Despite Dow Sell-Off, White House Economist Says There’s ‘No Recession in Sight’

Larry Kudlow, a White House economic adviser, | Source: Shutterstock

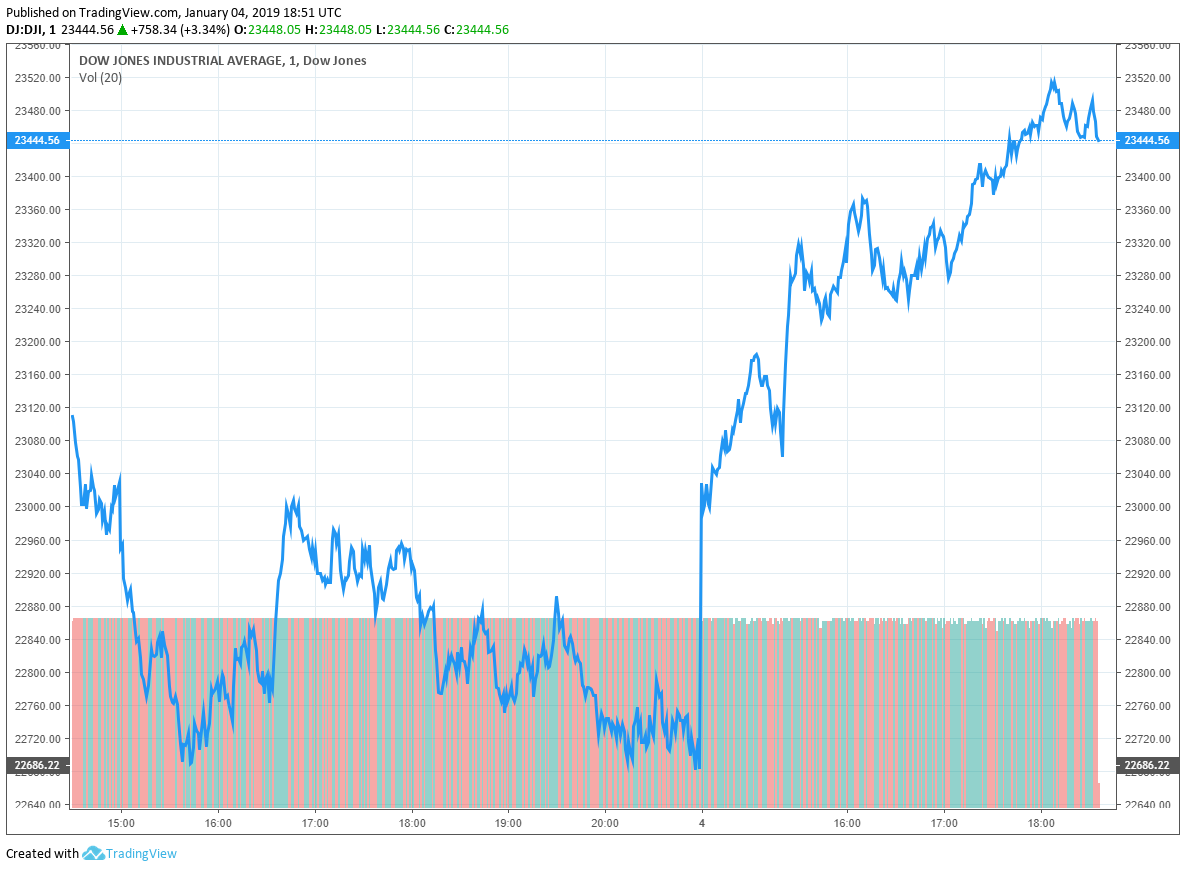

The top economic adviser to U.S. President Donald Trump has dismissed fears that the world’s biggest economy is about to slip into a recession, even as the Dow Jones Industrial Average and other market indices have suffered steep declines in recent months.

In an interview on Bloomberg TV, the National Economic Council Director Larry Kudlow acknowledged the gloomy economic forecasts that have been hitting the headlines in the recent past but added that fears of a recession were exaggerated:

There’s no recession in sight. I know this has been a gloomy period and I know people are concerned about the stock market.

As evidence that the U.S. economy was still going strong, Kudlow pointed to the Non-Farm Payroll numbers released Friday which beat estimates. The jobs report indicated that 312,000 jobs were added to the U.S. economy last month and this was nearly double the figure of 176,000 that economists had estimated. This was the biggest rise in payrolls since last year in February.

Dow Breathes Sigh of Relief

Additionally, wages rose by 0.4% from the previous month and by 3.2% from a year ago. The unemployment rate, however, ticked up to 3.9% against an estimate of 3.6% that the economists who were surveyed had been expecting.

Referring to the non-farm payroll numbers, Kudlow said that the jobs report had painted a more optimistic picture than what has been gracing the headlines in the recent past. Earlier this week, for instance, David Rosenberg, the chief economist and strategist of Canadian wealth management firm Gluskin Sheff, stated that the recent sell-off in the stock market was a signal that a recession could be expected this year.

According to Rosenberg, with the Federal Reserve Bank tightening policy, the chance of a recession occurring in 2019 had risen by over 80%:

We’ve got more than 80 percent chance of recession just based on the fact the Fed is tightening policy. This tightening of financial conditions that we’ve seen in the markets is going to end up having a cascading effect on the economy for the first few quarters of this year.

State of the U.S. Manufacturing Sector

Fears of an economic slowdown had also been fueled by the Institute of Supply Management (ISM) indicating that last month the U.S. manufacturing sector grew by the slowest pace since November 2016. Specifically, the ISM index declined from 59.3 in November to 54.1 in December.

Further contributing to a gloomy economic picture was the move by the biggest public firm in the U.S by market cap, Apple, to revise its revenue guidance for the first quarter downwards. This was after the tech giant recorded lower sales than had been expected in China, its biggest market outside of its home country.

Featured Image from Shutterstock. Price Charts from TradingView.