Dow Jones Rally Just a ‘Dead Cat Bounce,’ US Stock Market Could Crash 30%: David Tice

The Dow suffered a sharp reversal that thrust the DJIA into the red just hours after flashing a gain of more than 100 points. | Source: Shutterstock

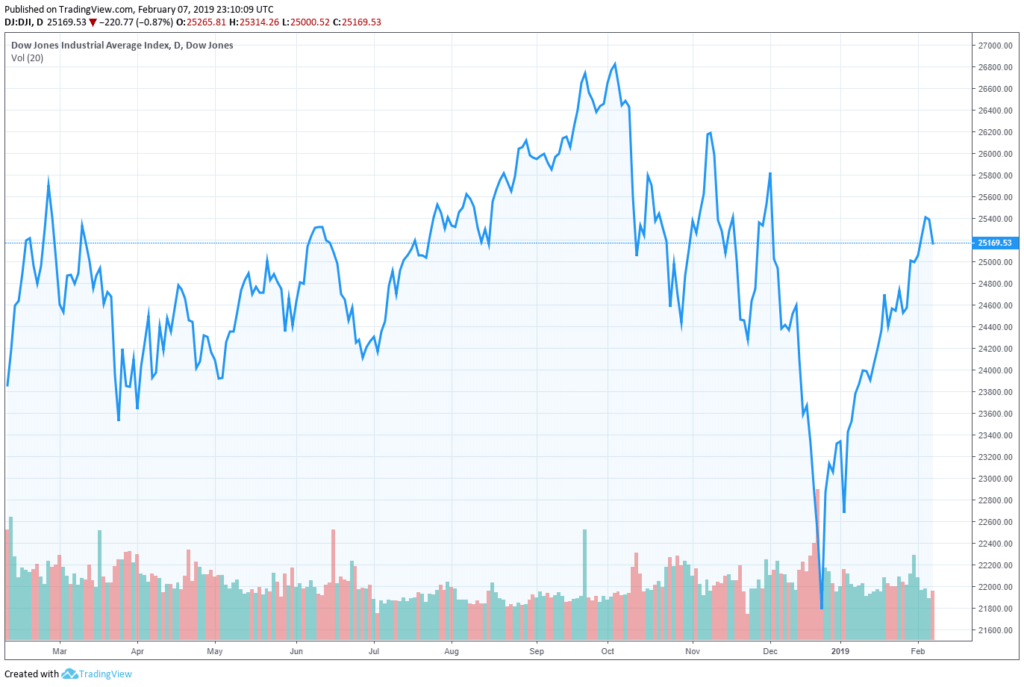

The recent Dow Jones rally is a “dead cat bounce” because the stock market is going to tank and a recession will eventually cast a dark shadow over the US economy. That’s the bleak prediction of investment perma-bear David Tice, who previously managed the aptly-named Prudent Bear Fund.

A dead cat bounce is a brief recovery from an extended bear market that’s followed by a prolonged downturn. Basically, that’s where Tice thinks the US stock market is right now.

‘We Are Now in a Bear Market’

Looking ahead, Tice claims a 10 to 30 percent market plunge looms on the horizon, so Wall Street shouldn’t get overconfident because of the recent bull runs.

“This is a rally inside a bear market,” Tice told CNBC on February 7. “We believe we are now in a bear market. The 200-day moving average was crossed back in October…We could have something between a 10 percent and a 30 percent decline [this year].”

Tice founded the Prudent Bear Fund in 1995 and sold it in 2008 to Federated Investors. He says despite the stock market’s recent rallies, he believes there’s a 50-50 chance of a recession this year.

Tice cited the disastrous monetary policies of the central banks, escalating corporate debt, and the economic slowdowns in Europe and Asia as the key drivers of the forthcoming recession.

“I tend to think with this massive amount of debt that we’ve added ― and this massive about of monetary stimulus that we’ve added ― it’s going to end very badly.”

David Tice: ‘Gold Represents True Money’

Tice says if the United States and China reach a trade deal, the Dow Jones may spike as much as 20 percent, but it will eventually come crashing down.

Accordingly, he suggests that individual investors cut back on their equity exposure, saying the stock market is too risky right now. However, Tice is bullish on gold, saying everyone should buy some of it.

“I’m a believer that gold represents true money. We are in a fiat money world, and it’s dangerous not to have some gold in your portfolio.”

Tice is a perma-bear who almost always expects the worst. As an example, in May 2017, Tice issued another woeful projection, saying the stock market would crash as much as 50 percent. He made the same gloomy prediction in 2012 and 2014. Those market crashes never materialized.

Interestingly, Tice praised bitcoin in 2017, when it was enjoying an unprecedented bull run. At the time, he said bitcoin “makes a lot of sense from a transactional basis.” It’s unclear what Tice’s views are of bitcoin now, in light of the current protracted Crypto Winter.

OppenheimerFunds CIO: No Recession For 5 Years

Meanwhile, other market analysts say concerns over a recession or a Dow Jones crash are overblown. Krishna Memani, the chief investment officer at OppenheimerFunds, says the US economy is definitely slowing down a little, but it will still increase more than 2%.

Moreover, Memani says there’s no recession ahead for at least another five years, as CCN.com reported in January 2019.

“There’s no recession imminent. I think five more years is what we are talking about. Valuations are meaningfully better.”

“And sentiment improves with the [US-China] trade talks. If we can find that resolution and the federal government opens up again, we will be home free.”

Memani says the biggest risk in the global stock market is trade. However, he’s confident that the ongoing trade disputes between the United States and China will be resolved. Why? Because both sides have too much to lose if they don’t fix the problem.

Despite the global economic slowdown, Memani is still recommending that investors buy. “We are telling people to buy right now because we expect these resolutions,” he said.