Dow Shrugs Off Ugly Housing Data to Jump 175 Points

The stock market is on the verge of a major recovery. Here's why Wall Street has suddenly turned bullish despite numerous macro threats. | Source: Shutterstock

The Dow and broader U.S. stock market advanced Tuesday after a pair of industrial blue-chip companies reported better than expected earnings. The rally lost some of its luster after the National Association of Realtors reported yet another month of disappointing housing sales.

Dow Rallies; S&P 500, Nasdaq Follow

All of Wall Street’s major indexes reported gains Tuesday, mirroring a positive pre-market session for Dow futures. The Dow Jones Industrial Average rallied 175.63 points, or 0.7%, to 27,347.53.

The broad S&P 500 Index of large-cap stocks gained 0.6% to 3,003.28, with ten of 11 primary sectors reporting gains. Materials stocks were the top performers, gaining 1.7% as a collective.

Meanwhile, the technology-focused Nasdaq Composite Index advanced 0.4% to 8,239.13.

Home Sales Continue to Disappoint

U.S. existing home sales declined again in June, marking the 16th consecutive month of year-over-year declines for the largest component of the real estate market.

Resales fell 1.7% to a seasonally adjusted annual rate of 5.27 million, far worse than the 0.2% drop analysts had expected, the National Association of Realtors (NAR) reported Tuesday. Like in previous months, tighter inventories and higher price levels were the main reasons for the decline.

Lawrence Yun, NAR’s chief economist, says the housing resale market is “running at a pace similar to 2015 levels” despite very low mortgage rates and a supposedly booming labor market. The national unemployment rate ticked up slightly in June but remained near its lowest level in about 50 years.

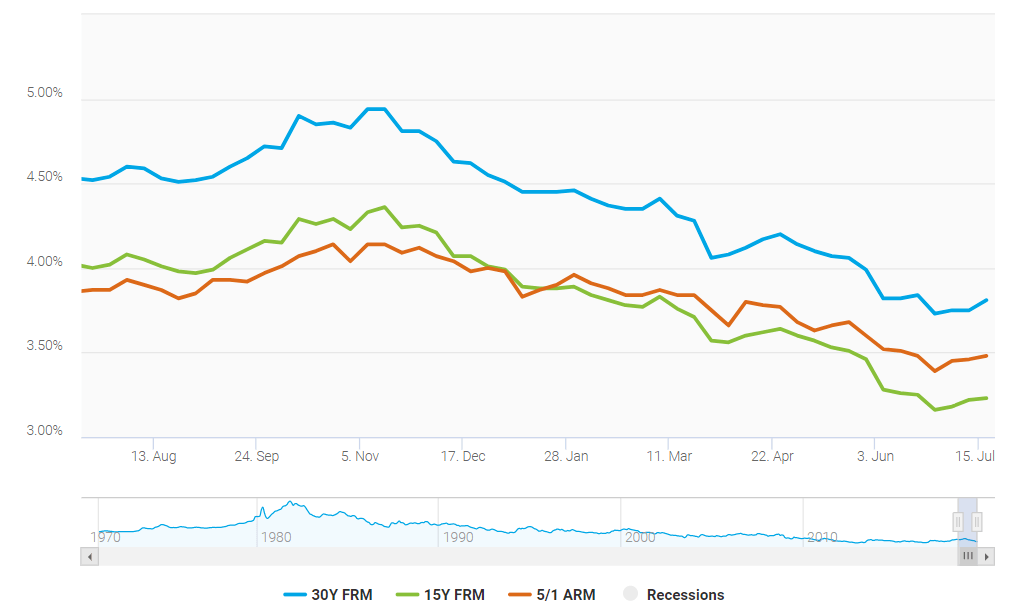

The housing market began its long unwind when the Federal Reserve initiated a faster rate-hike schedule under Chairman Jerome Powell. The federal funds rate impacts mortgage rates indirectly as banks and other lenders pass on higher costs to their customers.

Mortgage rates have been declining for most of 2019 and remain well below their long-run average. The commitment rate on a 30-year fixed-rate mortgage bottomed at 3.73% in the week ended June 27, according to Freddie Mac. Last week, 30-year rates averaged 3.81%.

In addition to weak home sales, permits for future building projects have also declined. Last week, the Commerce Department reported that June building permits dropped to their lowest levels in two years.

Click here for a real-time Dow Jones Industrial Average (DJIA) price chart.