Caution! Elon Musk’s $25 Million Tesla Stock Buy Is Smoke and Mirrors

According to a public filing, Elon Musk purchased $25 million worth of Tesla's stock last week, which only accounts for 0.1% of his net worth. | Source: Photo by DAVID MCNEW / AFP

By CCN.com: Tesla investors are supposed to be impressed that Elon Musk bought $25 million of Tesla’s stock in last week’s public offering. On the surface, the purchase might impress some people.

One must always look at Elon Musk’s actions in context. His $25 million stock purchase amounted to 102,880 shares, bringing Musk’s total number of TSLA shares owned to 33,927,560.

Only Elon Musk Makes a Drop Look Like a Storm

Musk’s Tesla stock purchase increased his stake in the stock by a whopping 0.3%, bringing his total share of Tesla ownership to 18.9%.

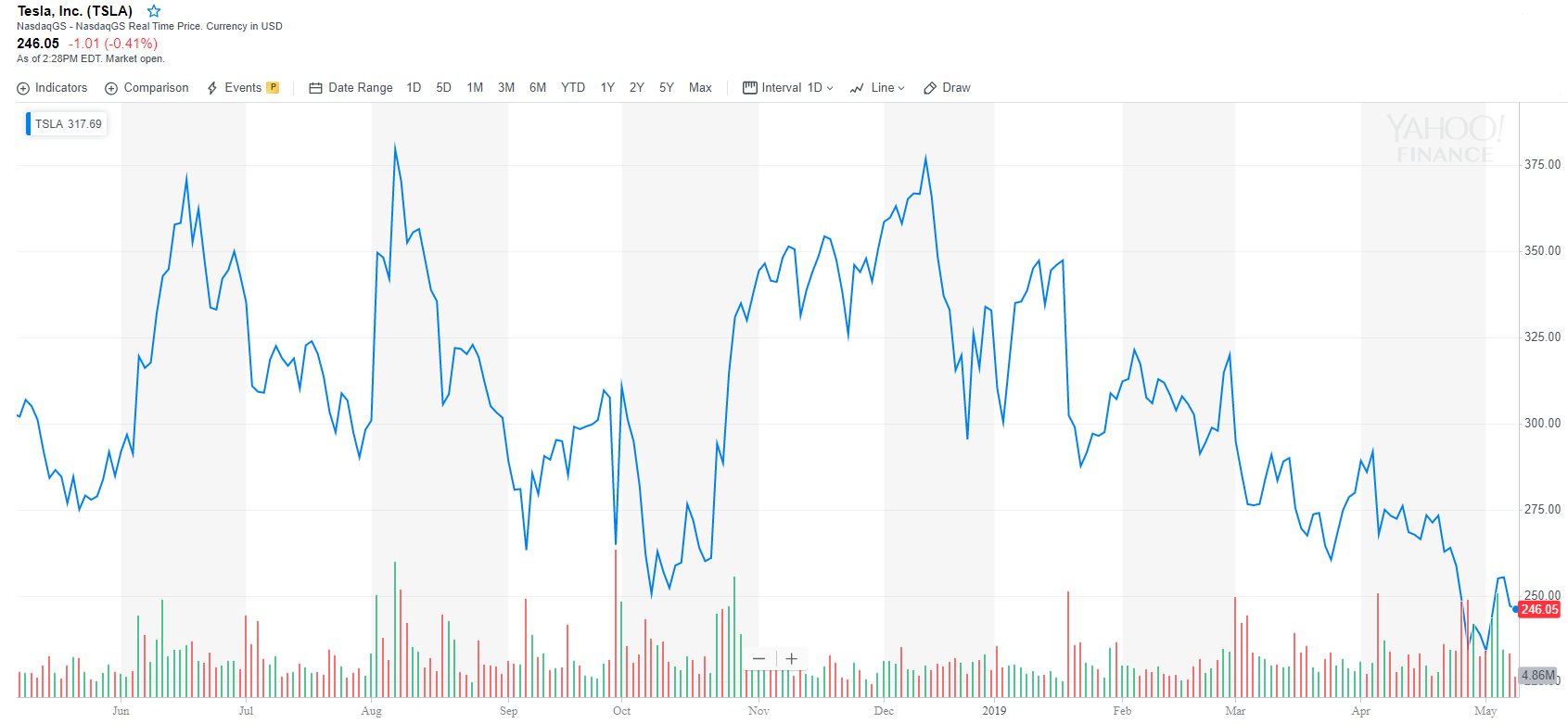

Considering Elon Musk has a net worth of $20 billion, spending 0.1% of that on more Tesla shares is hardly a vote of confidence, especially considering the new multi-year low for Tesla’s stock.

Don’t Be Fooled by Insider Purchases of Tesla’s Stock

There are two schools of thought regarding insider purchases such as this one by Elon Musk in Tesla’s stock.

First, no matter how rich someone is, they will still never throw good money after bad. Optics matter much less to rich people if weighed against the loss of wealth.

Thus, this Elon Musk’s stock purchase should be seen as a bullish sign.

That might be true if the person involved was anyone other than huckster Elon Musk.

Second, when it comes to failing companies that are burning through cash and whose products spontaneously combust, a CEO will throw enough money at his own stock in an attempt to create better optics. Why would a CEO buy another $25 million worth of stock if he thought the company was worthless?

It’s Just Monopoly Money to Musk

Elon Musk doesn’t really care about throwing another $25 million at Tesla’s stock. What matters is that he keeps the market talking about Tesla and investors distracted from the long-term challenges the company is facing.

One need look no further than last year’s infamous Elon Musk tweet, in which he said Tesla would be taken private at $420 per share – a tweet that got him in big trouble with the Securities and Exchange Commission. Instead, Tesla ended up selling more shares at $243 per share.

Bulls love pointing to the fact that drivers can now lease the Model 3, and margins are higher for leasing that selling cars outright. That may seem nice on the surface, but like everything having to do with Tesla, the promise of a lease does not mean that leases will actually be made.

Leasing needs to build in order to offset the declining margins, which hit 13% in Q1, which is a multi-year low.

Elon Musk Owes Banks Big Time

Tesla owners should also be concerned about Elon Musk’s position in the stock. While it appears to be substantial, he has borrowed heavily against that position. He owes more than $500 million to the banks that are involved in this latest capital raise – $213 million to Goldman Sachs, $209 million to Morgan Stanley, and $85 million to Bank of America.

The more Tesla stock falls, the higher the risk that he’ll be hit with a margin call and be forced to sell that position, driving the price even lower.

Tesla’s Stock Hangs in the Balance

Soon the market will have an idea about how supportive institutional holders are in the face of Tesla’s stock hitting multi-year lows.

Institutions will report their Q1 holdings, so we will get an idea as to how much was sold during the big drop in TSLA year-to-date.

With Tesla’s stock chart in a downtrend, technical traders may also begin running for the hills, causing the stock to drop even further.