Bitcoin Price Decline Will Persist until Mid-2019: Crypto Analyst Willy Woo

When the bitcoin price flatlined near $6,500 in mid-October, many crypto analysts predicted that the bears had finally become winded following a market downturn that has persisted for nearly a year and that the market could be primed for a December rally. However, technical analyst and trader Willy Woo does not believe that the flagship cryptocurrency’s immediate future is quite so rosy.

Writing on Twitter , Woo said that he does not expect the bitcoin price to find a floor until the second quarter of 2019, meaning that the market could face another seven months of downward pressure before conditions improve.

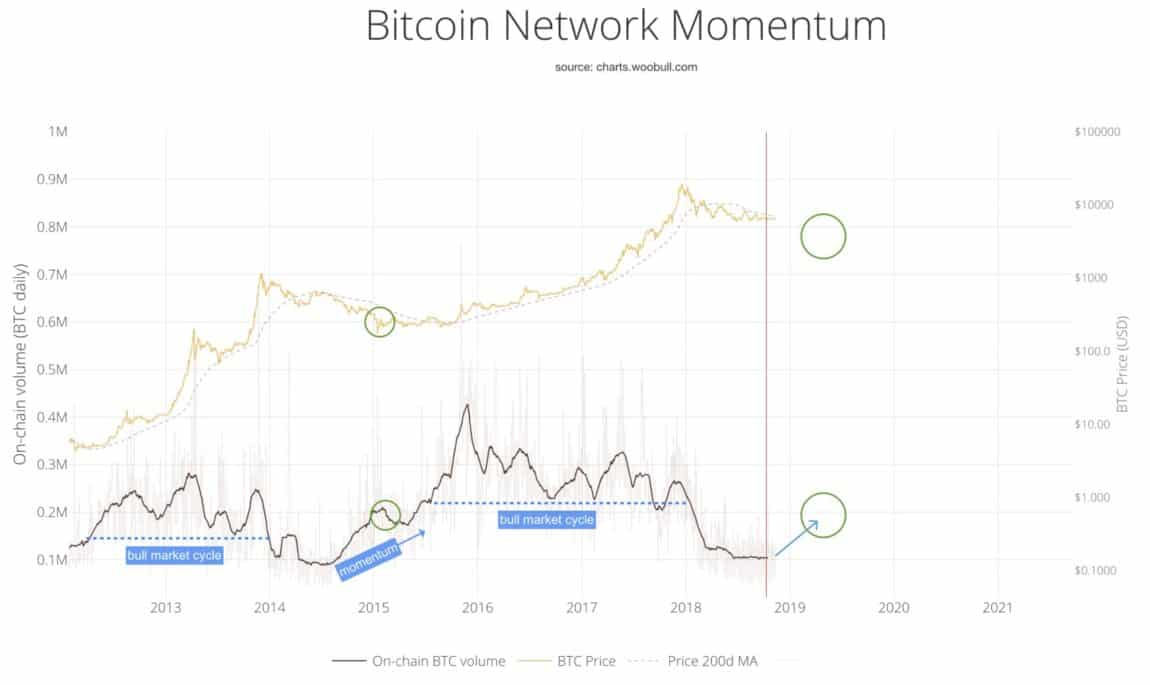

In addition to fundamental indicators such as the entrance of high-profile institutions into the cryptocurrency ecosystem, short-term bulls had pointed to a variety of technical data points to justify their optimistic outlook, including a marked increase in bitcoin’s transaction rate and steady average daily trading volume. Woo, on the other hand, cited several proprietary technical indicators that paint a somewhat darker picture, at least in the near-term.

For instance, Woo noted that NVTS — that is, Bitcoin network valuation divided by transaction value — has broken below its support level, which he said is a classic sell signal. Moreover, he said that Bitcoin Network Momentum (BNM) has yet to ramp up, which one would expect to see ahead of a bull cycle.

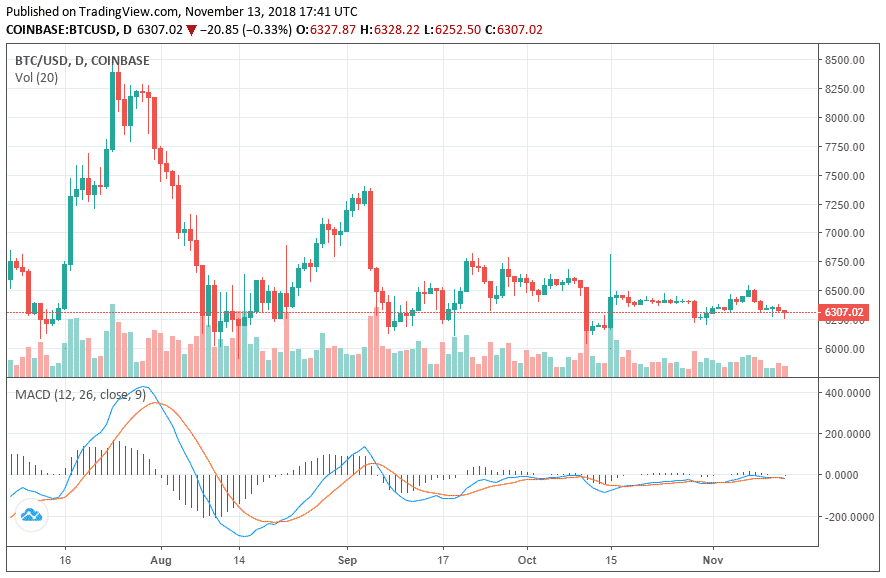

That’s not to say that the bitcoin price doesn’t have room to rise over the very short-term, but Woo said that it’s unlikely the cryptocurrency will break above its 200-Day Moving Average (DMA) since these moves have historically signified a shift from bear market to bull.

“If price (in the short term) bounces upwards here, which is certainly possible, I think the 200 day moving average is the upper band of the move. This is ~$7k right now,” he wrote on Tuesday. “Remember if price goes above the 200DMA, in the history of BTCUSD’s 8 year trade history, it’s been a reliable indicator of bear to bull transitions. It’s too early to transition out of the bear.

As of the time of writing, bitcoin was priced at $6,307 on Coinbase, up from an intraday low of $6,252. The overall cryptocurrency market, meanwhile, had a cumulative valuation of $212 billion.

Featured Image from Shutterstock. Charts from TradingView .