Bitcoin Rich List: Top BTC Holders In 2024

Bitcoin Rich List: Top BTC Holders In 2024

Key Takeaways

- Blockchain analytics reveal the top Bitcoin wallet addresses and the respective activities of each wallet.

- Exchanges, investors, and institutions mainly influence the Bitcoin distribution.

- Wealth concentration among Bitcoin holders raises centralization concerns.

- Increased adoption will lead to a more decentralized and fair Bitcoin ownership.

Despite the inherent pseudonymity of cryptocurrency transactions, blockchain analytics tools can show which wallets own the most Bitcoin. The wealthiest addresses in Bitcoin are exchanges, investors, and major institutions.

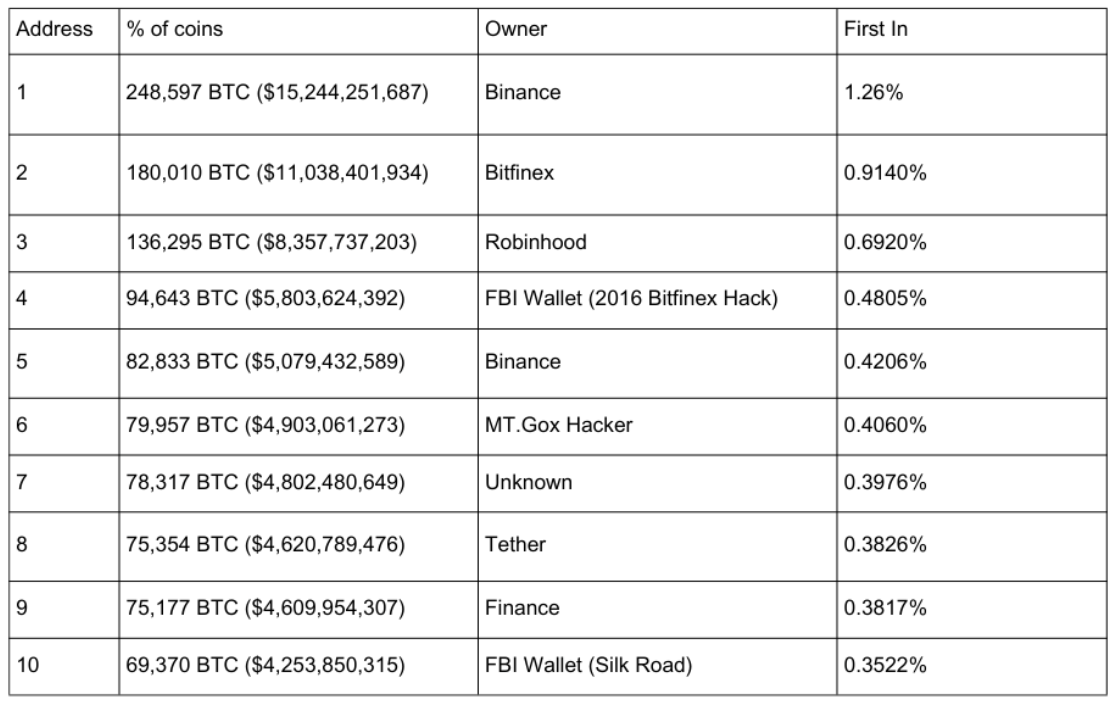

Top 10 Richest Bitcoin Addresses

The following ten BTC addresses showcase the respective values as of Bitcoin in BTC unit and in dollar terms as of May 9, 2024.

1. Binance Cold Wallet

BTC Hodl: 248,597 BTC

Dollar value: $15.2 Billion

The largest Bitcoin wallet is controlled by Binance which is the world’s top cryptocurrency exchange which holds 248,597 BTC equivalent to over 1.2% of all circulating Bitcoin.

This balance was achieved by mainly storing customer funds in a cold wallet with minimal outgoing transactions with the most recent of which was eight months ago involving 21,600 BTC.

2. Bitfinex Cold Wallet

BTC Hodl: 180,010 BTC

Dollar value: $11.0 Billion

The second-largest Bitcoin wallet is held by Bitfinex which was founded in 2012. The exchange has had its controversies but is still one of the largest holders of Bitcoin in the world today.

3. Robinhood Wallet

BTC Hodl: 136,295 BTC

Dollar value: $8.3 billion

The third-largest Bitcoin wallet belongs to the Robinhood trading platform , according to data available. This wallet is linked to Robinhood by Arkham Intelligence but unconfirmed by the platform, and is managed by Jump Trading as its custodian.

Starting in May 2023, it received several large deposits until June 30, after which only minor transactions occurred.

4. FBI Wallet (BTC 2016 Bitfinex Hack)

BTC Hodl: 94,643 BTC

Dollar value: $5.8 billion

The wallet is controlled by the U.S. federal authorities and holds Bitcoin stolen from Bitfinex in 2016 and became active in February 2022. The wallet was funded with large transactions on February 1, 2022, and has since only received minor amounts, without any outgoing BTC transactions.

The wallet’s future transactions are anticipated to be significant as the Bitfinex hack investigation and related prosecutions progress.

5. Binance Cold Wallet

BTC Hodl: 82,833 BTC

Dollar value: $5.0 billion

The second largest Bitcoin wallet controlled by Binance is a cold wallet holding more than 82 thousand BTC. It first became active in 2019. Since then, the wallet has seen an inflow of 9 thousand Bitcoin in May 2024.

6. Mt. Gox Hacker Wallet

BTC Hodl: 79,957 BTC

Dollar value: $4.8 billion

Controlled by a hacker, this wallet contains 79,956 BTC stolen from Mt. Gox in 2011, confirmed by former CEO Mark Karpeles as unauthorized transfers labeling it as stolen property.

Since then, the wallet has only received minor transactions and has not made any outgoing Bitcoin transactions since its creation.

7. Unidentified Owner

BTC Hodl: 78,317 BTC

Dollar value: $4.7 billion

The owner of the sixth-largest Bitcoin wallet remains unidentified. The wallet was activated on March 25, 2024 and received a substantial transfer of Bitcoin.

Following this large transaction, the wallet has seen minimal activity, only sporadically receiving small amounts of BTC.

8. Tether Cold Wallet

BTC Hodl: 75,354 BTC

Dollar value: $4.9 billion

Arkham Intelligence, reports that the seventh-largest Bitcoin wallet is owned by Tether, the issuer of the popular USDT stablecoin. This wallet has received multiple transactions consisting of thousands of BTC from the hot wallet account of Bitfinex.

9. Binance Cold Wallet

BTC Hodl: 75,177 BTC

Dollar value: $4.9 billion

The third largest Bitcoin wallet controlled by Binance is a cold wallet holding more than 75,000 BTC. It first became active in March 2024, when Binance transferred nearly $5 billion worth of Bitcoin to the address. Since then, the wallet has been completely dormant.

10. FBI Wallet (BTC From Silk Road)

BTC Hodl: 69,370 BTC

Dollar value: $4.2 billion

The tenth largest that hodls Bitcoin was originally used on the Silk Road, a notorious dark web marketplace for illegal goods and services. However, these funds were not confiscated directly from the Silk Road operators.

Instead, they were taken from a hacker known as “Individual X” in legal documents, who infiltrated Silk Road between 2012 and 2013 and stole significant amounts of BTC.

In November 2020, the hacker consented to surrender the stolen Bitcoin to U.S. authorities.

Who Is The Richest Known Bitcoin Holder?

Both individuals and institutions have generated significant amounts of wealth by holding Bitcoin, solidifying their positions as some of the wealthiest people and entities in the crypto space. Namely these people include:

Satoshi Nakamoto

At the core of Bitcoin is its mysterious creator, Satoshi Nakamoto, who is believed to hold over 1 million BTC. The true identity of Nakamoto remains unknown, and these coins, accumulated during Bitcoin’s early days have not moved in years contributing to the mystery surrounding the Bitcoin blockchain.

The Winklevoss Twins

Tyler and Cameron Winklevoss, founders of the Gemini exchange, were early adopters of Bitcoin, investing millions and accruing a substantial number of Bitcoin early on.

Michael Saylor

The CEO of MicroStrategy, Saylor is a vocal figurehead of Bitcoin, with his company holding a reported 214,246 BTC as part of its corporate assets.

CZ (Changpeng Zhao)

The CEO of Binance, one of the largest cryptocurrency exchanges, CZ’s personal Bitcoin holdings are speculated to be large, though exact figures are not public.

Larry Fink

As the CEO of BlackRock, Larry Fink oversees the introduction of Bitcoin into various investment products, including ETFs, potentially influencing significant institutional flows into Bitcoin.

Brian Armstrong

As the CEO of Coinbase, Armstrong leads one of the most influential crypto exchanges, which manages substantial Bitcoin assets both on behalf of clients and in corporate reserves.

Crypto Exchanges

Crypto exchanges themselves represent a significant portion of Bitcoin holdings:

- Binance: Holds a large number of Bitcoin acting as a custodian for its users.

- Coinbase: Holds a large amount of Bitcoin, providing secure storage for users’ digital assets.

- Bitfinex: Despite its controversial history, including a major hack, Bitfinex remains a key player with significant Bitcoin holdings.

Financial Institutions

Financial institutional involvement has grown, with entities like Grayscale Investments holding a significant amount of 292,268 BTC.

Other major players in 2024 include traditional financial institutions and hedge funds, which have increasingly begun to accept Bitcoin as a legitimate asset class.

How Do Individuals Accumulate Massive BTC Holdings?

The accumulation of massive Bitcoin (BTC) holdings by individuals is a phenomenon influenced by various strategic approaches and timing. Said strategies include:

- Early adoption: One of the most straightforward paths to becoming a major Bitcoin holder has been through early adoption.

- Mining: In Bitcoin’s early years, the initial low difficulty level meant that individuals could mine a significant amount of Bitcoin with basic hardware.

- Successful entrepreneurship: Founders and early investors when creating or facilitating platforms, exchanges, or services within the crypto ecosystem tend to become large holders.

The Significance Of Top BTC Holders Or Whales

When a small concentration of individuals or entities hodl a significant amount of Bitcoin these whales can affect the market in various ways, including:

- Market influence: Large transactions by whales can move Bitcoin prices, inducing volatility into the market either through actual trades or affecting market sentiment.

- Indicator of confidence: When prominent investors and large holders increase Bitcoin positions, it often signals a strong belief in Bitcoin’s long-term value.

- Centralization concerns The concentration of substantial Bitcoin holdings among a relatively small group of individuals and entities raises concerns about centralization which Bitcoin originally sought to disrupt.

The Future Of The Bitcoin Distribution

As Bitcoin matures, the BTC distribution is becoming more equal due to increased adoption and market acceptance. The potential for wider adoption suggests more individuals will begin to hold smaller amounts of Bitcoin, reducing the concentration of wealth and increasing market stability.

Additionally, it is important to note that while a small number of whales hold large amounts of Bitcoin, a significant portion remains distributed among smaller investors like “fish,” “crabs,” and “sharks.” These groups collectively hold a considerable share, supporting the decentralized nature of Bitcoin and ensuring it remains accessible to a diverse array of participants.

Conclusion

The rich list of Bitcoin marks individuals and institutions as the largest holders in the space holding a significant amount of BTC through various means. These players hold huge influence on market stability and indicate broader economic shifts. As Bitcoin continues to become accepted, its growing adoption may lead to a more decentralized distribution.

FAQs

Early adopters of Bitcoin, who invested before its widespread recognition, typically hold larger amounts due to the significant appreciation over time. While individual mining has become less profitable due to increased difficulty and the need for advanced equipment, it can still be a viable strategy in Bitcoin’s early days. Large holders, or whales, can influence Bitcoin prices, either by making large transactions or through strategic holdings, affecting market volatility.How does early adoption impact Bitcoin holdings?

Can Bitcoin mining still be profitable for individuals?

What are the implications of Bitcoin whales on market stability?

What role do Bitcoin exchanges play in the market?

Bitcoin exchanges act as custodians, holding substantial amounts of Bitcoin, facilitating trades, and providing liquidity to the market.

How does early adoption impact Bitcoin holdings?

Early adopters of Bitcoin, who invested before its widespread recognition, typically hold larger amounts due to the significant appreciation over time.

Can Bitcoin mining still be profitable for individuals?

While individual mining has become less profitable due to increased difficulty and the need for advanced equipment, it can still be a viable strategy in Bitcoin’s early days.

What are the implications of Bitcoin whales on market stability?

Large holders, or whales, can influence Bitcoin prices, either by making large transactions or through strategic holdings, affecting market volatility.