Blame Robinhood Traders for a Dangerous Electric Vehicle Stock Bubble

Tesla is leading the FOMO into electric vehicle stocks. Robinhood traders are in for a rude awakening when the EV bubble finally bursts. | Image: AP Photo/Jeff Chiu, File

- Electric vehicle stocks have surged as retail investors take an interest in the segment.

- While there’s a case for EV stocks, their valuations have gotten out of hand.

- Many of Robinhood’s most popular EV stocks have gone far beyond a reasonable price.

There’s no denying that electric vehicle stocks are a bet on the future. Growing retail participation among amateur traders with an appetite for risk appears to be inflating a dangerous bubble.

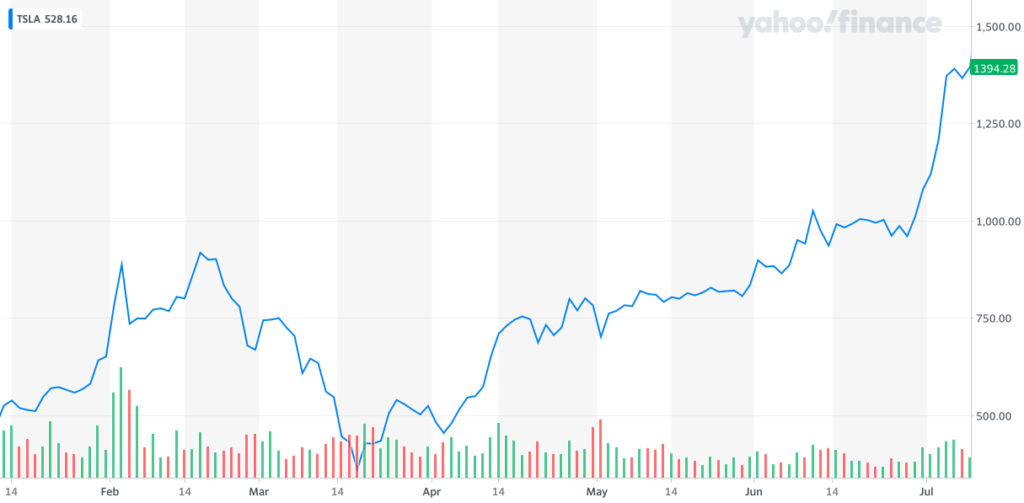

While you might roll your eyes at yet another criticism of the growing band of irrational Robinhood traders, consider this: Tesla’s (NASDAQ:TSLA) market cap surpassed that of Ford (NYSE:F), GM (NYSE:GM), BMW (OTCMKTS: BAMXF), Daimler (OTCMKTS: DDAIF), and Volkswagen (OTCMKTS:VLKAF) combined.

Don’t get me wrong, Tesla deserves some credit—the company has a cult-like following and its cars boast some of the most impressive technology available . But how much credit are we talking? Is Tesla going to sell more cars than all of the leading automakers combined? Will the company be more profitable? Because the firm’s sky-high valuation says without a doubt, it will.

EV Bubble isn’t Just Tesla

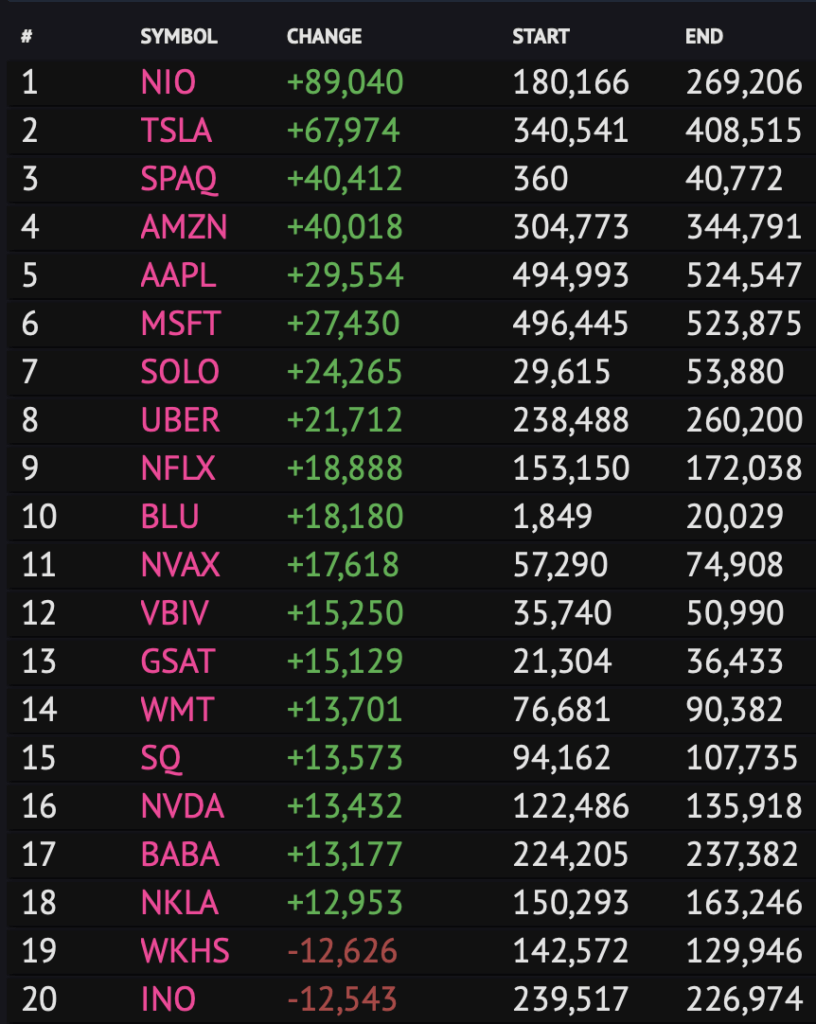

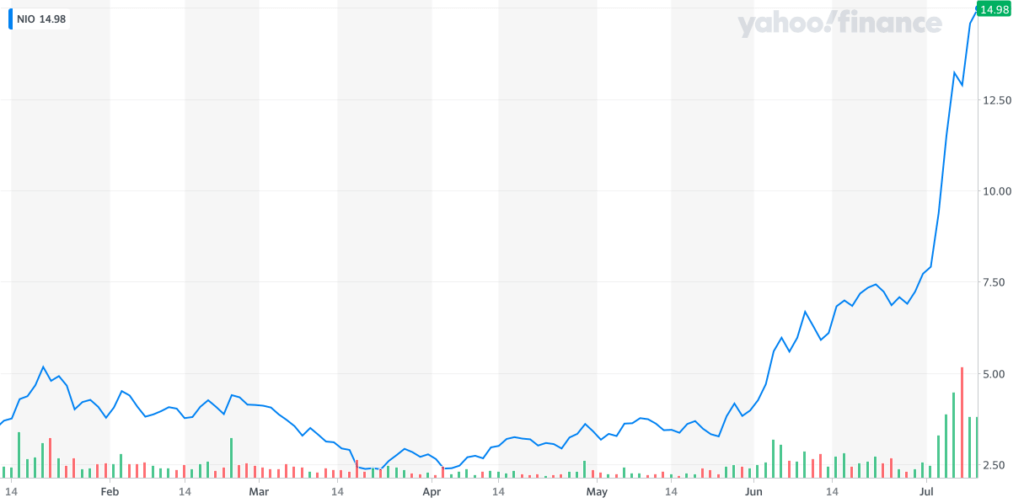

Let’s say you believe that Tesla is worth its hefty price tag. A quick look at Robinhood’s most popular stocks shows Elon Musk’s pride and joy isn’t alone in enjoying a surge in interest. Tesla ranks as the number two most popular stock. Nio (NYSE:NIO), a Chinese EV maker, has skyrocketed to number one.

Again, there’s certainly a case for NIO stock . Nio was staring over the cliff of bankruptcy just a few months ago but has been able to raise enough capital to reset its balance sheet.

It remains to be seen whether the firm will be able to turn a profit, especially considering just how crowded the market for electric vehicle makers has become in China. The nation is home to more than 400 EV manufacturers, most of which will go bankrupt over the next few years.

Speculative Trading on the Rise

NIO and TSLA aren’t the only stocks that have piqued Robinhood traders’ interests. Of the top 20 most popular stocks, four are electric vehicle makers. Two of those four don’t have anything to show for it .

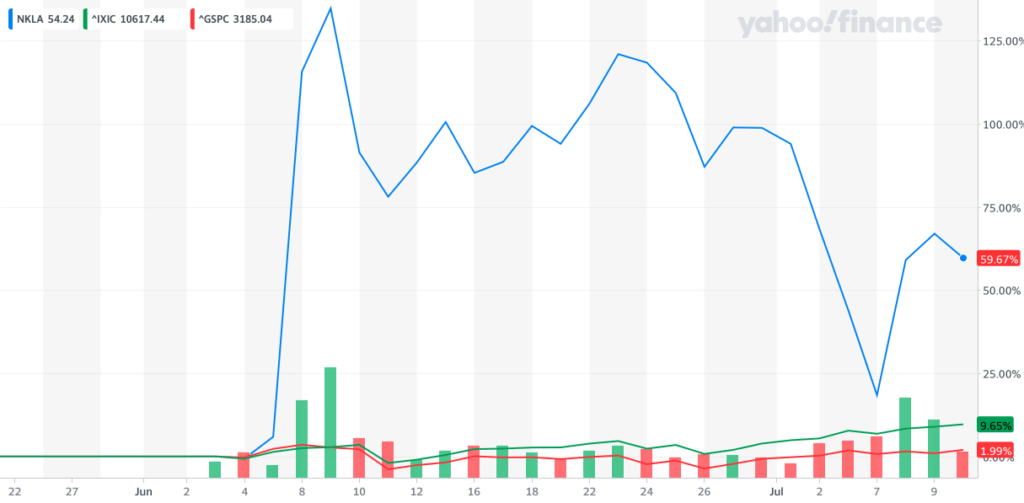

Nikola (NYSE:NKLA) is another EV maker that has soared in popularity over the past few weeks. The stock is up 76% since the beginning of May and sports a whopping $19.58 billion market cap. To put that into perspective, that’s akin to Ford’s $24 billion market cap–and NKLA doesn’t even have a product yet.

Nikola’s growth story is no doubt promising— JP Morgan’s Paul Coster said as much last week . The stock, however, is speculative at best, and even the best-laid plans can be upended by poor execution. That’s especially true in today’s uncertain environment.

Coster’s bullish thesis came with a $45 price target—roughly 20% lower than where the stock finished on Friday:

In our view, [Nikola] is currently a story-stock, but we are on board as long as the company executes to plan, and providing the stock offers a favorable risk-reward trade-off

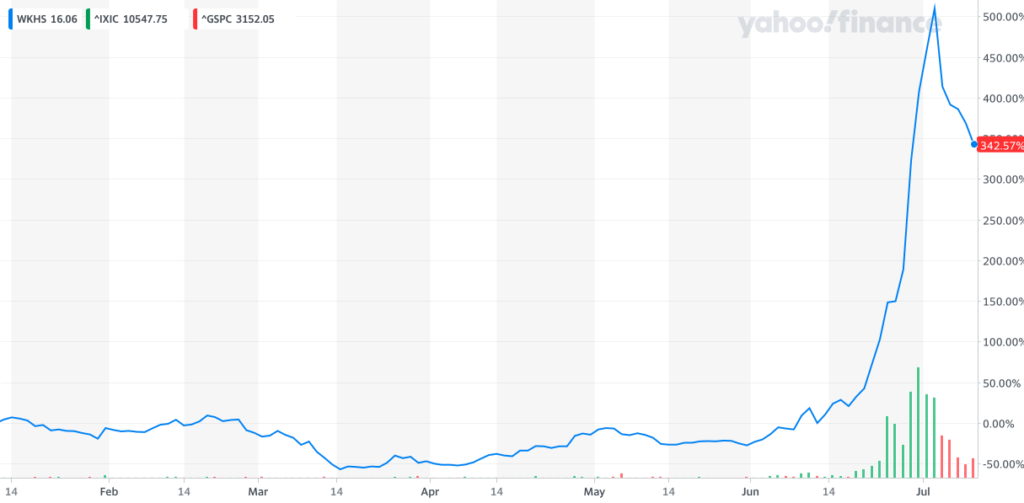

Workhorse (NASDAQ: WKHS), number 19 on Robinhood’s most popular stocks list, is another example of irrational exuberance among amateur investors. The stock is up 80% over the past month and 500% over the past six weeks.

WKHS, like the rest of the stocks mentioned, isn’t up for no reason. The firm recently passed important safety checks , and there’s an argument for its future as an EV player. Like Nikola, the case for Workhorse rests on a lot of what-if scenarios that investors don’t appear to be considering .

Colliers analyst Michael Shlisky, who was previously bullish on Workhorse, advised investors to “take a moment to recharge” on Thursday. He removed his $11 price target and cut his rating for WKHS from buy to neutral. Workhorse stock is currently trading nearly 30% higher than Shlisky’s bullish target.

What’s Next for EV Stocks

What’s happening on Robinhood is akin to the dot-com rush of the 1990s. For those who opened an account and started trading in March, stocks only ever go up. Making 500% on WKHS only strengthens the case for speculative bets.

As investors during the dot-com era learned, stocks can only trade on hype for so long. Eventually, the market always corrects to trade on fundamentals. When that happens, the millions of Robinhood traders enthusiastically pouring into electric vehicle stocks are going to be left holding the bag.

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com. The author holds no investment position in the above-mentioned securities.