Canaccord Says These 8 Pot Stocks Deserve a Look Thanks to the US Farm Bill

Canaccord Says eight pot stocks deserve a look thanks to the passage of the US Farm Bill. | Source: Shutterstock

Pot stock analysts believe that the CBD industry is about to explode. The reason? The $867 billion Farm Bill, signed into law by US President Donald Trump on December 20, officially excluded all cannabis products with 0.3% or less THC from the Controlled Substances Act. (THC is the psychoactive element in marijuana that gets users “high.”)

CBD has medicinal uses and is already legal in many states, as is its psychoactive component. As a result, farmers anywhere in the United States can freely grow “hemp” for both industrial and medical purposes .

Several Pot Stocks Set to Explode

Canaccord Genuity, a wealth management firm and investment bank with offices all over the world, believes the effects of CBD legalization will be huge. They rated the following stocks as most promising in a note today:

- Charlotte’s Web Holdings, Inc. (CWEB-CSE)

- Canopy Growth Corporation (WEED-TSE)

- Curaleaf Holdings, Inc. (CURA-CSE)

- Liberty Health Sciences Inc. (LHS-CSE)

- 1933 Industries, Inc. (TGIF-CSE)

- DionyMed Brands, Inc. (DYME-CSE)

- KushCo. Holdings, Inc. (KSHB-OTC)

- MJardin Group, Inc. (MJAR-CSE)

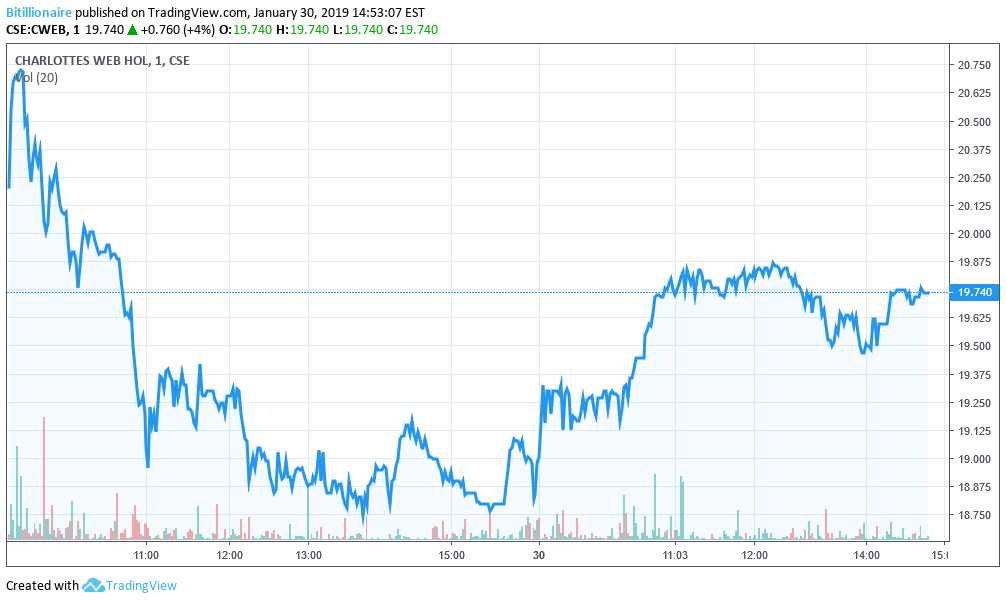

Of these, only Charlotte’s Web Holdings was given a firm “buy” rating. The others were categorized as “speculative buys.” The CNBC article on the subject lists the buy targets. In the case of CWEB, that price is $21 Canadian. At press time, CWEB was trading at $19.70, down from its 24-hour high of $20.73. If the advice of Canaccord is to be taken, that means there is still ample room to buy CWEB. However, do note that this article is not intended to be financial advice.

The first-quarter report from Canaccord has a message from CEO David Davieu regarding the strategization of the firm going forward. Davieu notes that growth stocks may face a challenging environment in the coming quarters. As a hedge, the firm is moving heavily into cryptocurrency and cannabis companies.

With signs that the economic backdrop could become more challenging for growth stocks, we anticipate that rising commodity prices will drive increased activities in the natural resource sectors, a historic area of strength for our firm. We also anticipate growing interest in non-traditional sectors where Canaccord Genuity has established a strong market position, such as cannabis and digital assets.

Canaccord Going Heavy on Cannabis and Cryptocurrency

Canada legalized marijuana nationwide last year. Pot stocks from the United States’ neighbor to the north have been booming as a result. For example, CWEB opened in August 2018 around $10, and has in the meantime almost doubled its per-share price.

Canaccord is continuing their expansion into digital assets despite lingering doubts about a Bitcoin ETF. Their doubts were again confirmed earlier this month when a Bitcoin ETF application was summarily withdrawn.

The note acknowledges that the Food and Drug Administration has yet to get fully on board with CBD legalization, but Canaccord this is a temporary situation.

While the FDA’s stance has added some initial caution by retailers looking to enter the CBD space, we believe this to be transient, and expect many mass market retailers to begin distributing CBD products over the course of 2019.

Marijuana legalization has revitalized several economies in the United States, most notably Colorado, which saw a $66 million marijuana tax surplus in fiscal year 2015 , the first full year of total legalization. More than 60% of Americans now support legalization of marijuana , paving the way for what may amount to a mandate for elected officials in coming years.

Featured Image from Shutterstock. CWEB chart from TradingView.com .