Crypto Firm Gladius Tattles on Itself Before SEC Brings Down the Hammer

Crypto startup Gladius Network tattled on itself to the SEC before the US regulatory agency could bring down the hammer on the illegal ICO issuer. | Source: Shutterstock

The SEC acknowledged a settlement with Gladius Network LLC today. Gladius raised almost $13 million in an ICO at the height of the crypto boom, from October to December 2017. The company tattled on itself last August, self-reporting potential violations to the SEC. As a result, the regulator has been gracious enough to opt not to impose additional financial penalties on Gladius. The catch? Gladius has to offer refunds on all ICO tokens.

Gladius Reports Itself to the SEC

The settlement is similar to the agreement NEO reached with Chinese regulators. In the case of NEO, the token had already surpassed its ICO price. One of the first tokens launched on NEO, the Red Pulse token, also conducted a refund .

The SEC order reads , in part:

“The Commission is not imposing a penalty because of the significant steps Gladius took to remediate the violation. Gladius, which was evaluating the applicability of the federal securities laws to its ICO,self-reported to staff in the Commission’s Division of Enforcement in the summer of 2018, and informed Commission staff that it wanted to do what was necessary to take prompt remedial steps. It cooperated with the staff’s investigation, providing information quickly and in a form useful to the staff.”

In this respect, Gladius differentiates from the Paragon and CarrierEQ (Airfox) ICOs, which were also prosecuted by the SEC late last year. Both companies paid a $250,000 fine and offered a full refund. The problem with the refund, for the token-funded companies, is that the tokens had not performed very well on the market. In the case of Paragon, the tokens were valued at about 1/3rd of their ICO price. This led CCN.com writer Joseph Young to speculate on how the SEC’s actions could send some companies into bankruptcy.

Crypto Firm to Offer Refunds and Register with SEC

Although they don’t have to pay any fines, Gladius does have to file registration with the SEC. The process involves disclosing much of its information publicly. For investors, such information will be useful in determining whether the GLD token is a worthwhile investment. For the company, it’s a minor headache. Of the three American ICOs mentioned in this article, they are coming out the cleanest. Their odds of getting approval from the SEC and continuing business are significantly higher.

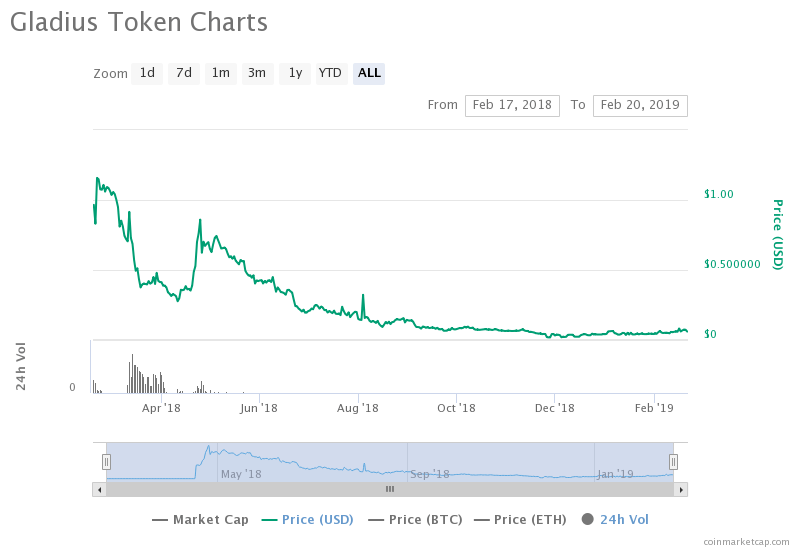

However, ICO investors might take the opportunity to recoup their original investment, given the market performance of GLA in the interceding months. The token had under $3,000 in trading volume over the 24-hour period and presently stands around 7 cents.

The GLA token is used to compensate users who sell resources (like bandwidth) to help websites thwart DDOS attacks. Gladius network is operational, but virtually unheard of in real-world uses, as many sites continue to rely on services like Cloudflare for the same purpose.

Read the full SEC order below:

SEC Gladius Network Order by on Scribd

Featured Image from Shutterstock