Dow Flinches After $6 Trillion Asset Manager Screams ‘Melt-Up’

. | Source: REUTERS / Brendan McDermid

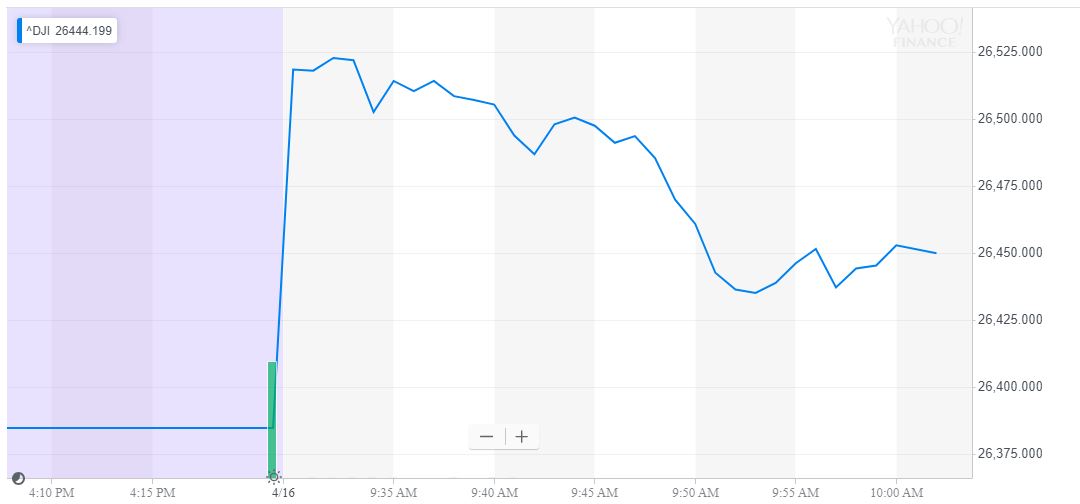

By CCN.com: The Dow Jones rally looked like it planned to kick back into gear on Tuesday, as the stock market bellwether and its peers all assembled strong opens. However, the DJIA gave up nearly 100 points after the world’s largest asset manager warned that the markets could enter a worrisome trend – one that could potentially hamstring President Trump’s reelection campaign.

Dow Struggles After Strong Open

The Dow Jones Industrial Average opened to triple-digit gains, briefly eclipsing the 26,500 mark. However, the Dow quickly pared its gains; by the closing bell the DJIA traded down to 26,452.66 for a gain of 67.89 points or 0.26 percent. The S&P 500 and Nasdaq brought similarly-muted returns, rising 0.05 percent to 2,907.06 and 0.3 percent to 8,000.23.

On Monday, all three indices posted minor declines, but Wall Street did its best this morning to pump the markets ahead of a fresh round of earnings.

Writing in a note to clients , UBS strategists chided investors for their doom-and-gloom global growth forecasts. They said that current equities valuations anticipate growth stabilization, while data from key regions such as China suggests that growth will continue to accelerate.

“The rally has been underpinned by dovish central banks and a sharp decline in global real rates, and we have shown that markets are priced for growth stabilization, but not for acceleration,” wrote the UBS team, which was led by Daniel Waldman, adding that this “leaves room for stocks to run higher.”

BlackRock Chief: Stock Market at Risk of Melt-Up

BlackRock CEO Larry Fink agrees that the parabolic stock market rally has plenty of more room to run, but he doesn’t necessarily think that is a good thing.

Speaking during Tuesday’s episode of CNBC show “Squawk Box ,” Fink said that the Dow and its peers could suffer a “melt-up” when cash that has remained on the sidelines begins to rush back into equities.

“We have a risk of a melt-up, not a meltdown here. Despite where the markets are in equities, we have not seen money being put to work,” said Fink, whose firm is the world’s largest asset manager. “We have record amounts of money in cash. We still see outflows in retail in equities and in institutions.”

Though they might initially appear bullish, melt-ups often mislead investors about where the stock market is actually headed. These sudden rallies frequently give way to sharp corrections.

That could bode ill for Donald Trump, whose 2020 reelection case hangs heavily on the stock market’s performance during his first term. Indeed, Goldman Sachs – which expects Trump to vanquish the eventual Democratic nominee – said that positive economic performance would be a key catalyst to his narrow electoral victory.

Already, the president has begun to hedge against a bull market reversal. He blames Federal Reserve policies for stifling economic growth, opining that the central bank’s four rate hikes in 2018 sapped as much as 10,000 points from the Dow, which entered Tuesday just below 26,400.

If the Dow does succumb to a melt-up over the next few months, Trump will have to hope that the upward momentum continues at least through November 2020.

France: Trump’s Notre Dame Advice Would Have Led to Cathedral’s Collapse

Meanwhile, Trump continues to audition for roles he can fill during his post-presidency swansong – whether that begins in 2021 or 2025.

On Monday, he doled out some unhelpful advice to embattled aerospace giant Boeing. The $215 billion company’s shares fell around 1 percent despite the president providing them with such insightful tips as “FIX the Boeing 737 MAX” and “add some additional great features.”

Later that day, he chirped in on the Notre Dame tragedy to advise the Parisian firefighters on how best to control the flames and save the historic medieval cathedral.

“So horrible to watch the massive fire at Notre Dame Cathedral in Paris,” Trump said. “Perhaps flying water tankers could be used to put it out. Must act quickly!”

Remarkably, French civil defense officials responded to Trump’s advice, revealing that his plan to use water-bombing aircraft could “lead to the collapse of the entire structure of the cathedral.”