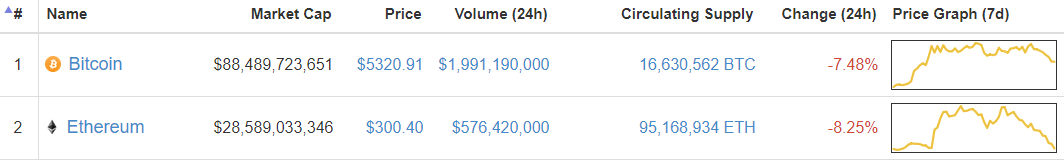

Ethereum, Bitcoin Prices Plunge in Apparent Market Sell-Off

The crypto markets took a bearish turn on Wednesday, shedding nearly $15 billion as traders initiated an apparent market sell-off. The bitcoin price bore the brunt of the blow, causing it to fall by almost $500 in the past day alone, but every top 5 cryptocurrency fell by more than 7%, and market caps up and down the charts began to evaporate.

The combined value of all cryptocurrencies entered the day at just under $175 billion, and many investors believed it would continue to ride last week’s market rally across the $180 billion threshold and set a new all-time high. However, the total crypto market cap experienced a steady decline throughout the day, bringing it to a present value of $161.7 billion — a 24-hour decline of about 8%.

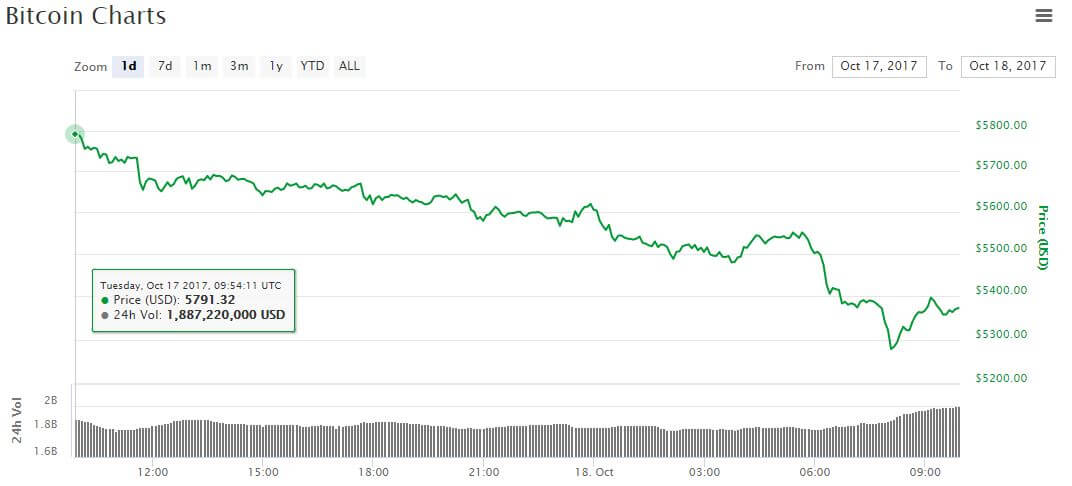

Bitcoin Price Drops $470

The markets dealt bitcoin a 7% blow, forcing the flagship cryptocurrency to return one of its worse single-day performances in recent memory. Yesterday, the bitcoin price was trading at $5,791, but it quickly began a steady retreat. By Wednesday morning, the bitcoin price had fallen below $5,600, and it continued to tumble from there, eventually extending as far downward as $5,279, although it has since recovered to a present value of $5,321. This represents a 24-hour decline of $470 and reduces bitcoin’s market cap to $88.5 billion.

As CCN.com pointed out in an earlier analysis, today’s pullback likely stems from traders taking profits derived from last week’s meteoric rally. Another theory is that traders are bearish on the outlook for the Communist Party of China’s (CPC) national congress, where conservative forces under Xi Jinping are expected to retain the upper hand over progressive officials who tend to favor reduced state control of the economy and would perhaps take a more conciliatory approach to cryptocurrency.

In any case, despite the day’s disappointing performance, the bitcoin price continues to hold well above the psychologically-important $5,000 threshold, and its fundamentals should provide investors with a long-term bullish outlook.

Ethereum Price Tests $300

The ethereum price fell prey to the correction as well, declining 8% to place it just pennies above the $300 barrier. Since the Monday morning activation of Byzantium — an important Ethereum protocol upgrade — the ethereum price has fallen by nearly $50. Ethereum now has a market cap of $28.6 billion.

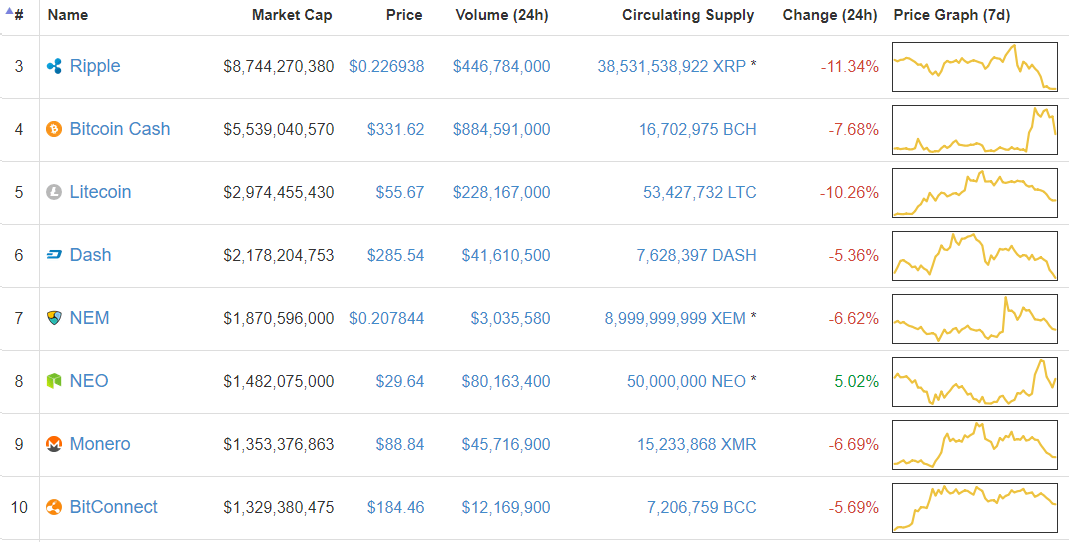

Altcoin Markets Turn Red

The Wednesday contraction extended up and down the charts, causing 85 of the top 100 cryptocurrencies to post single-day declines.

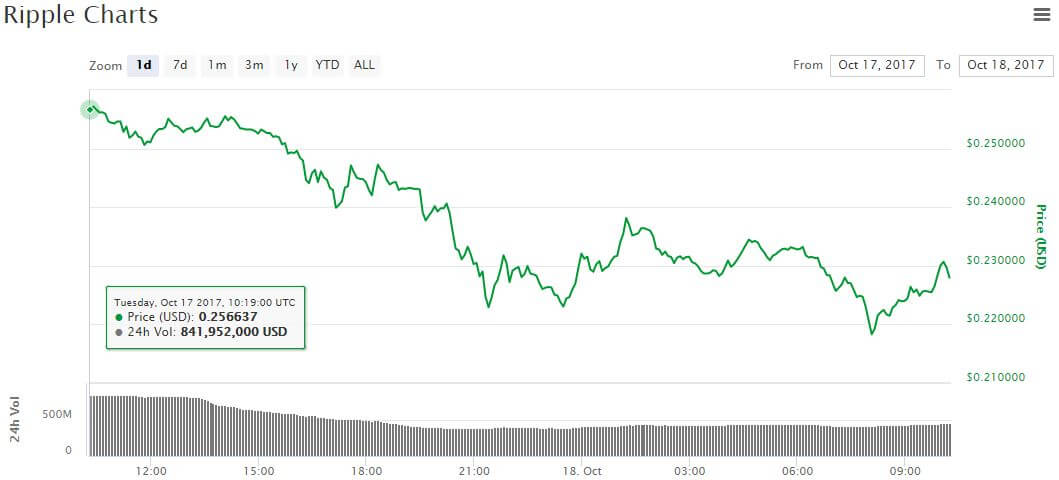

The ripple price dropped 11%, disappointing many XRP investors who thought this week’s Toronto fintech conference would lead to a price bump. Ripple is currently trading at $0.227, which translates into a $8.7 billion market cap.

The bitcoin cash price fell 8%, reversing the short-term progress it had made on Tuesday, while the litecoin price plunged by more than 10%. The dash price declined by 5% to dip below the $300 mark, and NEM and monero each posted 7% declines. NEO was the lone outlier in the top 10; it managed to climb by 5%, bringing its price close to $30. The bitconnect price, meanwhile, declined by 6% but managed to retain the 10th position in the market cap rankings.