Dow Reverses 150-Point Drop Because Lower Interest Rates are Coming

How central banks respond to slowing economic growth will have a direct impact on the bond markets, says UBS. | Source: REUTERS / Erin Scott

The Dow and broader U.S. stock market pared most of their losses Tuesday, as investors remained cautiously optimistic that a new era of ultra-loose monetary policy will keep the bull market running indefinitely.

Dow Recovers; S&P 500, Nasdaq Still Lower

After plunging by as much as 151 points, the Dow Jones Industrial Average (DJIA) pared nearly all of its losses by the afternoon session. The DJIA suffered a significant setback after the open as President Trump unleashed another tweetstorm targeting China’s unfair trade practices. By 3:06 p.m. ET, the index was down only 23.74 points, or 0.09%, at 27,197.61.

The broad S&P 500 Index of large-cap stocks fell 0.2% to 3,015.71, with six of 11 sectors reporting declines. Utilities stocks declined 1.1% as a whole. The S&P 500’s healthcare unit dropped 0.6%. Losses in these and other sectors offset noticeable gains in energy and materials stocks.

The Nasdaq Composite Index was last down 0.1% at 8,284.95.

Federal Reserve Takes Center Stage

The Federal Reserve’s policy-setting board kicked off its two-day meeting in Washington on Tuesday against growing expectations that a rate cut will soon follow.

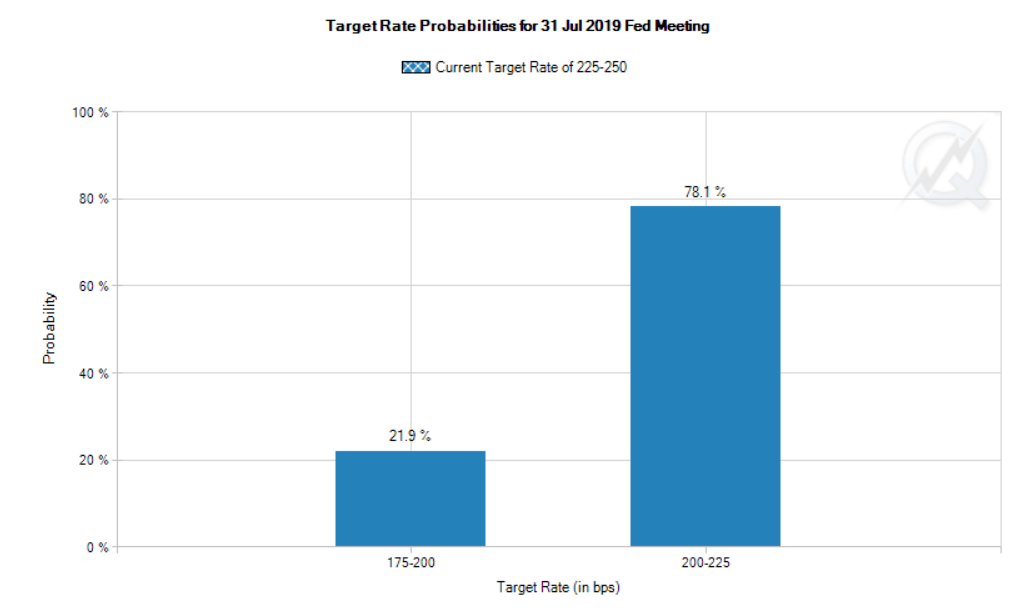

Fed Fund futures prices say there’s no chance the central bank doesn’t cut interest rates on Wednesday. The only debate is whether policymakers will lower the federal funds rate by 25 basis points or 50 basis points. The chance of a 50 basis-point reduction currently stands at 21.9%, according to CME Group’s FedWatch Tool .

Even if the Fed cuts rates by 25 basis points on Wednesday , it is still expected to lower again in the fall.

Central bankers began to pivot away from policy normalization earlier this year after it became apparent that higher interest rates were partly responsible for the fourth-quarter market meltdown. Officials are now blaming the China trade war for the uncertain macro climate that has befallen the U.S. economy. All this, and most measures of economic health suggest the Fed should be raising interest rates, not lowering them.

Click here for a real-time Dow Jones Industrial Average (DJIA) price chart.