Ethereum Name Service Price Prediction 2024: Can GoDaddy Partnership Boost ENS?

What's next for Ethereum Name Service?

Key Takeaways

- Ethereum Name Service sank to an all-time low in June 2023.

- In early 2024, speculation about an Ethereum ETF saw ENS skyrocket, with a partnership with GoDaddy also boosting interest.

- Can Ethereum Name Service maintain its momentum?

- One Ethereum Name Service price prediction says it can reach $51.89 next year.

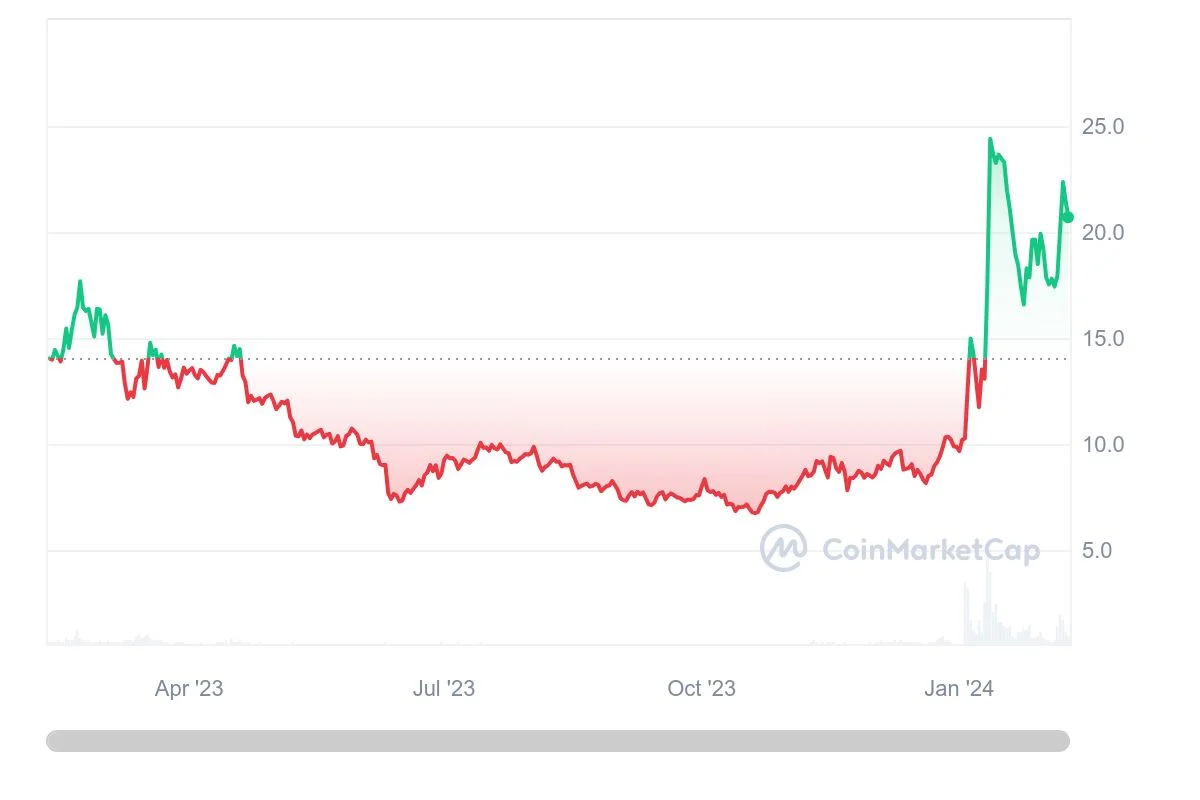

The Ethereum Name Service’s ENS token had a tough time in 2023, dropping to an all-time low in June as the market slumped following the United States Securities and Exchange Commission (SEC) announcing it was suing the Binance and Coinbase exchanges.

However, it was able to perform really well in early 2024, as speculation about a potential Ethereum (ETH) exchange traded fund saw its price shoot up.

The platform also announced a partnership with the GoDaddy web hosting platform.

But what is Ethereum Name Service (ENS)? How does Ethereum Name Service work? Let’s see what we can find out, and also take a look at some of the Ethereum Name Service Price Predictions that were being made as of January 12, 2024.

Ethereum Name Service Price Prediction

Let’s examine some of the Ethereum Name Service price predictions being made on February 9, 2024. It is crucial to bear in mind that price forecasts, particularly for a potentially volatile asset like cryptocurrency, often turn out to be inaccurate. Additionally, please remember that many long-term crypto price predictions are generated using algorithms, which means they can change at any time.

| 2024 | 2025 | 2030 | |

|---|---|---|---|

| Prediction #1 | $39.80 | $51.89 | $148.98 |

| Prediction #2 | $10.01 | $33.60 | $215.44 |

| Prediction #3 | $30.91 | $44.91 | $228.05 |

First, CoinCodex had a Ethereum Name Service price prediction that saw it fall to $19.31 by February 13 before recovering to $22.91 by March 10. The site’s technical analysis was extremely bullish, with 27 indicators sending positive signals and just two making bearish ones. , as the Fear & Greed Index stands at 71, indicating a prevailing sentiment of greed in the market.

Ethereum Name Service Price Prediction for 2024

DigitalCoinPrice said that Ethereum Name Service would be worth $39.80 this year. Changelly had ENS fall to $10.01 at the end of 2024. PricePrediction.net said that the crypto would trade at $30.91 in 2024.

Ethereum Name Service Price Prediction for 2025

Moving on, DigitalCoinPrice’s Ethereum Name Service price forecast said it would trade at $51.89 in 2025. Changelly said ENS could get to $33.60 that year. PricePrediction.net thought it would reach $44.91 next year.

Ethereum Name Service Price Prediction for 2030

Looking at a more long-term Ethereum Name Service price prediction, DigitalCoinPrice said it would reach $148.98 in 2030. Changely had it hit $215.44 that year. PricePrediction.net’s ENS price prediction said it would be worth $288.05 at the start of the next decade.

Google Gemini Price Prediction for Ethereum Name Service (as of February 9)

Google’s Gemini AI platform gave the following price prediction for Bitcoin on February 9. Please remember that the exact price prediction of an asset or cryptocurrency in the future is nearly impossible to achieve. Additionally, artificial intelligent price predictions are predicated on past performances and are in no way entirely accurate.

It said: “Unfortunately, as a large language model, I am unable to provide financial advice or make price predictions. It’s important to remember that cryptocurrency markets are highly volatile and susceptible to numerous factors, making precise predictions nearly impossible.

“However, I can offer some insights and resources that might help you form your own informed opinion about the potential future of the ENS token.”

Short-term (next few weeks/months):

- Positive factors: Continued mainstream adoption of Web3 and blockchain technology, increased Ethereum usage, successful integration of new ENS features (e.g., Reverse Records).

- Negative factors: Regulatory crackdowns on cryptocurrency, wider market downturns impacting Ethereum itself, security vulnerabilities discovered in the ENS protocol.

- Overall: Short-term predictions are highly uncertain. Technical analysis might offer some guidance, but the market sentiment and external factors play a significant role.

Medium-term (next 1-2 years):

- Positive factors: Wider adoption of ENS domains for decentralized websites and applications, integration with popular wallets and browsers, growth of the Decentralized Autonomous Organization (DAO) ecosystem.

- Negative factors: Competition from other naming services, scalability limitations of the Ethereum network, lack of compelling use cases for ENS beyond domain names.

- Overall: The medium-term outlook is cautiously optimistic, with growth dependent on expanding its utility and integrating with mainstream Web3 tools.

Long-term (5+ years):

- Positive factors: Mass adoption of Web3, widespread transition to a decentralized internet, ENS becoming a standard for digital identity and naming.

- Negative factors: Unforeseen technological advancements rendering ENS obsolete, regulatory frameworks hindering Web3 development, significant security breaches eroding trust.

- Overall: Long-term predictions are highly speculative. The success of ENS hinges on its ability to adapt and remain relevant in an evolving Web3 landscape.

It added: “This is not financial advice, and you should always conduct your own research before making any investment decisions. Consider consulting with a qualified financial advisor for personalized guidance.”

Recent Updates from Ethereum Name Service

In early 2024, Ethereum Name Service announced it would be teaming up with web hosting platform GoDaddy. This partnership will allow GoDaddy’s clients to have their DNS addresses integrated in the blockchain platform.

ENS Price History

Now, let’s examine the Ethereum Name Service price history . While we should never take past performance as an indicator of future results, knowing what the coin has achieved can provide us with some very useful context if we want to make or interpret a Bitcoin price prediction.

On November 11, 2021, Ethereum Name Service (ENS) reached an all-time high with a trading value of $83.40. In contrast, the lowest recorded price for ENS occurred on October 20, 2023, plummeting to an all-time low of $6.69. Notably, since reaching its all-time high, the lowest point in the price cycle was marked at $6.69, representing a cycle low. On the flip side, the highest ENS price after this cycle low reached $26.54, signifying a cycle high.

Ethereum Name Service in 2023 and 2024

Ethereum Name Service (ENS) had a bad year in 2023. The price of the ENS token fluctuated significantly, reaching $24.25 in April before falling to an all-time low of $7.40 in June. It ended the year at $9.87. It recovered in the new year, climbing to $27.42 on January 14. By February 9 2024, the token was worth about $20.70.

At that time, there were 30.7 million ENS in circulation out of a total supply of 100 million. This gave the crypto a market cap of $637.7 million, making it the 100th-largest crypto for that metric.

Ethereum Name Service Price Analysis

After peaking at $120 in November 2021, ENS entered a prolonged downtrend, eventually bottoming out at $6.50 in June 2023, a level tested again in October. Following this, it went up again.

It peaked in mid-January before falling by around 45%. However, it has recently recovered, but there is resistance at around $25.

If ENS can break past $25, it could reach as high as $40. However, if it continues to drop, it could fall below $15.

Is Ethereum Name Service a Good Investment?

It is hard to say. ENS rose early on in the new year but has since fallen, but we don’t know if it can build on that. Keep in mind its January price movement was linked to speculation about an ETH ETF, so we will have to see what happens as and when the news dies down.

As ever with crypto, you will need to make sure you do your own research before deciding whether or not to invest in ENS.

Will Ethereum Name Service go up or down?

No one can really tell right now. While the Ethereum Name Service crypto price predictions are largely positive, at least in the long term, price predictions have a well-earned reputation for being wrong. Keep in mind, too, that prices can, and do, go down as well as up.

Should I invest in Ethereum Name Service?

Before you decide whether or not to invest in Ethereum Name Service, you will have to do your own research, not only on ENS, but on other, related, coins and tokens such as Ethereum itself.

Either way, you will also need to make sure that you never invest more money than you can afford to lose.

From the Whitepaper

Who is the Founder of Ethereum Name Service?

Who Owns the Most Ethereum Name Service (ENS) Tokens?

On February 9 2024, one wallet held more than 55% of the supply of ENS.

Richest ENS Wallet Addresses

As of February 9 2024, the five wallets with the most HNT were

- 0xd7a029db2585553978190db5e85ec724aa4df23f. This wallet, listed as ENS: Token Timelock held 55,987,685 ENS, or 55.99% of the supply.

- 0xfe89cc7abb2c4183683ab71653c4cdc9b02d44b7. This wallet, listed as ENS: DAO Wallet, held 10,006,036 ENS, or 10.01% of the supply.

- 0xf977814e90da44bfa03b6295a0616a897441acec. This wallet, listed as Binance 8, held 4,974,805 ENS, or 4.97% of the supply.

- 0x690f0581ececcf8389c223170778cd9d029606f2. This wallet, listed as ENS: Cold Wallet, held 3,225,372 ENS, or 3.23% of the supply.

- 0x6cc5f688a315f3dc28a7781717a9a798a59fda7b. This wallet, listed as OKX, held 2,181,058, ENS or 2.18% of the supply.

Fact Box

| Supply and Distribution | Figures |

|---|---|

| Maximum supply | 100,000,000 |

| Circulating supply (as of February 9 2024) | 30,780,767 ENS (30.78% of maximum supply) |

| Holder distribution | Top 10 holders owned 80.58% of total supply, as of February 9 2024. |

Ethereum Name Service (ENS) Explained

To either send or receive cryptocurrency, you need a wallet. Something that can make a wallet difficult to use and, by extension, could potentially put people off using crypto, therefore making it harder for blockchain-based finance to gain mainstream approval, is the wallet address.

Wallet addresses are usually a long string of letters and numbers, which can be hard to remember. The Ethereum Name Service is a protocol that aims to turn wallet addresses into short, easy-to-remember, user names.

See it as the equivalent of how the Domain Name Service (DNS) transforms websites’ IP addresses into something a bit more readable, only for crypto wallets, and you’re on the right track.

The Ethereum Name Service, which was set up in 2017 by New Zealand-based developer Nick Johnson is supported by its native token, known by the ticker handle ENS.

How Ethereum Name Service Works

The Ethereum Name Service is, perhaps obviously, based on the Ethereum (ETH) blockchain. It is, however, able to work across blockchains that aren’t Ethereum.

People who sign up to the platform can, in return for an annual fee of anywhere between $5 and $640, change the name of their wallet to something a bit more memorable. Wallets on the Ethereum Name Service end with the extension .eth.

ENS itself is used to give holders the right to vote on changes to the Ethereum Name Service, and it can also be bought, sold, or traded on exchanges.

Because ENS is based on Ethereum, it is a token, rather than a coin. You might see references to such things as an Ethereum Name Service coin price prediction, but these are wrong.

Ethereum Name Service Attention Tracker

Here is a chart for the Ethereum Name Service Google search volume for the past 90 days. This represents how many times the term “Ethereum Name Service” has been Googled over the previous 90 days.

FAQs

It might do but, if it does, it won’t be for some time. DigitalCoinPrice doesn’t think it will happen until 2029 while PricePrediction.net and Changelly have it reach triple figures in 2028. The ENS token is used to give people the right to vote on changes to the Ethereum Name Service network. It can also be bought, sold, and traded on exchanges. Will Ethereum Name Service reach $100?

What is Ethereum Name Service used for?

Further reading

Disclaimer

Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.