Ethereum, Bitcoin Prices Skid as Crypto Market Cap Reaches Monthly Low

The crypto markets continued to bleed on Monday, as the total value of all cryptocurrencies dipped below $90 billion. Leading the retreat were bitcoin and ethereum, whose prices both fell by at least 4.5%. Altcoins, as usual, were hit even harder, causing 10 of the top 15 coins to post weekly declines of at least 10%.

The markets had spent the past few weeks attempting to stay above the $100 billion threshold, but even that number now appears out of sight. At $87.9 billion, the current total crypto market cap has reached a monthly low. It is also the first time in July the total market cap has dropped below $90 billion.

Bitcoin Price Stumbles

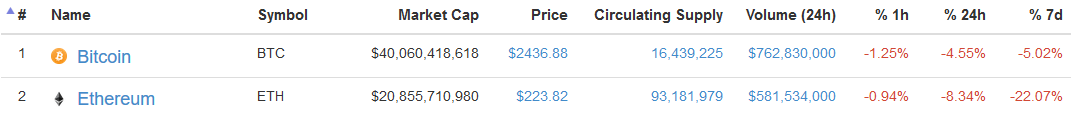

Despite a slight decline, the bitcoin price had remained relatively stable for the past week. That changed on Sunday when the bitcoin price briefly increased to $2,635. However, bitcoin’s momentum abruptly reversed course, dropping 4.6% to $2,437 on Monday. Bitcoin’s market cap is now just a hair over $40 billion.

Ethereum’s Downward Spiral Continues

The ethereum price’s downward trend continued on Monday, as the ether token tumbled another 8% to $224. In the past week, the ethereum price has fallen by an astonishing 22%.

Ethereum has also seen a pronounced drop in trading volume. At $581 million, ethereum’s 24-hour trading volume is now only 76% as large as bitcoin’s. This is a significant change from last month’s bull run, when ethereum consistently topped bitcoin volume. This also marks a nearly 50% decline in ethereum volume since last Monday.

Nevertheless, ethereum investors should not panic. Last week, a prominent U.S. banker told Business Insider he believes the Ethereum blockchain is superior to Bitcoin’s.

Additionally, Vitalik Buterin recently addressed criticisms of Ethereum, conceding–among other things–that its “scalability sucks.” There is a temptation to circle the wagons when the market is no longer moving in your favor, so his willingness to recognize and frankly discuss these issues in public should help reassure investors that ethereum’s long-term outlook is positive.

Altcoin Markets a Dismal Sight

The downturn continued to erode altcoin market caps. The Ripple price saw an uncharacteristic 8% decline, falling to $0.218. Ripple’s market cap is now just $8.4 billion. Litecoin fell almost 6% to $47.54. Ethereum Classic dropped 3%–and 10% for the week–to $16. The NEM price fell nearly 9% to $0.14. The IOTA price fell 16% to $0.254; its weekly decline is 32%. Monero, which recently climbed to the 9th-place spot, declined 8% to about $42. Of the top 15 coins, only Dash and BitConnect have managed to avoid weekly declines.

The downturn hit no major coin harder than EOS. The EOS price fell another 13% on Monday, bringing its weekly decline to 51%. At present, the EOS price is $2.08.

Bitcoin Dominates Market Share

Ethereum’s price skid has pushed the Flippening further and further out of sight. In just the past week, Bitcoin increased its share of the market by more than 4% to 45.8%. Ethereum, on the other hand, experienced a decrease of almost 3% to 23.7%.

If this trend continues for even another day, bitcoin could boast a market share more than double the size of ethereum’s.

Featured image from Shutterstock.