Is Ripple (XRP) A Good Investment In 2024? Fundamental Analysis Offers Key Insights

Is Ripple (XRP) A Good Investment In 2024? Fundamental Analysis Offers Insights

Key Takeaways

- The Ripple blockchain enhances cross-border payment efficiency.

- The Ripple legal outcomes vary with some XRP sales classified as securities and others not specifically institutional ones versus one’s made on crypto exchanges, respectively.

- Technological competition challenges Ripple’s market position in a maturing crypto ecosystem.

- Ripple actively supports emerging stablecoin and CBDC projects.

Investors often employ both technical and fundamental analysis to make informed decisions. Having explored the technical aspects of XRP vs. USD and XRP vs BTC, we now focus on the fundamental factors influencing Ripple and its native token, XRP, as of April 2024.

These developments touch on Ripple’s fundamentals in no particular order. In some cases, the fundamentals can be viewed as opportunities for growth and in others, the opposite.

XRP’s Real World Use Case In 2024

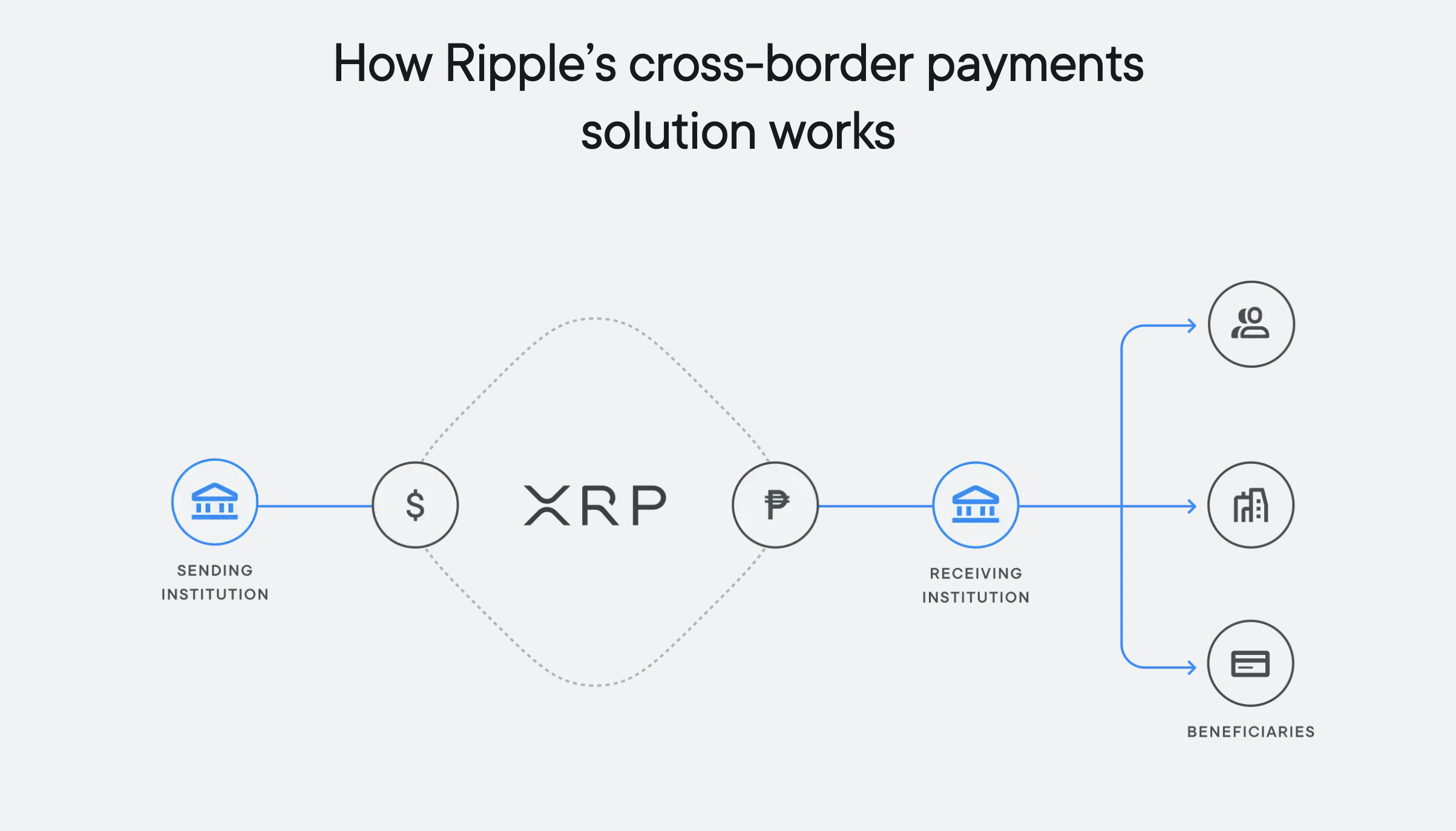

As global banks face challenges from rising interest rates, shrinking customer portfolios, constrained credit, and limited economic growth, Ripple’s blockchain-powered solutions aim to offer a robust alternative for cross-border payments.

By leveraging crypto and blockchain technology, Ripple claims to enable faster transactions and significant cost savings, estimated at $10 billion for banks.

This modern payment technology will enhance liquidity, freeing up capital previously locked in pre-funded accounts. It will also maintain and potentially increase transaction volumes by simplifying and speeding up international payments.

As a result, Ripple’s solutions provide banks with an effective tool to navigate economic turbulence and capture growth in emerging markets, making blockchain a key player in sustaining and expanding bank revenues despite rising rates.

SEC’s Lawsuit Against XRP: Is XRP A Security Or Not?

On July 13, 2023, Judge Analisa Torres of the U.S. District Court for the Southern District of New York issued a nuanced decision in the Securities and Exchange Commission’s case against Ripple Labs and two of its executives. The lawsuit alleged unregistered offerings and sales of XRP as a security. Judge Torres’s ruling differentiated between the types of XRP sales:

- Institutional sales: Were deemed securities transactions.

- Sales on crypto exchanges: These distributions were not deemed securities.

This partial victory for Ripple marked a significant moment in cryptocurrency regulation, indicating that the classification of digital tokens might depend heavily on the context of their sale.

The case began with the SEC’s 2020 complaint against Ripple, emphasizing that Ripple had conducted extensive promotional activities suggesting the utility and investment value of XRP. The court analyzed these sales under the framework established by the Howey test, which considers whether a transaction qualifies as an “investment contract” and thus a security.

For institutional sales, Ripple’s direct marketing and contractual agreements led the court to classify these as securities transactions. However, XRP sales on exchanges did not provide enough direct connection between Ripple and the buyers to meet the Howey criteria for a securities transaction.

The ruling has significant implications for the regulation of digital assets, demonstrating the need for a new approach that considers the specifics of how and to whom tokens are sold. The case suggests that not all transactions with the same token will necessarily be regulated in the same way, underscoring the complexity of applying traditional securities law to digital currencies. This decision might influence future regulatory approaches and legal standards applied to similar cases in the cryptocurrency space.

XRP Deemed Not A Security According To Sales Made On Crypto Exchanges

Judge Analisa Torres’ ruling in the SEC vs. Ripple case emphasized that XRP sales through programmatic trading on exchanges did not meet the third prong of the Howey test for qualifying as securities transactions.

This decision was based on the understanding that buyers on these exchanges were not aware they were purchasing XRP directly from Ripple, and thus could not have a reasonable expectation of profits based on Ripple’s efforts. This view suggests that the recognition of a transaction as a securities sale under Howey requires buyers to know that the investor’s investments directly fund the issuer’s efforts.

Judge Torres also noted that general marketing efforts by Ripple didn’t equate to direct promises to exchange buyers, reinforcing the need for a buyer’s awareness of its transaction’s nature to satisfy the Howey test. This ruling could influence how other courts handle similar cases involving token sales on exchanges, particularly in scenarios where the issuer’s participation in the market isn’t transparent to buyers.

Technological And Market Position Of Ripple

Despite being a pioneer in blockchain technology with a focus on facilitating cross-border payments, Ripple’s technological edge has been questioned. Issues surrounding control and the degree of decentralization have sparked debates that undermine the communal trust in Ripple’s infrastructure.

Moreover, the rise of decentralized finance (DeFi) and enhancements in Ethereum’s network have diverted attention and market share away from XRP. These shifts highlight the intensely competitive nature of the cryptocurrency space, where innovation and scalability are important for maintaining relevance.

Ripple’s SEC Filings And SEC Penalties

The U.S. SEC is pursuing fines and penalties amounting to $2 billion against Ripple Labs regarding the sale of the cryptocurrency XRP, according to Ripple’s Chief Legal Officer, Stuart Alderoty. These developments were shared via social media posts, with the related court documents initially filed under seal but expected to be publicly filed with redactions soon.

This legal action arises from a broader accusation by the SEC in 2020 against Ripple and its executives for raising over $1.3 billion through an unregistered securities offering involving XRP. Although the SEC has since dropped some claims against Ripple’s executives, it continues to press for substantial penalties.

This case is closely watched due to its implications for the cryptocurrency industry, particularly following Judge Analisa Torres’ mixed rulings which found some of Ripple’s XRP sales as unlawful securities transactions while others did not meet the legal definition of a security.

The outcome of this case could significantly influence other ongoing legal battles involving major crypto companies and the SEC’s regulatory approach to cryptocurrencies.

Ripple’s Impact On Cross-Border Payments

Ripple has claimed to continue enhancing its blockchain capabilities, notably improving transaction speed and scalability, which bolsters XRP’s appeal among both institutional and retail investors. Additionally, Ripple’s successful partnerships with global banks and payment networks have further solidified XRP’s role in the digital payment ecosystem and boosted investor confidence in its long-term potential.

Ripple’s XRPL Powers Global Expansion with AUDD Stablecoin Integration: Transforming Cross-Border Payments

Ripple is actively contributing to the advancement of stablecoins, notably through its integration with the XRP Ledger (XRPL). Novatti Group Limited has leveraged XRPL to launch AUDD, a 1:1 fiat-backed stablecoin pegged to the Australian dollar, facilitating swift and cost-effective transactions. This development not only supports stablecoin use but also enhances Ripple’s cross-border payment solutions, which utilize XRP as a bridge currency.

The deployment of AUDD on XRPL enables global payments and trades with other XRP-based tokens via its decentralized exchange, further integrating stablecoins into Ripple’s suite of payment solutions. This strategic move aligns with Ripple’s broader vision of fostering an Internet of Value, where financial inclusivity and liquidity are significantly improved through digital currencies and tokenized assets.

Ripple And Republic of Palau Launch Pioneering Stablecoin Pilot On XRP Ledger To Enhance Digital Economy

In 2023 Ripple launched a stablecoin project in partnership with the Republic of Palau. This initiative led to the creation of the Palau Stablecoin (PSC) , which is backed by the U.S. Dollar and issued on the XRP Ledger..

The pilot phase of the project involves Palau government employees using the PSC for transactions with selected local merchants to test its effectiveness in real-world scenarios. This stablecoin aims to enhance financial inclusivity and reduce transaction costs for citizens and merchants alike by leveraging Ripple’s CBDC technology.

The pilot is part of a broader strategy to digitize Palau’s currency, streamline economic and government transactions, and foster a robust digital economy within the nation.

Ripple Whitepaper Unveils Growth Opportunity In SME Cross-Border Payments

Ripple’s latest whitepaper, “Big Opportunity in Small Business Payments ,” highlights a significant growth opportunity for banks in the B2B cross-border payments sector, particularly for small- and medium-sized enterprises (SMEs). While SMEs represent 90% of global businesses and are important to regional economies, SMEs often face challenges with traditional banking services, such as slow processing times, high transaction fees, and a lack of payment transparency.

Ripple suggests that digital assets and blockchain technology may bridge the gap, offering SMEs real-time, cost-effective, and traceable payment solutions. This could potentially unlock a share of the $110 trillion business-to-business (B2B) payments market, allowing banks to better serve this underserved sector and leverage innovative fintech solutions to enhance payment efficiency, interoperability, and customer satisfaction.

Ripple Enters Stablecoin Race As Market Poised For Massive Growth

Ripple intends to claim a share of the rapidly expanding stablecoin market with the launch of its own stablecoin later in 2024.

This move comes as industry experts project the stablecoin market to balloon from its current $150 billion valuation to surpass $2.8 trillion by 2028. Ripple’s CEO, Brad Garlinghouse, underscored this growth potential during a Fox Business interview with Maria Bartiromo.

Ripple’s established network of banks and financial institutions within RippleNet could accelerate stablecoin adoption for cross-border payments and remittance use cases.

Moreover, potential integration with the XRP cryptocurrency could offer unique liquidity solutions, especially in markets where fiat on/off ramps are limited. A successful stablecoin could drive demand for XRP if it facilitates on/off ramps or plays a role in providing liquidity.

Ripple’s proactive approach in engaging with regulators could foster trust in its stablecoin offering, appealing to institutional investors. However, the success of Ripple’s stablecoin depends on both adoption within RippleNet and the broader evolving regulatory environment surrounding stablecoins.

Security Concerns Faced By Ripple

Further complicating Ripple’s position are recent security concerns. A notable incident involved the hacking of Ripple’s co-founder and executive chairman, Chris Larsen, on January 31st, where transactions amounting to 213 million XRP (valued at approximately $112.5 million at the time) were highlighted.

Although the breach targeted Larsen’s personal assets, it raised broader questions about Ripple’s security measures and the robustness of its network defenses. Such incidents can exacerbate investor anxieties, potentially affecting the perception and valuation of XRP.

XRP Sentiment And Enthusiasm In 2024

Cryptocurrency valuations are heavily influenced by investor sentiment, which can often overshadow fundamental realities. The controversies surrounding Ripple, whether it be its legal challenges or security issues, have dampened the once-hyped allure of XRP.

The decline in sentiment is important to consider as it directly impacts trading behaviors and can lead to sustained price depressions or volatility.

Furthermore, clearer regulatory guidelines in various global markets have mitigated legal risks, encouraging more investors to engage with XRP. The overall positive sentiment in the cryptocurrency market in 2024, alongside a strong, supportive community, has also played a huge role in driving XRP’s price higher.

Looking forward, Ripple’s focus on leveraging XRP for fast and efficient cross-border payments, stablecoins and CBDCs is expected to keep its prospects bright, although investors should remain cautious of ongoing legal and regulatory developments.

Overall, the enthusiasm in “XRP to the moon” is supported by substantial and strategic advancements that make XRP a compelling option for those considering cryptocurrency investments.

Conclusion

In conclusion, Ripple’s current fundamental landscape presents a mixed bag of potent opportunities tempered by significant risks. Regulatory uncertainties and security concerns pose the most immediate threats to Ripple’s stability and attractiveness as an investment. However, Ripple’s technological innovations and its pivotal role in the evolving payment ecosystem continue to provide a strong case for potential long-term value.

Investors considering XRP must weigh these factors carefully, keeping an eye on both ongoing legal developments and advancements within the broader crypto market.

For those looking to invest, a cautious approach with a readiness to adapt to new information would be prudent. Ripple’s journey through its legal and competitive challenges will be important to watch for assessing its future price trajectory in the cryptocurrency domain. However, after examining the fundamentals, how is XRP performing against the USD and how is it performing against its BTC pairing?

FAQs

The SEC case was mixed, with institutional XRP sales deemed securities and crypto exchange sales deemed not, affecting Ripple’s legal standing. Decentralization concerns and competition from DeFi and upgraded networks like Ethereum challenge Ripple. Ripple supports stablecoin operations, such as the Palau Stablecoin, improving financial inclusivity and reducing transaction costs.How did the 2020 SEC case impact Ripple?

What technological challenges does Ripple face?

How does Ripple contribute to the stablecoin market?