Bitcoin trading took a bearish turn today when yesterday’s corrective decline intensified into a stronger wave of decline below support. The turnaround is not being interpreted as evidence of a return to decline, but as a larger correction in the longer-term advance.

This analysis is provided by xbt.social with a 3 hour delay. Read the full analysis here . Not a member? Join now and receive a $29 discount using the code CCN29.

Bitcoin Price Analysis

Time of analysis: 14h50 UTC

BTC-China 4-Hour Chart

From the analysis pages of xbt.social, earlier today:

RelatedNews

Cutting just above the recent top, a dark red Fib line from the November 2013 all-time high. Price has not traded above the latter line for over 12 months, and it has provided tough resistance on the upside on several occasions during the decline. In the plain arithmetic scale chart, this line was breached to the upside several weeks ago. Here, in log scale view, the line represents a formidable barrier to advance.

In light grey, channel lines define the advancing channel. A horizontal line shows the level of the January high close price at 1881 CNY (BTC-China) and $309 (Bitfinex).

Price has been trading in the upper half of the channel and, today, broke below the channel mid-line. At the bottom of the channel is the ascending 200MA (red) and above price the long-term Fib line presents the only obstacle between price and its destination.

The familiar structure in which price negotiates a descending obstacle from below is the “triangle”. A triangle typically has 5 subwaves (abcde) and once concluded to the downside, price surges up-and-out of the triangle, breaches the obstacle and completes the surge at a distance equal to the widest part of the triangle.

Another means of dealing with an overhead obstacle is to fall away from it and re-approach with more momentum after bouncing off downside support. This appears to be the market’s preferred tactic as can be seen during the advance to date, specifically, at the magenta arrow that shows a similar wave (and reaction) to the present wave’s shape and function.

Summary

Bitcoin price has fallen away from $290 and 1800 CNY to lows at $269 (Bitfinex) and 1666 CNY (BTC-China). Strong counter-trend moves such as this are often retraced rapidly and completely. We may see the top of the trend channel sooner than we think.

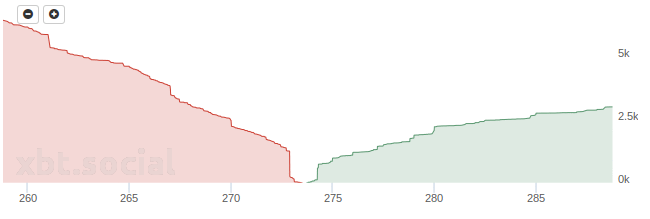

The Bitfinex depthchart shows a mirror image to yesterday’s orderbook: the bulls are ready to buy.

Click here for the CCN interactive price chart.

What do readers think? Please comment below.

This analysis is provided by xbt.social with a 3 hour delay. Read the full analysis here . Not a member? Join now and receive a $29 discount using the code CCN29.

Readers can follow Bitcoin price analysis updates every day on CCN.

Disclaimer

The writer trades Bitcoin. Trade and Investment is risky. CCN accepts no liability for losses incurred as a result of anything written in this Bitcoin price analysis report.

Bitcoin price charts from TradingView.

Images from Shutterstock.