Circle Takes Aim at Crypto Index Funds with Market Cap-Weighted Investing

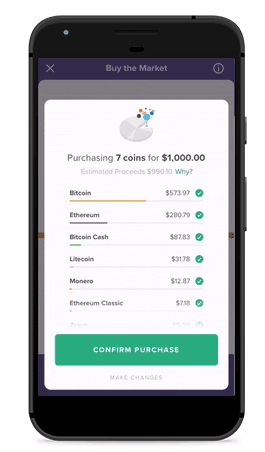

Cryptocurrency brokerage service Circle Invest is taking aim at crypto index funds with its new “Buy the Market” feature, which allows retail investors to purchase market cap-weighted positions in the assets listed on the platform.

The feature, added to the investing app in its latest update, gives investors the option to decide how much they want to invest and then automatically distribute it across the cryptocurrencies supported by the platform according to each coin’s circulating market cap.

At present, Circle Invest supports bitcoin (BTC), ether (ETH), bitcoin cash (BCH), litecoin (LTC), ethereum classic (ETC), monero (XMR), and zcash (ZEC), and more will likely be added in the future.

There are no extra fees for the service, which Circle clearly intends to market as a low-cost alternative to the growing number of cryptocurrency index funds that provide investors with a similar product, albeit with more functionality and a more familiar wrapper.

Several firms — including Grayscale, Coinbase, and Bitwise Asset Management — have launched cryptocurrency index funds in recent months to provide investors who want to bet on the ecosystem as a whole rather than individual assets with the ability to gain exposure to a variety of large-cap coins.

However, these funds are currently restricted to accredited investors, require buyers to make large initial contributions, and charge management fees as high as three percent per annum.

So while Circle Invest’s feature may not be as robust as a full-scale crypto index fund (it will not rebalance one’s portfolio on a regular basis, for instance) it does provide retail investors with the ability to easily open a market cap-weighted position in a significant slice of the cryptocurrency ecosystem at a very low cost.

As CCN.com reported, Circle recently raised $110 million in a Series E funding round led by industry giant Bitmain, assigning the Goldman Sachs-backed firm a $3 billion valuation.

Featured Image from Shutterstock