How China’s Plans to Launch Its Own Currency Might Affect Bitcoin

China’s central bank, the People’s Bank of China (PBOC) has revealed that it is in discussions to launch its own digital currency. What does this mean for Bitcoin?

A statement by the PBOC about issuing its own digital currency is making its way around the globe and has people wondering about the consequences.. Here are some of the major points:

PBOC is Partnering with Major Institutions

In the story, it’s stated that this is a partnership with Citibank and Deloitte & Touche to determine the best way to build and issue the digital currency. This is a huge move by all parties as they could create a large global economic force. It started back in 2014 with research into how to build and issue the currency and they explored “related business operations, key digital currency technologies, environments for the issuance and circulation of digital currencies.” Now it appears the work is done and they are ready to move into the design phase.

Why is China doing this?

From the statement, it is clear the PBOC understands the digital global landscape and how the emergence of new technologies will shape the future. This move seems to be an attempt to become the reserve currency of the new digital world.

The PBOC states:

…Under China’s new economic normal, the exploration of the issuance of digital currency by the central bank has positive practical significance and far-reaching historical significance. The issuance of digital currency can reduce the significant costs of issuing and circulating traditional currencies, improve the convenience and transparency of economic transactions, reduce money laundering, tax evasion, and other criminal acts, enhance the central bank’s control of over the money supply and currency circulation, better support economic and social development and aid in extending financial services to under-served populations.

Going forward, the establishment of a system for issuing and circulating a digital currency will help China build an entirely new financial infrastructure, further improve China’s payment systems, improve payment and settlement efficiency and promote increased overall economic quality and efficiency.

There you have it. This is the exact opposite of what digital currency was supposed to be. When Satoshi released Bitcoin, I wonder now if he knew this would be the outcome. This looks like a push towards a cashless one-world currency reminiscent of the book of revelations. All that is missing is QR codes tattooed on the backs of our hands.

What does this mean for Bitcoin?

This announcement will likely shake the foundations of the bitcoin community and will likely spark a huge concern over the future of the largest network on earth. While technical details are lacking, the implications could be dire. Here are a few of my major concerns.

- China Controls a Large portion of the network

This point is very critical. If the Chinese adopt the SHA-256 algorithm the consequences to bitcoin would be drastic. It is estimated that the top 4 Chinese Bitcoin pools control 30% of the bitcoin network. Other estimates assume between 40-60% of the network is Chinese miners. If those miners quit mining bitcoin the network could stall and blocks may never move.

- Chinese Exchanges

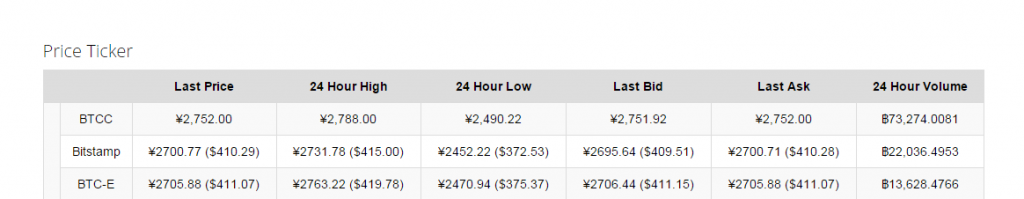

BTCC (bitcoin china) literally controls the bitcoin market. In this image captured from the website on 1/20/2016 at 19:40 UTC, you can clearly see that nearly ¾ of the Bitcoin volume occurs on this exchange. If these trades were to stop the market would implode.

- All ASIC Chips Are Manufactured in China

The Chinese control the output of hardware. If they suddenly stopped producing miners it would take a long time to grow the network back to over 1 Exahash. Without the growth of hashing power, the network becomes more vulnerable to consolidated operations of large hashing power.

Whatever the outcome of the design phase, the implications to Bitcoin are going to be drastic and irreversible. Unless Americans and Europeans can pick up the slack and reverse the Chinese mining dominance, the future may be dark for bitcoin.

Disclaimer: Translations are unofficial.

Featured image from Shutterstock.