Dow Risks Snapping Three-Day Win Streak as Bond Yields Dive

The Dow Jones risked snapping its three-day winning streak after bond yields resumed their punishing slide. | Source: Shutterstock

By CCN.com: The Dow and broader U.S. stock market all turned lower on Tuesday, as heightened geopolitical tumult drove investors out of equities and into the perceived safety of government bonds.

Dow Slides; S&P 500, Nasdaq Follow

All of Wall Street’s major indexes declined Tuesday, mirroring a tepid pre-market for Dow futures. The Dow Jones Industrial Average fell 173.35 points, or 0.7%, to close at 25,962.44.

The broad S&P 500 Index of large-cap stocks fell 0.8% to 2,900.51. Ten of 11 major sectors reported declines, with materials leading the way.

The technology-focused Nasdaq Composite Index declined 0.7% to 7,948.56.

Bond Yields Resume Slide

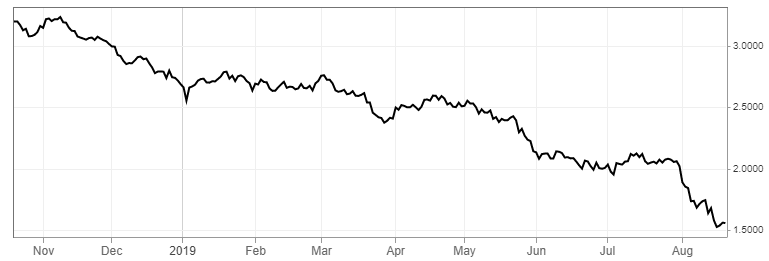

After a brief pause, government bond yields resumed their slide on Tuesday, underscoring investors’ collective anxiety over the economy.

The yield on the benchmark 10-year U.S. Treasury note fell to a low of 1.54% on Tuesday. Last week, the yield dropped below 1.5% for the first time in three years.

Yields are tumbling again less than a week after a closely-watched yield curve inverted for the first time since before the financial crisis. The 10-year yield has crossed below the 2-year yield prior to every recession that has occurred within the past 50 years, albeit with a nearly two-year time lag.

Some analysts have argued that the most recent yield-curve recession signal is being distorted by what’s happening outside of the United States. That’s the view of Mohamed El-Erian, the chief economic advisor of Allianz, who told CNBC last week that the bond market has “no choice but to import the effect of negative policy rates in Europe.”

The European Central Bank (ECB) was recently given more ammo to ease monetary policy even further after core inflation fell to its lowest level in two years.

Click here for a real-time Dow Jones Industrial Average chart.