Dow Won’t Crash Because Trump Won’t Let It Happen: J.P. Morgan

A Dow spiral? Not under Trump's watch, a JP Morgan analyst claims. | Source: AP Photo/Jacquelyn Martin

By CCN.com: The Dow Jones chalked up back-to-back losses this week, but don’t fear an all-out crash. Trump won’t let it happen, says JP Morgan’s top analyst.

As trade war fears persist, Marko Kolanovic said Trump would sooner sign a trade deal with China than let the US economy fall into recession on his watch. With the 2020 election looming, there’s no way Trump will let the stock markets crash, the JP Morgan analyst affirmed .

“If there is a trade deal, which would be rational to expect going into election year, we think that about half of the market damage could be quickly reversed.”

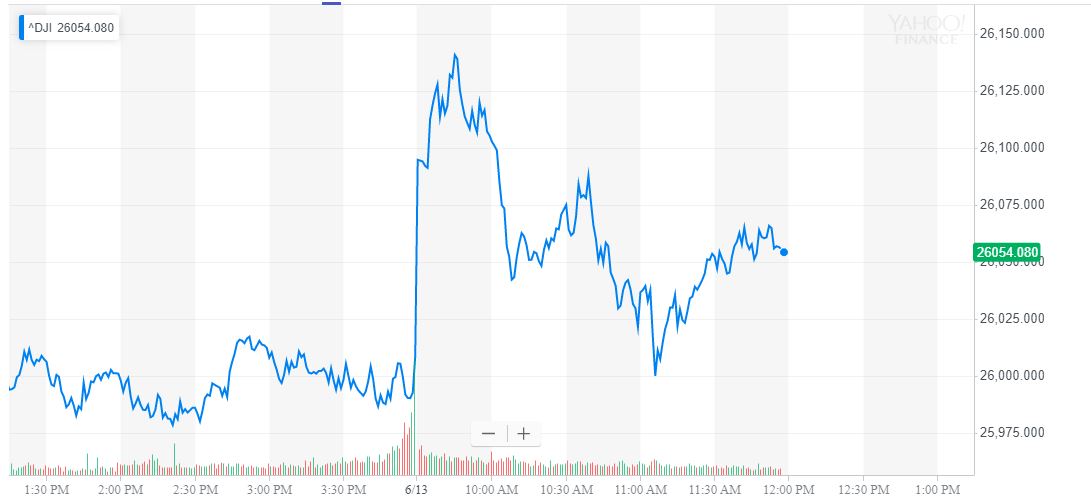

Dow creeps higher on Thursday

The Dow Jones Industrial Average crept higher on Thursday, putting the DJIA on track to snap its back-to-back losses. By 11:57 am ET, the Dow had gained 51.95 points or 0.2 percent, lifting the index to 26,056.78.

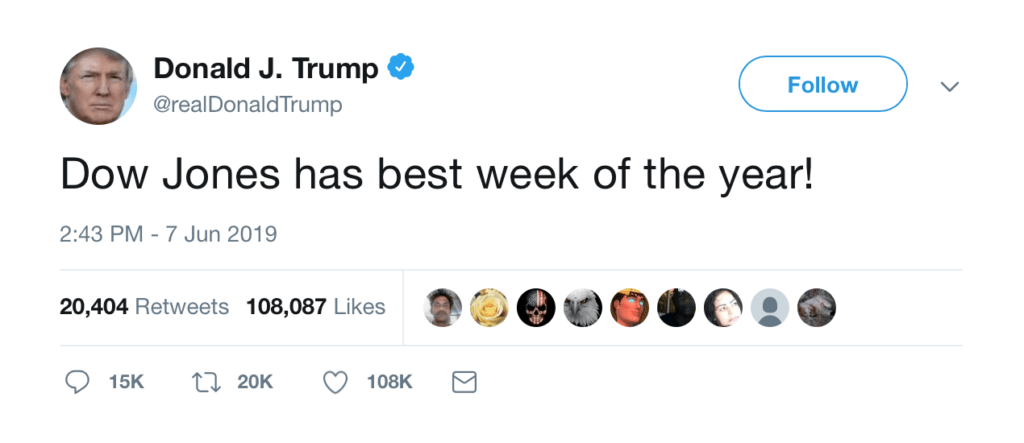

Markets have been volatile since early May when Trump pulled the plug on China negotiations and hit the country with higher tariffs. At the same time, traders are trying to price in the possibility of rate cuts at the Federal Reserve.

There will be no “Trump Recession”

A host of Wall Street banks have sounded the recession alarm in recent weeks. As CCN.com reported, Morgan Stanley analyst Michael Wilson said even lower interest rates might not prevent a recession.

“Fed could cut as soon as July but it may not halt slowdown/recession.”

Kolanovic poured cold water on the threat of recession. He said the president will stop the bleeding if trade tensions continue to harm the US economy. A recession under his watch would be labelled the “Trump Recession,” Kolanovic said, an outcome the president will do almost anything to avoid as the campaign for re-election kicks gears up.

For that reason, the JP Morgan analyst is “cautiously optimistic” on stocks.

“[A trade deal] would translate into a quick ~5% rally in broad markets, and a 10-20% rally in value and high beta.”

Dow stocks already feeling the trade war pain

Trump may be forced to act on the trade deal soon, though. Reports reveal the trade war is already hitting the Dow’s biggest stocks hard .

Apple, which makes 57.9 percent of its abroad, is expected to post a significant loss of revenue in upcoming quarterly reports. Boeing, which derives 54.7 percent of its business overseas, looks set to report a 43.7 percent dip from last year.

Second-quarter earnings season just around the corner, and if the trade war pain hits the markets, Trump’s hand may be forced.

Plunge protection team, assemble

Trump knows that inking a deal with China will boost the stock market (and his approval rating). He is waiting for the opportune moment to pull the trigger.

If the Dow shows signs of weakness before that moment, he can always call on the infamous Plunge Protection Team. The Working Group on Financial Markets was last called into action in December when the S&P 500 slumped towards its worst fall since the Great Depression.

In other words, Trump still has two aces in his pocket if a recession does lurch closer.

Click here for a real-time Dow Jones Industrial Average (DJIA) price chart.