Dow Plunges Below 26,000 after Donald Trump Bashes Fed

In a blistering critique, President Trump blamed the Federal Reserve for wiping 10,000 points off the Dow Jones, which he says should be above 35,000. | Source: REUTERS / Carlos Barria

The Dow and broader U.S. stock market declined sharply Monday afternoon, as investors digested President Donald Trump’s latest criticism of the ‘gentleman who loves quantitative tightening,’ a direct reference to Federal Reserve Chairman Jerome Powell.

Dow Plunges; S&P 500 and Nasdaq Follow

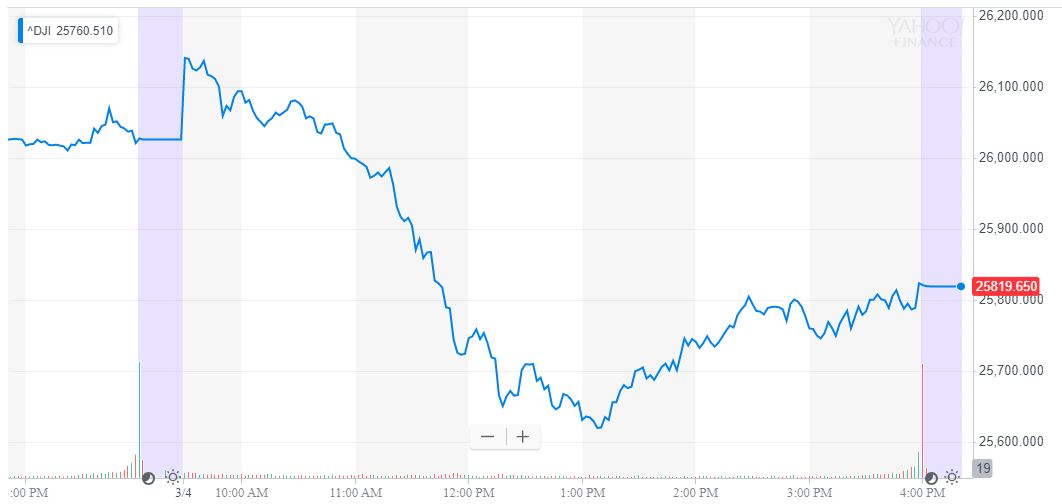

All of Wall Street’s major indexes erased gains to end firmly in the red. By the closing bell, the Dow Jones Industrial Average had plunged 206.67 points, or 0.79%, to 25,819.65. The blue-chip index rose triple digits after the open, reflecting a strong pre-market session for U.S. stock futures.

Twenty-eight of 30 index members reported losses. UnitedHealth Group Inc. (UNH) was the Dow’s weakest link, falling 4.12%. Shares of Boeing Co (BA), McDonald’s Corp (MCD), and Walgreens Boots Alliance Inc. (WBA) each fell more than 1.8%.

The broader S&P 500 index of large-cap stocks fell 0.39% to 2,792.81. All 11 primary sectors traded lower, with health care leading the declines. Health stocks were down 1.34% on average. Information technology also fell considerably.

The technology-focused Nasdaq Composite Index also reversed gains, falling 0.23% to 7,577.57.

A measure of expected volatility known as the CBOE VIX surged 7.81% to 14.63. The so-called “fear index” settled near five-month lows on Friday.

Trump Lashes Out Against Fed

President Donald Trump has made it abundantly clear he is no fan of the Federal Reserve. On Saturday, he called out Jerome Powell for taking the sails out of the U.S. economy through aggressive interest rate hikes.

“We have a gentleman that loves quantitative tightening in the Fed,” Trump told a Conservative Political Action Conference on Saturday. “We have a gentleman that likes a very strong dollar in the Fed. So with all of those things — we want a strong dollar but let’s be reasonable — with all of that, we’re doing great. Can you imagine if we left interest rates where they were? If we didn’t do quantitative tightening? I want a dollar that’s great for our country but not a dollar that’s prohibitive for us to be doing business with other countries.”

Led by Powell, central bankers raised the federal funds rate a total of four times last year. They have since backed off on their hawkish stance now that it is abundantly clear that stocks and the economy have become addicted to cheap money. Futures traders now fully expect the Federal Reserve to remain on the sidelines throughout 2019, according to Fed Fund futures prices

The minutes of the January 29-30 Federal Open Market Committee (FOMC) meetings confirmed the central bank’s dovish pivot. According to the official transcript , which was released on February 20, there are a “variety of considerations that supported a patient approach.”

The Fed’s next policy meeting will be held March 19-20 in Washington.