In January of last year, the U.S. stock market went through one of the largest bull markets in recent history, with technology stocks like Alphabet and Apple achieving record high numbers.

Markets News & Opinions

3 min read

Downturn or Not, Bitcoin Has Still Outperformed Apple Since Last January

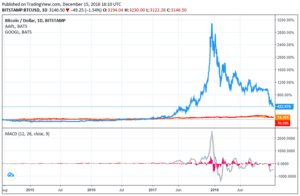

Within the past two years, the stock price of Apple (AAPL) increased from $115 to $165, by 43.7 percent. Alphabet (GOOGL), the parent company of Google, saw its share price surge from $792 to $1,071, by 32.7 percent.

During the same period, the Bitcoin price increased from $1,000 to $3,155, by 215 percent, even after an 85 percent plunge in value.

Critics: Bitcoin Will go to Zero

As the price of Bitcoin (BTC) dropped substantially against the U.S. dollar, outspoken critics against the digital currency have started to claim that Bitcoin will inevitably reach zero by losing all of its value.

However, such a claim disregards the abnormally strong rally of Bitcoin in the previous year during which its value increased by more than 1,850 percent against the USD, from $1,000 to $19,500. In any market, a rally of a similar magnitude is often followed by a long-lasting downtrend and a several-month-long consolidation period.

Every market goes through a bull and a bear cycle. In 2018, the Dow Jones and most tech major stocks in the likes of Apple, Alphabet, and Facebook deleted all of their yearly gains amidst an intense market sell-off.

Fundamentally, the catalysts that fuel the growth of cryptocurrencies and traditional stocks are drastically different. But, all markets similarly go through bear and bull cycles, especially following an abnormal rate of growth that cannot be sustained in the long run.

Apple has gone through four major corrections in the past 11 years with every drop averaging at around a 30 percent decline in share price. In contrast, Bitcoin has experienced five major corrections with every drop averaging at nearly 85 percent. And, on average, it took the dominant cryptocurrency 65 weeks to recover and achieve a new all-time high.

Markets move solely based on the demand from investors, and if investors deem a large rally cannot be maintained throughout the years to come, even some of the largest markets can experience steep sell-offs as seen in the performance of the Dow Jones in the past week.

Argument is Wrong

Bitcoin could take a longer time to recover than in previous years because the market is more structured and a big portion of the mainstream is already aware of the asset class.

But, it is inaccurate to claim that the asset could drop to zero because of its 85 percent decline in price this year because, in the previous year, it demonstrated a 1,850 percent gain and a major correction was expected after such a large movement.

Featured Image from Shutterstock. Charts from TradingView .