Ethereum Price Tear Almost Reached $60

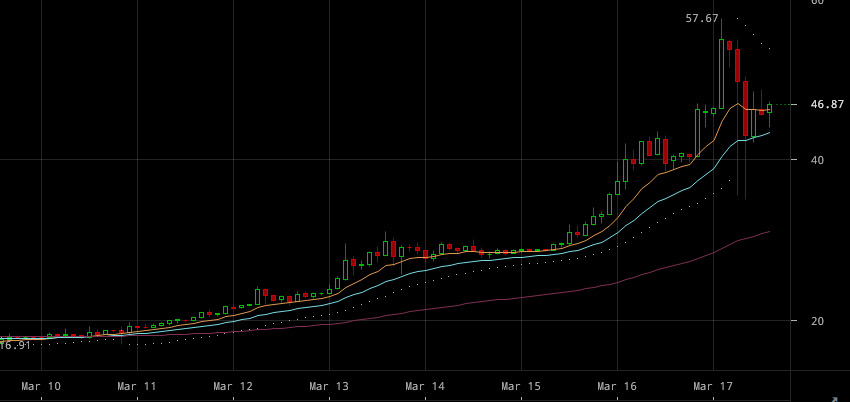

When Europe woke up this morning and checked eth’s price, they may have seen a small rise from $40 to $46, but America had a very eventful night.

Eth’s price rose to above $57 on Coinbase yesterday, giving it a market cap of more than $5 billion. It then quickly fell to around $35 and just as quickly rose to stabilize around $46, just in time for European investors to wake up and think nothing happened.

Some speculate the swings can be explained by institutional investors moving into eth. They may have quickly brought up the price, thinning the sell side, and then crashed it down, allowing them to buy in at a cheaper price.

But it may have also been organic as the currency gains momentum. Some of it is from bitcoiners, some from outside the digital currency space and some comes from no other place than South Korea, a country known for gaming.

Eth’s uses extend beyond just a currency to fully codable money which means it can be incorporated into fantasy games in a way that allows increased transparency and reduced cheating.

The seemingly enthusiastic adoption by South Korea may indicate that such gaming projects are underway or are being discussed, leading to a higher current price of $54 on Korbit, which describes itself as South Korea’s leading exchange.

Further momentum may have been given to the currency by increased in-fighting in the bitcoin community over the ever-rising transaction fees and delays which may have led to some bitcoiners switching to eth.

There is much talk about a flipping, a point where eth surpasses bitcoin’s market cap, with many bitcoiners saying in public forums that they have flipped. A statement that might be supported by bitcoin’s price fall of $100 yesterday.

Some urge caution. This is a currency that likes to move fast, break things, and then fix them. Setbacks should be expected as well as potential losses, but some are getting very rich.

It’s not clear whether frenzy has taken hold or whether this is just the beginning, but momentum in price and attention seems to have shifted from bitcoin to ethereum. If it can retain protocol level stability and avoid any debacles, it may go very high indeed as the race is now on.

Bitcoin won last time, but we’ll see who does this one. Its high transaction fees are clearly pricing out businesses, with most choosing eth as the alternative. The scalability debate continues with no resolution in sight. Miner’s indecision appears to have created protocol stagnation.

There seems to be a drip, drip, from bitcoin to eth, both from hodlers and businesses, with bitcoin’s market share of digital currencies falling to an all-time low . That drip might turn into a stampede as r/ethtrader now has almost as many users online as r/bitcoin.

Will it happen? Who knows, but the tweet by Peter Todd, a Bitcoin Core developer, who publicized a vulnerability that was being fixed, seems to have opened a new race between the two biggest digital currencies.

Featured image from Shutterstock.