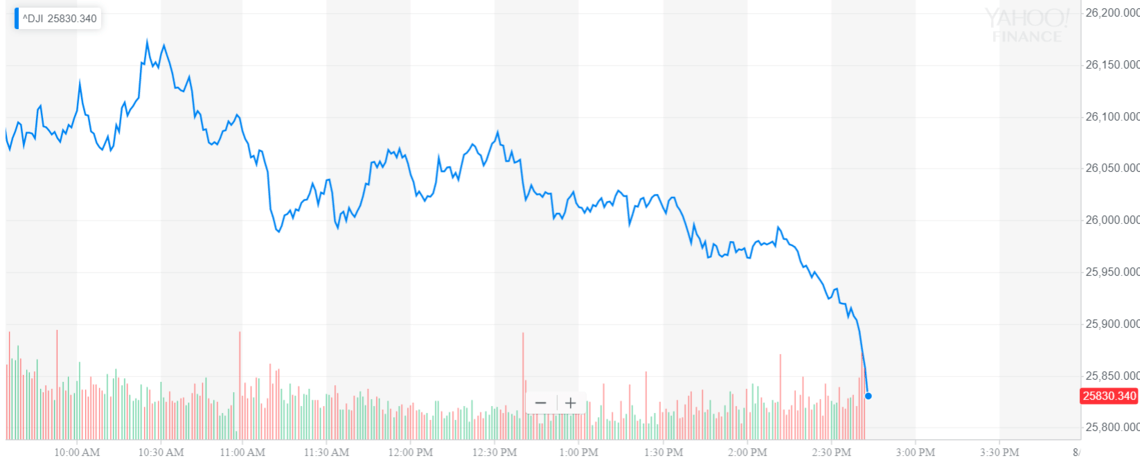

Dow Plunges 400 Points as Haven Demand Fuels Gold & Treasuries

The Dow plunged below 26,000 as demand for safe haven assets fueled spikes in gold and US Treasury bond prices. | Source: REUTERS/Brendan McDermid/File Photo

The Dow and broader U.S. stock market plunged anew on Monday, as threats to global economic health fueled a massive rally in haven assets like Treasuries and gold bullion.

According to Goldman Sachs, bullion prices are heading higher over the next six months as U.S.-China trade tensions continue to erode risk sentiment.

Dow Plunges 400 Points; S&P 500, Nasdaq Follow

All of Wall Street’s major indexes were trading sharply lower, mirroring a volatile pre-market for Dow futures. The Dow Jones Industrial Average plunged 398.18 points, or 1.51%, to 25,889.26. Twenty-nine of 30 index members were in the red.

The broad S&P 500 Index of large-cap stocks fell 1.32% to 2,880.26, with all sectors reporting losses. Financials stocks were the hardest hit, falling 1.9%. Seven other sectors declined by 1% or more.

The technology-focused Nasdaq Composite Index dumped 1.33% to 7,853.13

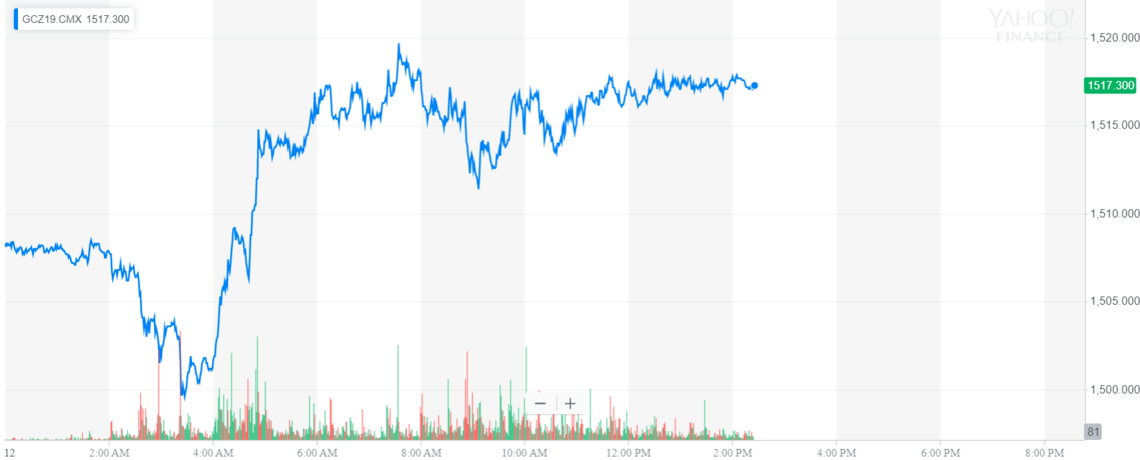

Rise of the Safe Havens

Turbulence in stocks fueled a large rally across haven assets, pushing the benchmark 10-year U.S. Treasury yield lower by 10 basis points. The yield reached a session low of 1.640%, according to CNBC, which is still higher than last week’s bottom of 1.595%. Bond yields fall when prices rise.

Gold prices were back near six-year highs, with the December futures contract reaching a high of $1,519.90 a troy ounce on the Comex division of the New York Mercantile Exchange. The futures contract was last up $8.70, or 0.6%, at $1,517.20 a troy ounce.

Bullion is up more than 18% year-to-date and could be ready to go a lot higher in the near term, according to Goldman Sachs. The investment bank has given bullion a three-month price forecast of $1,575 and a six-month target of $1,600 in light of the ongoing U.S.-China trade war.

Read why gold could be heading for $2,000 a troy ounce .

On Friday, President Trump said the United States isn’t ready to make a deal with China and cast doubts about upcoming trade talks scheduled for September. As Goldman Sachs pointed out, markets are no longer expecting an agreement before the 2020 presidential election.

Click here for a real-time Dow Jones Industrial Average chart.