Ethereum Token BAT Crashes Nearly 20% after Coinbase.com Listing

Ethereum token BAT rode the “Coinbase bounce” to a four-month high, but on Friday the cryptocurrency’s price fell back toward earth with a resounding thud.

Ethereum Token BAT Leads Market Pullback

The crypto market as a whole traded down heading into the weekend, with valuations collectively dropping by $6 billion over a 48-hour period. However, no large- or mid-cap cryptocurrency was hit as hard as Basic Attention Token (BAT), the native asset of Brave’s digital advertising ecosystem.

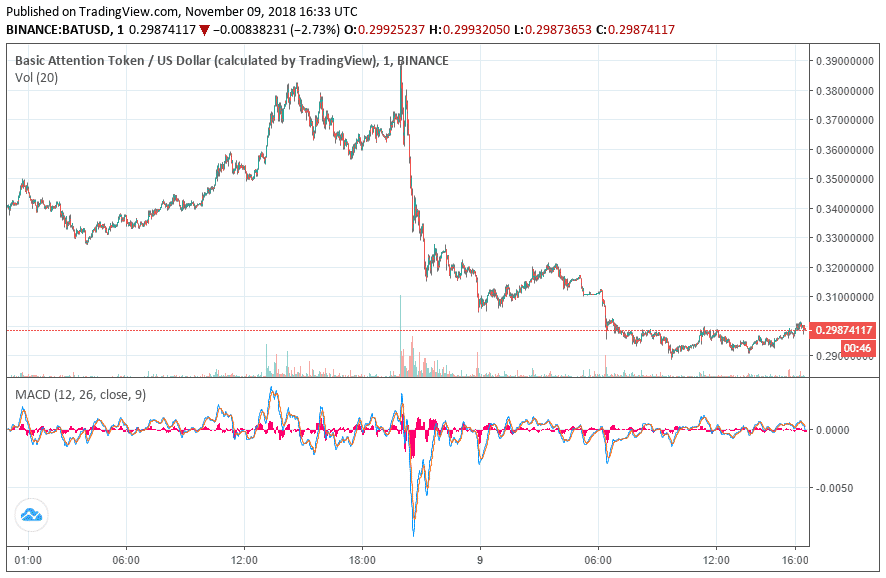

BAT, which runs on Ethereum as an ERC-20 token, fell more than 18 percent for the day. The majority of that movement occurred late last night, shortly after the BAT price peaked at $0.39 on Binance. The token has shed nearly one-quarter of its value since then and is currently priced just below $0.30, which translates into a market cap of $298 million.

BAT Takes a Hit after Coinbase Hype-Cycle Ends

Friday’s pullback, while not entirely reversing the gains BAT had made this month, nevertheless represented a marked reversal of fortune for the cryptocurrency.

BAT’s early November rally appears to have been virtually entirely connected to the token’s listing on Coinbase, which took place over several steps that saw BAT gradually integrated into the cryptocurrency trading giant’s various platforms.

Initially, BAT was listed on Coinbase Pro, the firm’s order-book cryptocurrency exchange. About one week later, after the exchange had developed a liquid trading market, BAT was listed on Coinbase.com, the brokerage service through which a significant percentage of cryptocurrency investors make their first crypto purchase.

That final listing occurred yesterday, bringing an end to the speculative hype cycle that inevitably surrounds a cryptocurrency’s price when it is listed on Coinbase — or supporters believe that it will be. BAT investors, it seems, bought the rumor and sold the news.

Featured Image from Shutterstock. Charts from TradingView .