Dow Jones Rallies 130 Points After a Boost from US-China Optimism

This morning, Dow Jones Industrial Average Futures Trading predicted a gain of over 130 points for the index at market opening . The US stock markets have been buoyed by news that trade tariffs could be eased or even rolled back.

Futures trading as of 8.20am ET, for the Dow Jones, showed 148-point gains implying the 130 point opening rally. The index proved its rally before paring gains back to 100 points and 0.42%.

Tariffs on China Could Be Eased

Yesterday, it emerged that Treasury Secretary Steven Mnuchin had proposed lifting at least some tariffs to incentivize China to give ground in upcoming US-China trade-talks. The Dow Jones subsequently rocketed 250 points before falling back as any firm plans were disputed by the US Treasury.

The Dow Jones did end yesterday with substantial gains, 162 points and 0.67% higher. The Nasdaq and S&P 500 also gained less than 1%.

Art Hogan, chief market strategist at B.Riley FBR said :

“This market is desperate for good news on trade progress.”

He described the markets as a “coiled spring” waiting on investor’s moves which could be buoyed by positive outcomes. He added:

“You get a whiff of it and there’s a pop. The problem is, then reality sets in.”

The fact that the idea of reduced tariffs is out there and being discussed appears to be enough to inspire investors today.

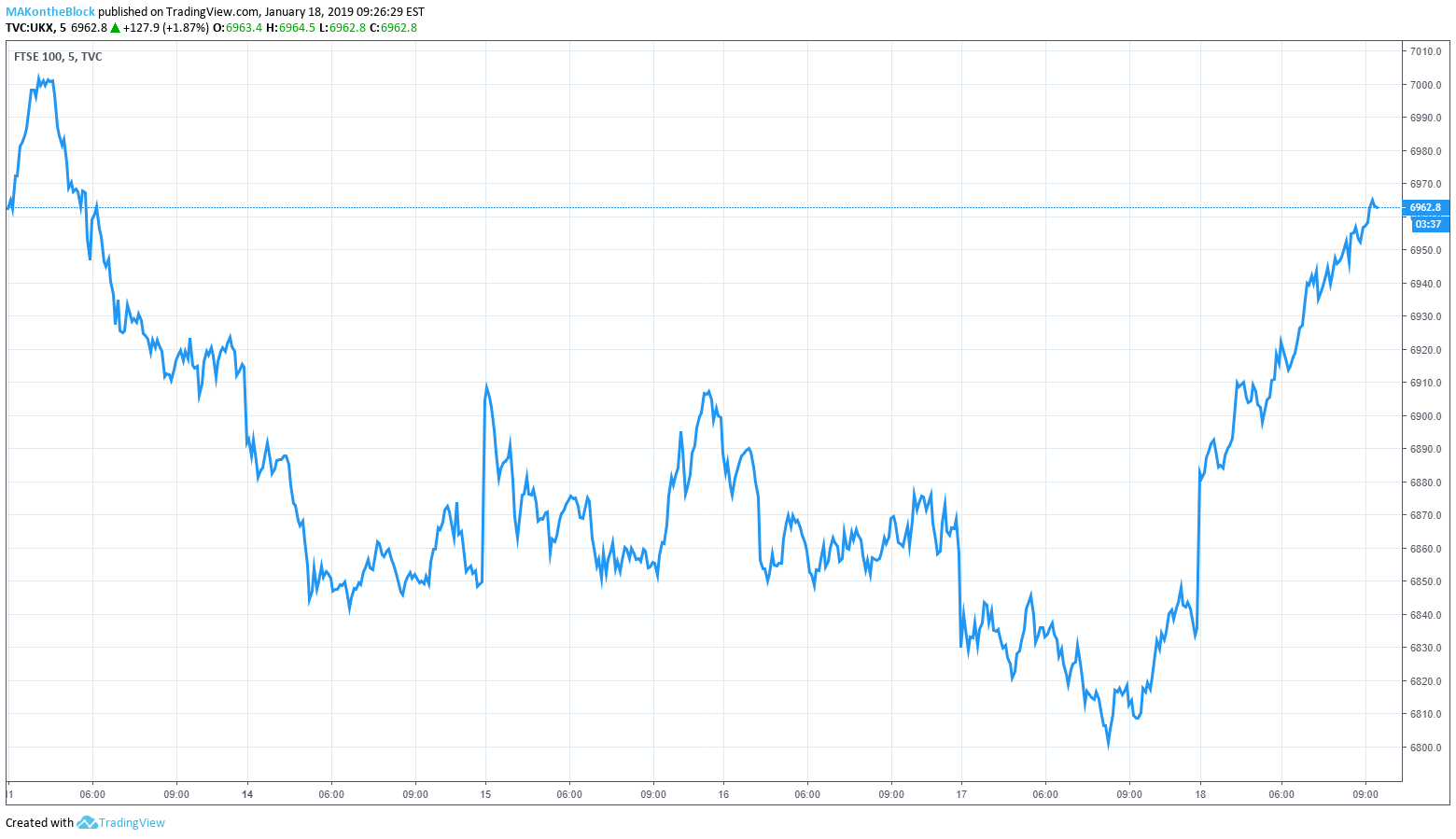

European Markets Rally

Despite ongoing Brexit uncertainty European stock markets are also rallying on news the US-China trade war could be winding down. The pan-European Stoxx 600 reached a 1% high during morning trading to reach its highest level since December 5, 2018.

The FTSE 100 is also up nearly 2%.

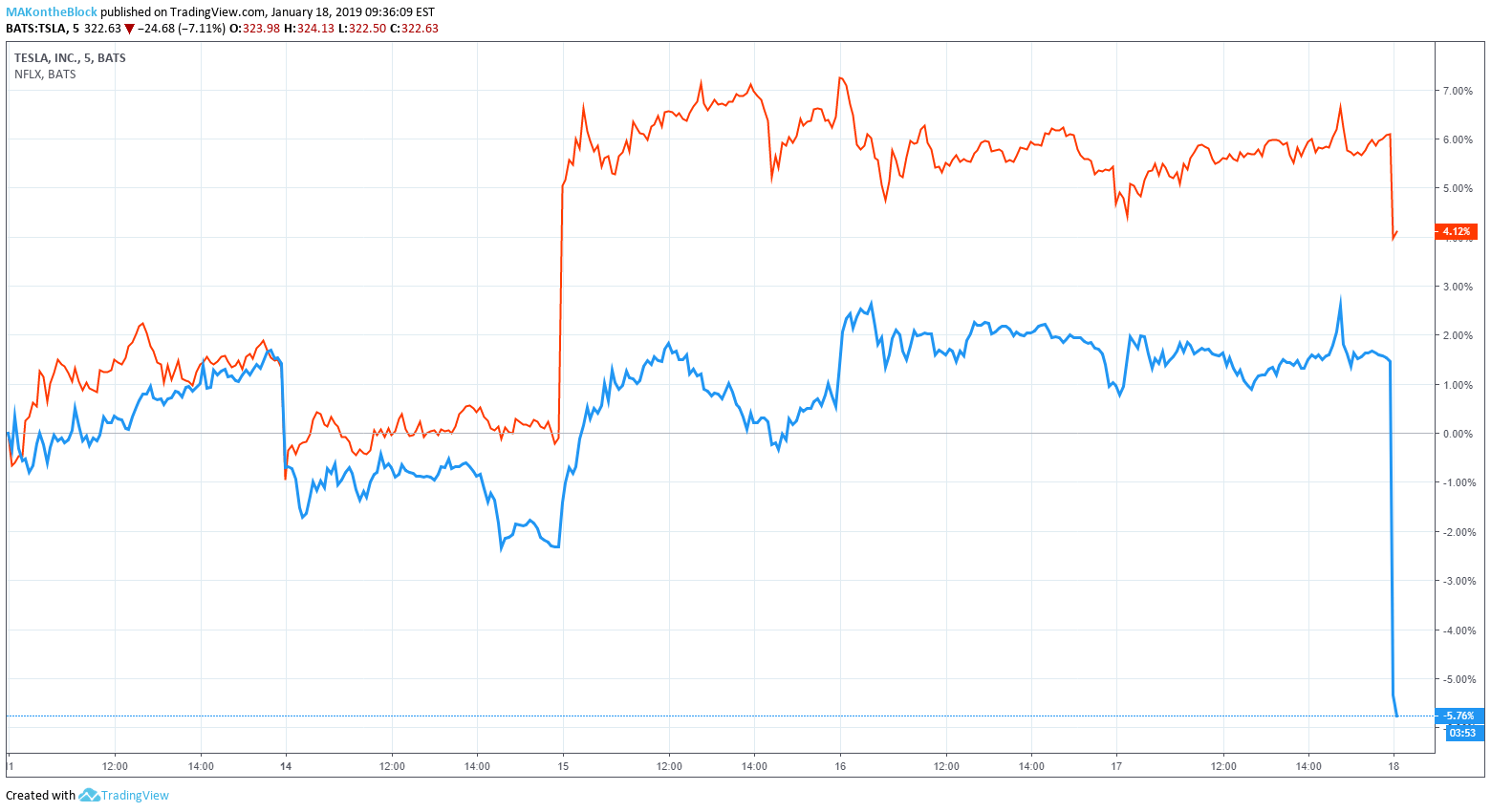

Netflix and Tesla Stocks Under Pressure

Tesla has announced cuts to its full-time workforce of 7% adding further pressure to the electric automaker. Tesla is seeing a rocky start to 2019 and increased competition from decades-old automotive companies like Ford and General Motors.

Netflix stocks have rallied more than 50% in 2019. The first FAANG stock to report fourth-quarter earnings, it delivered profits of $0.30 per share against analyst’s predictions of $0.06 per share. Revenue was somewhat short of forecasts which may impact Netflix share price today. That said, Netflix subscription price increases look like a tactic to address its revenue growth in the first-quarter of 2019.

Shortly into today’s trading session, Tesla shares fell over 6% and Netflix over 2%.

Elsewhere bitcoin and the cryptocurrency market is trading sideways with analysts taking the view that digital asset markets are “apathetic” to US stock market and global stock moves.