Dow Futures Gain Despite Deafening 2020 Correction Warnings

It's been a record-setting year for the Dow but there are growing red indicators of a stock market correction in 2020. | Source: AP Photo/Richard Drew; Edited by CCN.com

- Dow futures signal that investors are taking a break from the aggressive activity witnessed last week.

- Various players on Wall Street are warning of an impending stock correction.

- Stock market veterans argue that earnings far outstrips the appreciation in equities.

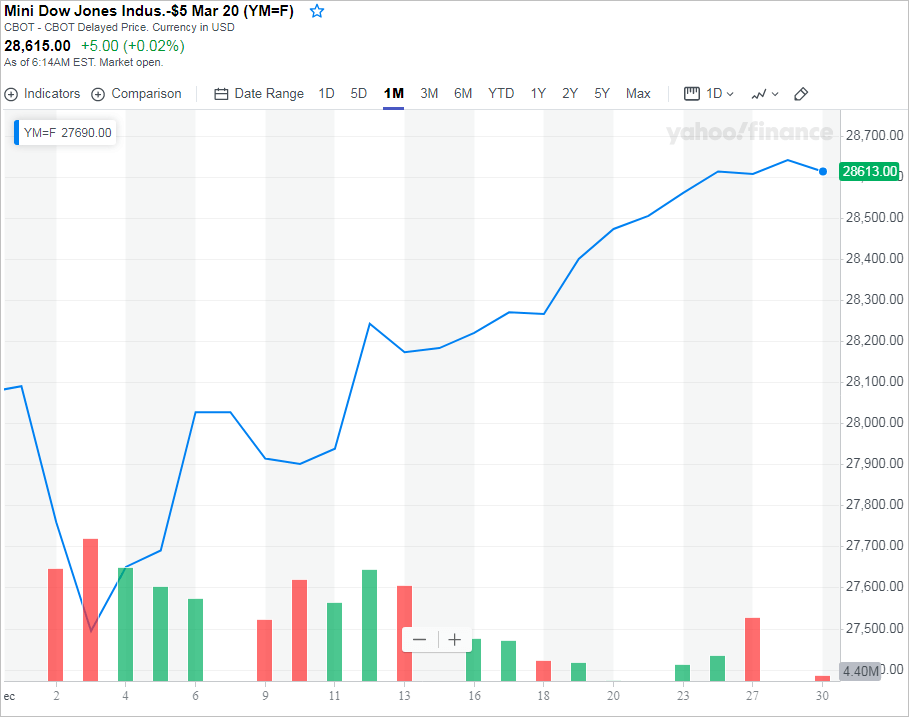

Dow Jones Industrial Average (DJIA) futures gained marginally in Monday’s pre-market hours as jitters over an impending stock correction grow by the day. After notching several record-highs in the third quarter, the slight uptick in pre-market hour trading in the Dow futures suggests that investors have hit pause as 2020 beckons.

Various players in Wall Street have already sent warnings regarding an impending stock correction. This comes at a time when US stocks are considered heavily overpriced causing some investors such as Warren Buffett to stay away from the market.

Dow futures just grow 0.08%

Perhaps a sign of weariness, investors seemed content to adopt a wait-and-see attitude in Monday’s pre-market hours. This follows a week in which major stock indices hit record highs. At 6:14 AM EST, the Dow futures had climbed by 0.02% or a mere 5 points.

Futures of other stock indices also rose marginally. The S&P 500 futures went up by 0.07% . Likewise, the Nasdaq 100 futures appreciated by just 0.03% .

Investors take a breather as warning bells sounded

Various Wall Street titans have issued warnings on the likelihood of 2020 witnessing a stock correction. A correction occurs when stocks lose more than 10% of their value.

On Sunday long-time Wall Street bull Edward Yardeni told CNBC that the stock market had rallied in a “melt-up fashion” rather than the reassuring “leisurely pace”. Consequently, Yardeni expects a significant correction within the first few months of 2020:

10% to 20% [correction] would be quite possible if this market gets to 3,500 well ahead of my schedule.

The S&P 500 index closed Friday at 3240 points.

Similar concerns have been echoed by money manager Jack Ablin of Cresset Capital. Last week Ablin stated that “valuations are pretty stretched”. This is based on the fact that the appreciation was disproportional to the earnings growth. In 2020 Ablin expects stocks to “go back to fair value”, with a 15% correction expected.

Investment manager Vanguard has also placed the odds of a correction in 2020 at 50%.