Bitcoin Price Fights for $10,000 as Volatility Triggers Record Trading Volume

The bitcoin price has been on a mid-week rollercoaster, and that volatility has rippled throughout the markets. Trading volume has surged to record levels and coins across the spectrum have taken steep dives from their all-time highs — although most weekly charts remain in positive territory.

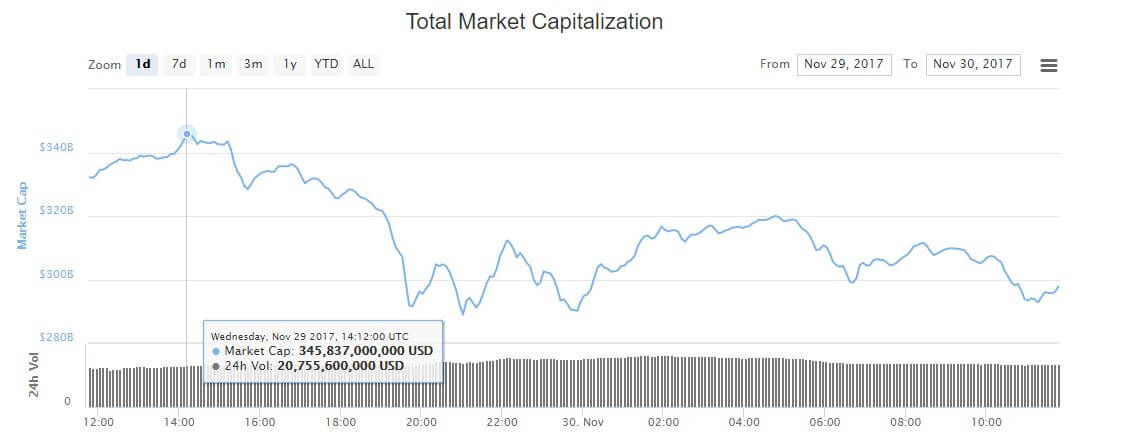

At one point, combined daily volume reached $25 billion — a new all-time high — and 24-hour volume remained above the $20 billion mark throughout a day of manic trading.

Within the past 24 hours alone, the total cryptocurrency market cap has fluctuated between a high of $345.8 billion and a low of $289 billion. That’s a spread of nearly $57 billion — and it occurred within a seven-hour period. To provide some context, the crypto market cap did not even reach a total valuation of $57 billion until May 16.

At the time of writing, the crypto market cap was valued at $298.6 billion, representing a single-day decline of almost $35 billion.

Bitcoin Price Fights for $10,000

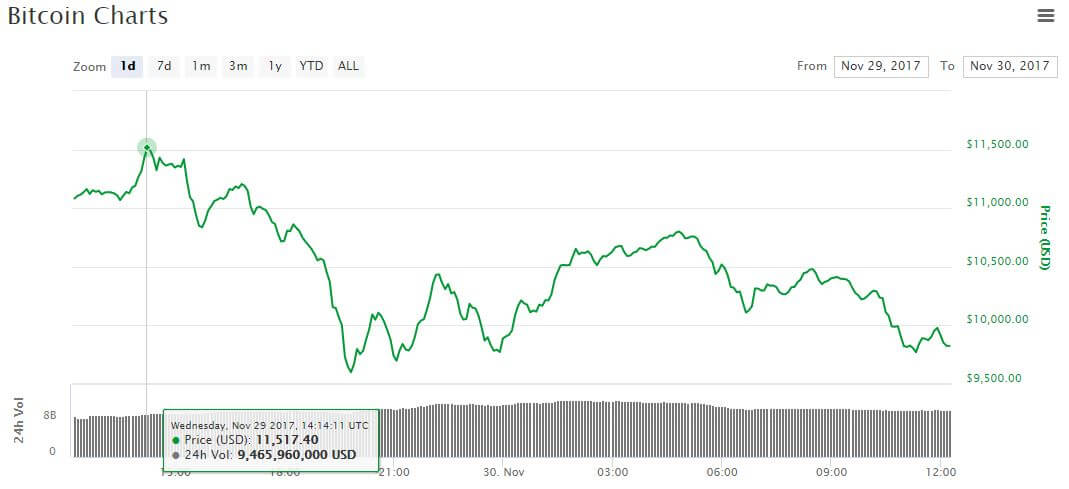

Led by insatiable demand by Asian traders, the bitcoin price crossed the historic $10,000 milestone for the first time on Monday. Since then, the bitcoin markets have been characterized by unprecedented volatility. This volatility was heightened by persistent outages on bitcoin exchanges located throughout the world. Within a five-hour period, the global average bitcoin price traded as high as $11,517 and as low as $9,601, and it has spent Thursday morning fighting to hold above the $10,000 mark.

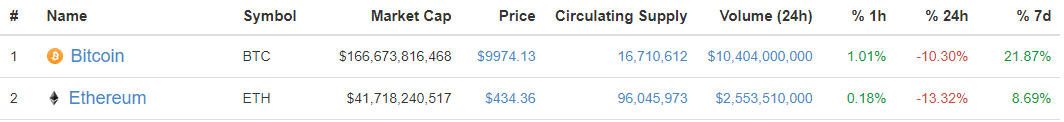

At the time of writing, bitcoin was losing that battle. Bitcoin is currently trading at a global average of $9,974, which translates into a $166.7 billion market cap. This represents a 24-hour decline of 10 percent, but — importantly — a seven-day increase of 22 percent.

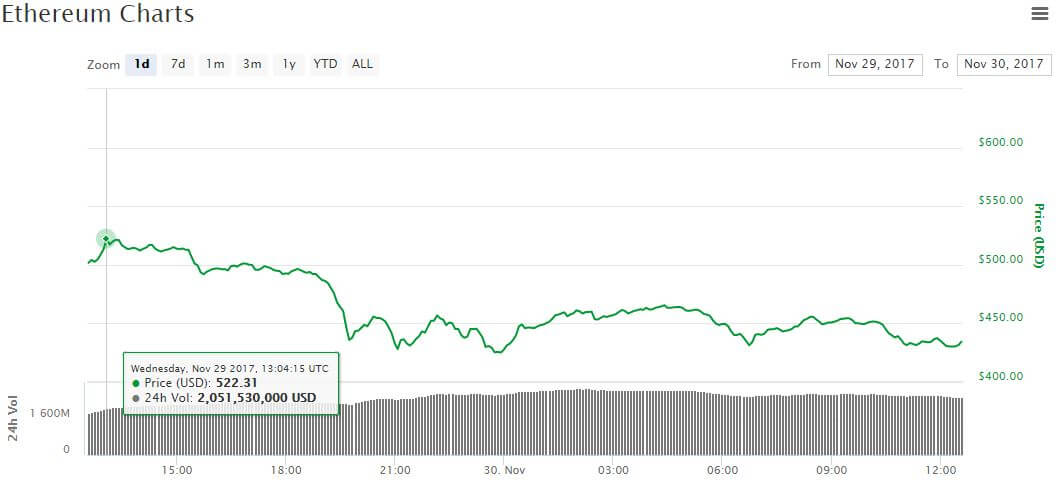

Ethereum Price Attains $500 Before Crash

As bitcoin goes, so go the markets: this principle has certainly been true this week. Numerous cryptocurrencies have ridden on bitcoin’s coattails to attain new all-time highs, and most of those coins have seen significant setbacks since the markets began to retrace.

One such cryptocurrency was ethereum. On Wednesday, the ethereum price broke through $500 for the first time, ultimately rising as high as $522 before the markets began to slide. At present, the ethereum price is trading at $434, providing the second largest cryptocurrency with a $41.7 billion market cap.

Altcoins Post Double-Digit Declines

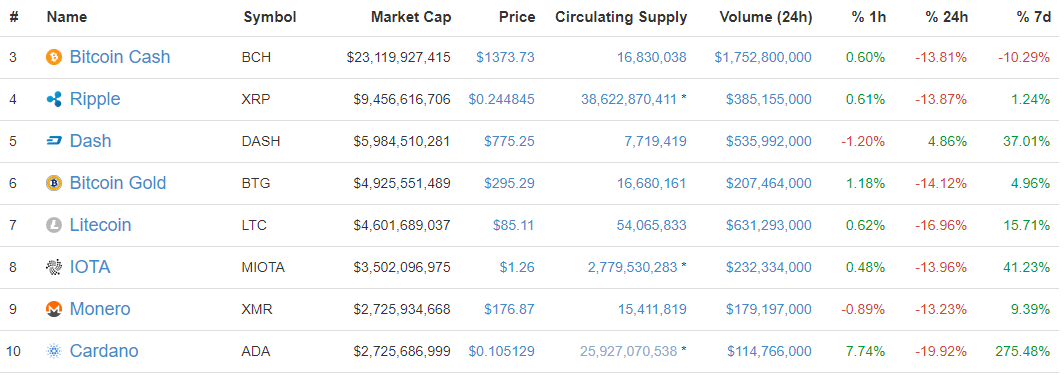

The altcoins markets tell a similar story. Nine of the 10 largest cryptocurrencies posted single-day declines in excess of 10 percent; however, nine of the top 10 coins have also made positive movement for the week.

In this latter case, the lone outlier is bitcoin cash. At $1,374, the bitcoin cash price is down nearly 14 percent for the day and 10 percent for the week.

Ripple, perhaps bolstered by the announcement that TechCrunch founder Michael Arrington is launching a $100 million XRP-denominated crypto hedge fund, managed to eek out a small gain for the week despite yesterday’s dip.

Dash, meanwhile, was the lone top 10 cryptocurrency to resist the market’s downward pressure and post a 24-hour advance. The dash price is currently valued at $775, representing a 24-hour gain of five percent and a seven-day surge of 37 percent.

Bitcoin gold — fresh off the revelation that its official wallet repository was hacked last week — fell by 14 percent, while litecoin plunged 17 percent after reaching the historic $100 mark. IOTA, monero, and cardano posted similarly-disappointing single-day performances, although each continues to boast an impressive weekly chart.

Featured image from Shutterstock.