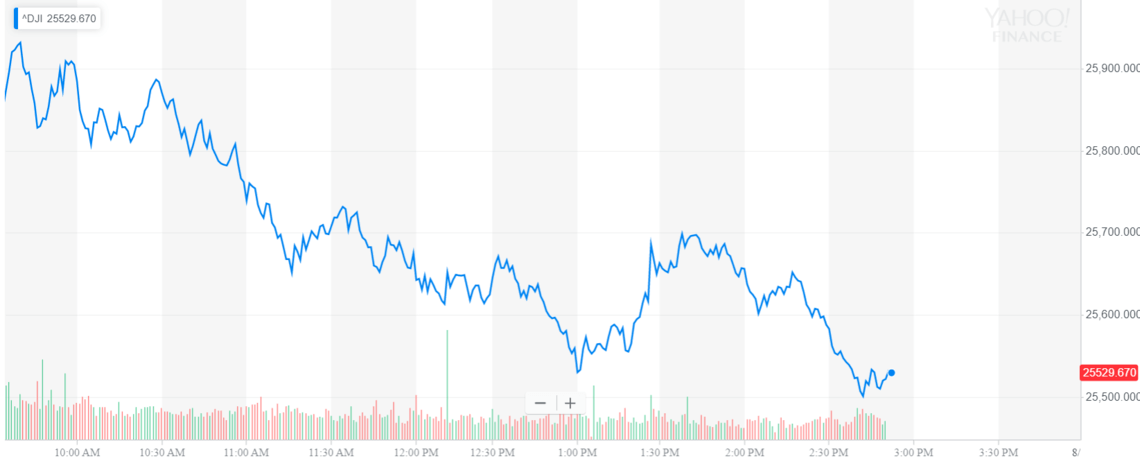

Dow Suffers 750 Point Crash as German Economy Teeters on Recession

The Dow suffered a vicious 750 point crash as the German economy teetered on the brink of a devastating recession. | Source: REUTERS/Kai Pfaffenbach

By CCN.com: The Dow and broader U.S. stock market plunged anew on Wednesday, erasing the previous day’s recovery after a slumping German economy raised red flags about the health of the global economic recovery.

Dow Jones in Free-Fall; S&P 500, Nasdaq Follow

All of Wall Street’s major indexes were headed for massive losses, mirroring a volatile pre-market for Dow futures. The Dow Jones Industrial Average plunged more than 750 points – nearly 3% – before a half-hearted respite reduced the nosedive to a still-grisly 656.41 points. The DJIA last traded at 25,623.5 for a session decline of 2.5%.

The broad S&P 500 Index of large-cap stocks tumbled 2.45% to 2,854.55. All 11 primary sectors fell, with energy and financials each dropping more than 3%.

Plunging technology shares dragged the Nasdaq Composite Index sharply lower. The tech-laden benchmark fell 2.63% to 7,805.49.

The CBOE Volatility Index, commonly known as the VIX, was back to trading above its historic mean Wednesday. The VIX, which generally trades inversely with the S&P 500, surged 22.43% to 21.45.

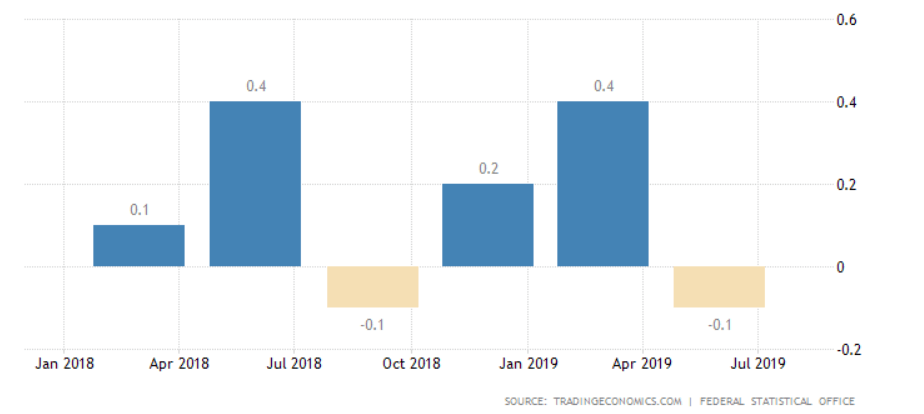

German Economy Shrinks

Global equity markets were under pressure Wednesday after Germany, the world’s fourth-largest economy, experienced a mild contraction in the second quarter.

Gross domestic product (GDP) – the value of all goods and services produced in the economy – declined 0.1% between April and June, government data showed. The export-driven economy has contracted in two of the last four quarters. A technical recession is defined as back-to-back quarters of negative growth.

Germany’s gravitational pull on the dismal euro region was apparent in the second quarter, as Eurozone GDP expanded just 0.2%.

A slumping Germany is a dire warning that global economic health is waning. The same factors that weakened Germany’s economic output – U.S.-China trade tensions, weak global auto sales, and Brexit uncertainty – are impacting other nations as well. Without a strong German economy, Eurozone contraction is likely to follow.

Click here for a real-time Dow Jones Industrial Average chart.