Charlie Lee Slams ‘Silly’ Investors for Not Holding Onto Litecoin

The Litecoin creator continues to defend his decision to sell all of his LTC. | Source: Flickr

By CCN.com: Crypto investors should do as Charlie Lee says, not as he does. The Litecoin creator was featured as a guest on Laura Shin’s Unchained podcast , where he defended his decision to liquidate the holdings of the cryptocurrency that he spawned, Litecoin (LTC).

Lee, who is a Google alum, is a highly respected individual in the crypto community and his contribution to the ecosystem can’t be denied, as evidenced by a coin that has muscled its way into the six biggest cryptocurrencies. His decision to sell the cryptocurrency at year-end 2017 near the peak was simply bad PR. He doesn’t want investors to copy his strategy.

“If you’re not holding onto Litecoin because I don’t have any, then your reason for holding and using Litecoin is just silly to begin with.”

His intentions behind selling were admirable. After some of his Twitter followers accused him of “trying to pump the Litecoin price” and questioned his motives, he liquidated in the spirit of decentralization. Lee sold in three rounds with the final batch of LTC priced at around $350. He did so with the expectation that the announcement wouldn’t rock the markets considering the sale was already complete by that time.

What he failed to consider, however, is that people would accuse him of not having “skin in the game” after he sold the cryptocurrency whose traits he imagined. It’s almost like not rearing your own kid in your house. While Lee has sweat equity in Litecoin, there is no better marketing for any coin including LTC than experiencing the ride alongside other investors.

Charlie Lee Is a Trend Setter

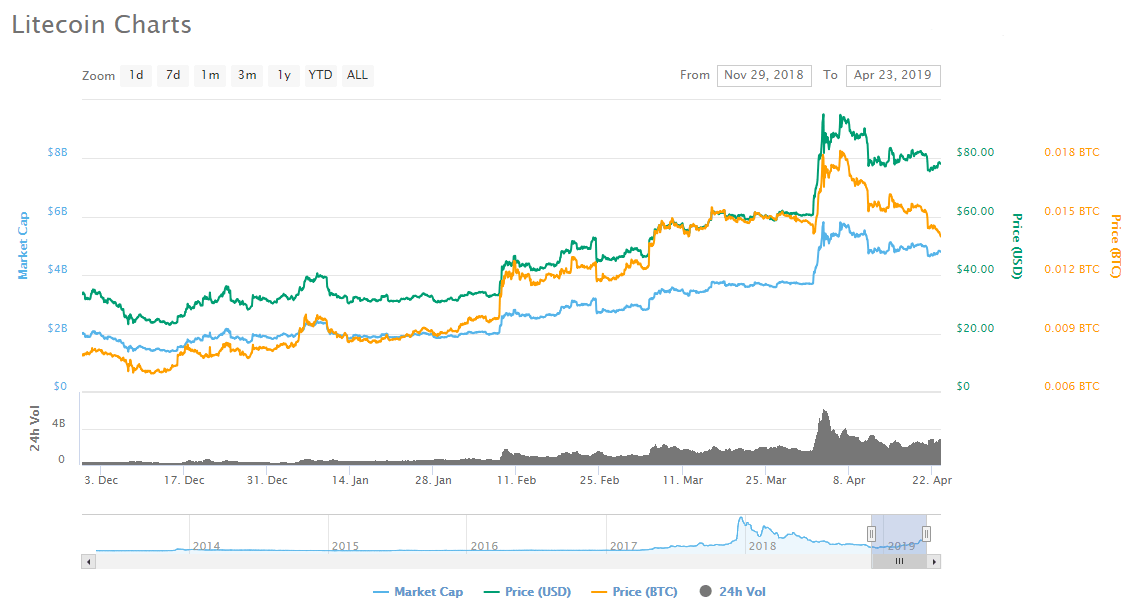

Despite his distance from the cryptocurrency, Litecoin has been a trend-setter. The LTC price has more than doubled since year-end 2018, arguably putting the final nail in the crypto bear market. If Charlie Lee is able to steer the project in a direction that is so well received by the crypto community, imagine what he could accomplish if he would just replenish his Litecoin holdings.

Bitcoin’s Early Days

Lee might have sold his Litecoin for personal reasons, but it wasn’t because he couldn’t take the heat of volatile prices. He first invested in bitcoin when it was trading at $30 and then saw the coin plummet to $2 within a year. He didn’t panic and stayed in the game because he recognized that bitcoin’s fundamentals didn’t change.

“The price drop was because it was overhyped at the beginning,” he said.

Lee continued mining bitcoin and “playing around with it.” Now he advises investors:

“The key is to not put everything in, right? Don’t invest more than you can afford to lose.”

Silver to Bitcoin’s Gold

It’s no coincidence that Litecoin has become known as the digital silver to bitcoin’s gold. Charlie Lee set out for the cryptocurrency to be used that way when he launched it. This explains features like cheaper fees so that people could use LTC for micro-transactions, for example.

When Lee launched Litecoin, bitcoin’s market cap was only $100 million. Today BTC’s market cap is $99 billion and Litecoin’s is nearly $5 billion. Even Lee didn’t expect that to happen when he launched Litecoin as a “side project.” Now TD Ameritrade is trialing Litecoin on its brokerage program. Not too shabby for a side gig.