Cryptocurrency Market Cap Nears All-Time High as Bitcoin Dominance Hits Historic Low

The cryptocurrency market cap came within $11 billion of its all-time high on Tuesday, signaling that the ecosystem has recovered from the late-December downturn that temporarily caused more than $200 billion in capital to evaporate from the markets. This rally has been altcoin-driven, and, as the bitcoin price continues to languish below $14,000, the flagship cryptocurrency’s market share has reached a historic low.

Cryptocurrency Market Cap Nears All-Time High

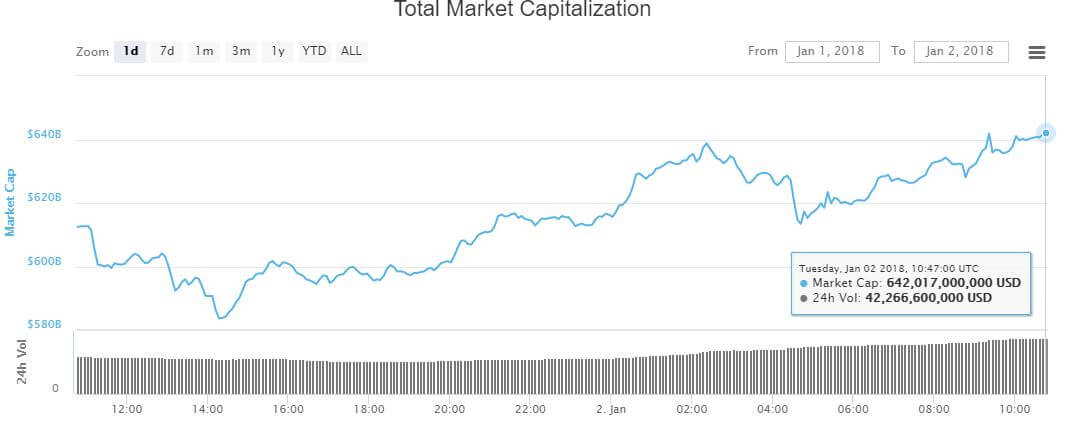

Cryptocurrency valuations climbed a combined $30 billion leading into the first regular business day of 2018, bringing the cryptocurrency market cap to $642 billion. This represented a single-day increase of five percent and placed the cryptocurrency market cap within striking distance of $653 billion, the all-time high it set in mid-December as the bitcoin price approached $20,000.

Bitcoin Price Returns Minor Increase

The bitcoin price took a wavy course to begin the year, but it managed to assemble a minor day-over-day increase on Tuesday morning. After fluctuating between $12,795 and $13,898, the bitcoin price ended the day at $13,484 on Bitfinex for a 24-hour gain of about one percent. Accounting for the moderate premiums of Asian cryptocurrency exchanges, the global average bitcoin price is now $13,792, which translates into a $231.4 billion market cap.

Notably, bitcoin’s market share is now at a historic low. After boasting a dominant 68 percent stake in the market as recently as Dec. 8, bitcoin now accounts for just 36 percent of the total cryptocurrency market cap.

Ethereum Surges to All-Time High in Bid to Reclaim Second Spot in Rankings

Ripple and ethereum continued to jostle for the second spot in the market cap rankings, and — following an ethereum price rally — the contest was neck-and-neck.

The ripple price achieved a four percent increase, a moderate gain that raised its global average price to $2.34 and market cap to $90.6 billion.

However, this rally was eclipsed by that of the ethereum price, which soared by fifteen percent to set a new all-time high above $900. By the time of writing, the ripple price had ebbed back to $842 on Bitfinex, leaving its market cap at $85.2 billion.

At this level, ethereum is worth just $5.4 billion less than ripple, meaning that a relative increase of seven percent should be sufficient to restore ethereum’s status as the second-most valuable cryptocurrency.

Altcoins Chip Away at Bitcoin’s Market Share

The altcoin rally extended throughout the wider markets, raising the total altcoin market cap above $400 billion for the first time.

Altogether, every top 10 cryptocurrency posted at least a minor single-day advance (as did 87 of the top 100), and three rose by more than 10 percent.

The bitcoin cash price rose by one percent, enabling the fourth-largest cryptocurrency to once again crack the $2,500 barrier. The cardano price rose 12 percent, raising its market cap above $20 billion for the first time in its short history. The litecoin price rose seven percent, bringing it just below $250.

IOTA and stellar posted the best performances among top 10 cryptocurrencies, rising 16 percent and 32 percent, respectively. Stellar now has a market cap of $10.3 billion, making it the eighth most valuable cryptocurrency.

Ninth-ranked NEM rose three percent to $1.09, raising its market cap to $9.8 billion, while the dash price saw an eight percent increase to $1,143 to round out the top 10.

Write to Josiah Wilmoth at josiah.wilmoth(at)CCN.com.

Featured image from Shutterstock.