Deutsche Bank Celebrates ‘Dollar Day’ by Accidentally Shilling Bitcoin

German financial giant Deutsche Bank has accidentally made the case for Bitcoin while commemorating National Dollar Day. | Source: Shutterstock

When the fat-cats at Deutsche Bank instructed their social media interns to draft a tweet commemorating National Dollar Day , they probably didn’t realize that they’d accidentally end up shilling Bitcoin to their more than 650,000 followers.

But while the Bitcoin isn’t directly mentioned, it’s difficult to imagine anyone writing a better advertisement for the leading cryptocurrency.

Is Deutsche Bank a closeted Bitcoin admirer?

In the tweet, Deutsche Bank observes that since the U.S. monetary system was established on this day in 1786, the dollar has lost tremendous purchasing power. The German multinational notes that the equivalent of a single dollar from 1791 now has the purchasing power of about $27.60 today.

You do not need years of exposure to Bitcoin to appreciate that Deutsche Bank has by implication turned a negative spotlight on the world’s favorite reserve currency – and by extension, the worldwide fiat currency regime. The bank inadvertently made a case for an anti-inflationary currency that is not printed at the whim of unelected government bureaucrats.

With the maximum number of Bitcoins that will ever be in circulation capped at 21 million, the cryptocurrency was designed to be free of the inflationary risks that all fiat currencies have proven to be susceptible to. This was stated unambiguously in the Bitcoin whitepaper :

“Once a predetermined number of coins have entered circulation, the incentive can transition entirely to transaction fees and be completely inflation free.”

And yet the dollar is hardly the world’s worst fiat currency…

Deutsche Bank’s celebration of a fiat currency that has lost its purchasing power dramatically over the years is all the more significant for Bitcoin since the dollar is one of the world’s strongest currencies.

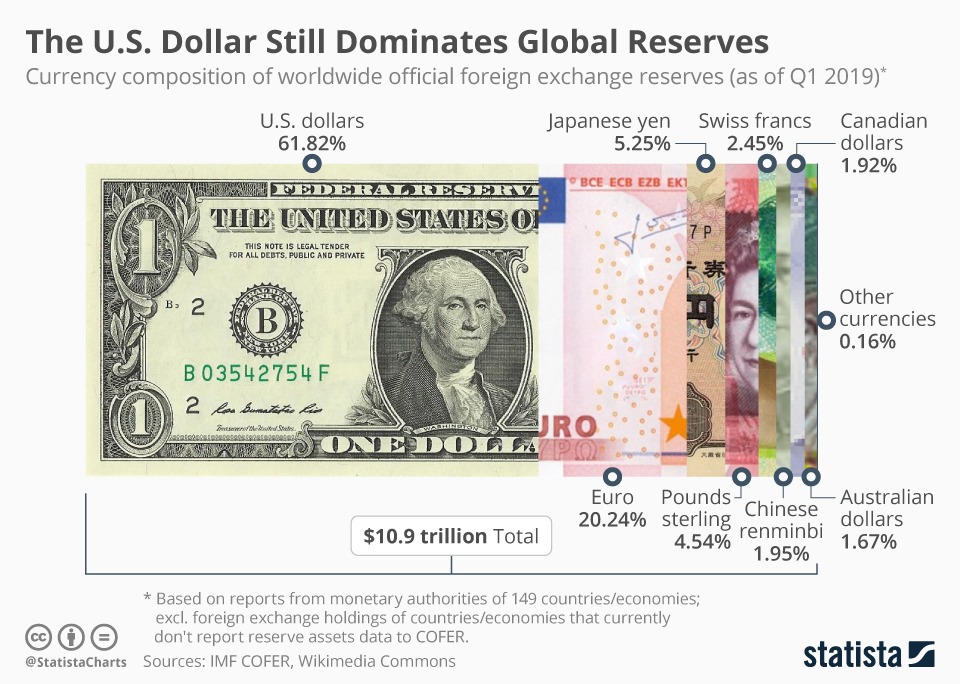

As of last year’s third quarter, the U.S. dollar constituted close to 62 percent of all the foreign exchange reserves held by central banks across the world.

This means that if your wealth is held in the dollar and you are a little apprehensive over its declining purchasing power, you should be outright panicking if you are holding other fiat currencies.

Bitcoin offers freedom from the tyranny of fiat

So how bad can it get? Well, unchecked printing of money by central banks has in the past led to the total collapse of fiat currencies with Europe, Latin America, and Africa offering standout cases .

Germany’s Papiermark in the 1920s is a perfect example from the 20th century when yearly inflation rose to over 300 million percent in the European country. Most recently, Zimbabwe provided another example of why a hard-capped cryptocurrency is the future when inflation rose to 500 quintillion percent.

Fortunately, there is no need to repeat these same mistakes in the 21st century with Satoshi Nakamoto already having gifted us the solution: Bitcoin.

Disclaimer: The views expressed in the article are solely those of the author and do not represent those of, nor should they be attributed to, CCN.com.