go to secure the stimulus.

The ECB faces opposition from the Constitutional Court of Germany , whose constitutional judges ruled against the stimulus proposal.

JPMorgan economist Greg Fuzesi said that ECB could tread more carefully or more aggressively to “demonstrate its independence.”

So far, Lagarde reaffirmed the ECB’s intent to move ahead with the stimulus. It indicates that it sees troubling numbers to weigh to ensure the stock market and the economy can become resilient.

Retail Investors are Fueling a Stocks Rebound, But it Remains Vulnerable

According to Michael Krause, co-founder Counterpoint Mutual Funds, retail investors drove the recent stock market rally more than anything else.

Krause said :

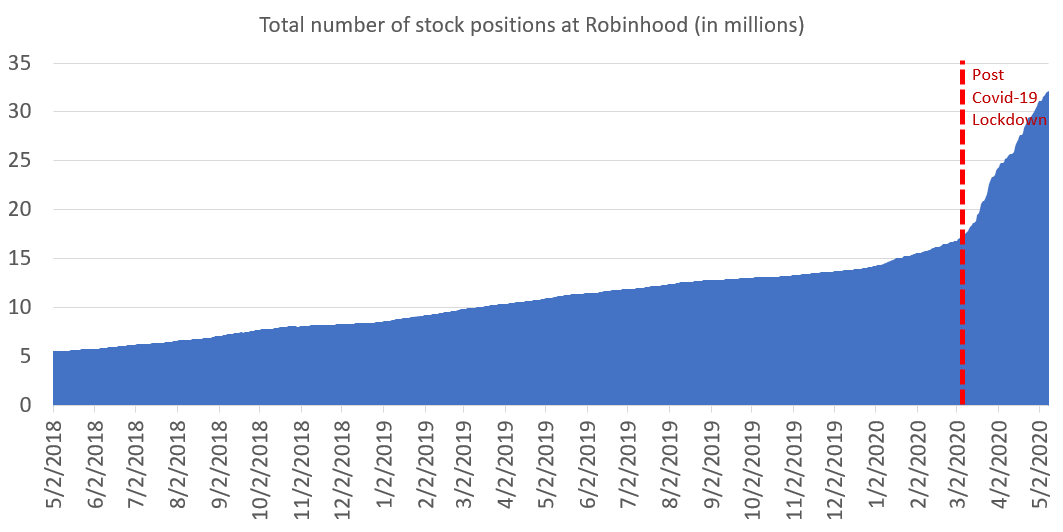

If you are wondering what has been fueling the stock market, daytrading and retail investor flows are alive and well. Robinhood, source: Robintrack/Robinhood API data. Good proxy for what all retail US stock traders are doing.

The sentiment around the stock market is rising as economies reopen, but the grim unemployment and business productivity levels show the vulnerability of equities.