Bitcoin Price Crashes Below $4,000 as China Bitcoin Ban Rumors Intensify

The crypto markets crashed on Wednesday as China bitcoin ban rumors intensified. Virtually every top 100 cryptocurrency was hit by a significant decline, causing the market to shed billions. The bitcoin price led the retreat, plunging below $4,000. The ethereum price, meanwhile, dropped below $275 as the wider markets shed $15 billion.

Industry Leaders Add Fuel to the Fire

The market began the day in recovery mode, but the mood progressively soured. First, popular Chinese OTC trading service BitKan announced it was going to suspend trading. Then, ViaBTC added crypto-to-crypto trading pairs in what appears to be an attempt to hedge against the potential closure of CNY deposits.

Later in the day, several prominent industry figures cited unnamed sources who said the rumors that China was preparing to ban bitcoin exchanges were true. Litecoin creator Charlie Lee tweeted that “Looks like this time China finally banned Bitcoin exchanges. (Anonymous source I trust fully) There’s only one response: JUST HODŁ.” The post has since been deleted, but an archived version can be viewed here. Then, Chainstone Labs CEO Bruce Fenton posted a Twitter thread wherein he stated that several credible sources had confirmed to him that the bitcoin exchange ban rumors were credible. Finally, well-known bitcoin trader WhalePanda shared a rumor that China was planning to issue its own Tether-like digital currency.

These rumors spooked traders and forced the markets into a steady decline. After rising to almost $152 billion Tuesday morning, the total value of all cryptocurrencies plummeted as low as $135.4 billion on Wednesday. At present, the total cryptocurrency market cap is $136.8 billion–a daily decline of almost $15 billion.

Bitcoin Price Crashes Below $4,000

The bitcoin price had weathered the China rumors quite well over the course of the past week, but Tuesday’s comments from leading industry figures forced it into decline. After beginning the day above $4,300, the bitcoin price crashed by more than $400–a 24-hour decline of 10%. At present, the bitcoin price is $3,886, reducing bitcoin’s market cap to just $64.6 billion.

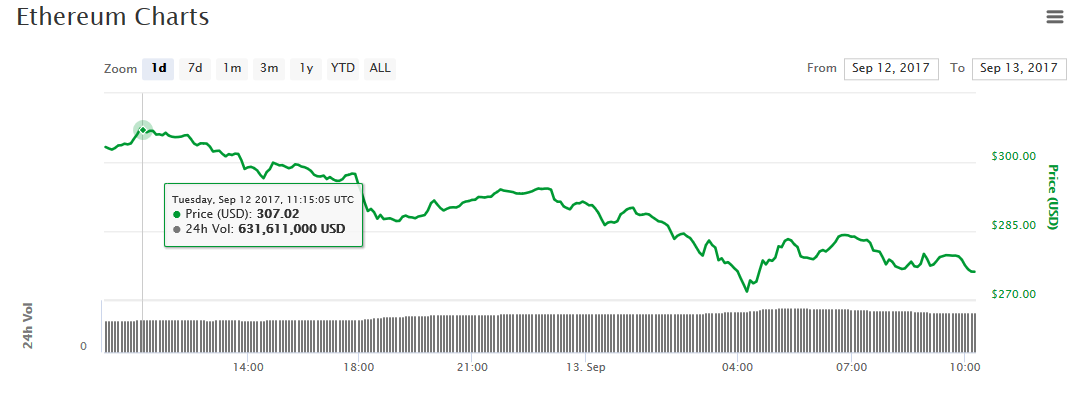

Ethereum Price Slides 11%

The ethereum price tracked with bitcoin’s retreat, sliding more than 11% for the day. The ethereum price had rallied past $300 on Tuesday but now sits at just $271. This gives ethereum a market cap of $25.6 billion.

Altcoin Prices Evaporate

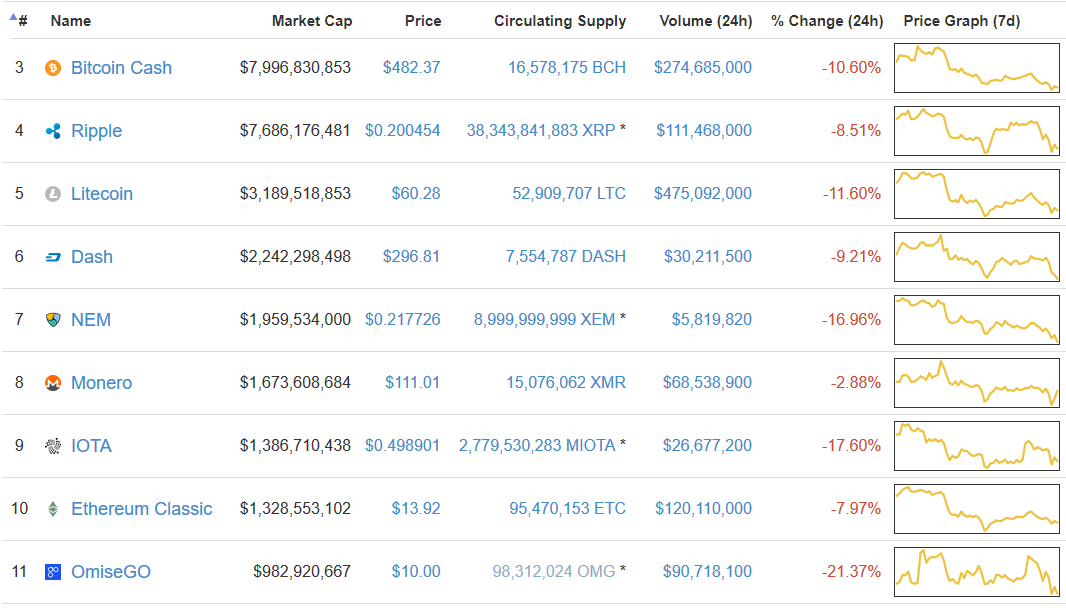

The regulatory uncertainty in China plunged the altcoin markets into decline. Only 4 of the top 100 cryptocurrencies managed to make positive movement on Wednesday, and a significant number posted double-digit drops.

The bitcoin cash price–which tested $700 less than a week ago–fell 11% to $482. This pushed its market cap below $8 billion. Ripple, which just announced a new partnership to test blockchain remittance in Asia, saw its price fall 9%.

The litecoin price fell 12% and is in danger of dropping below the $60 threshold, while the Dash price has already dipped below $300. Seventh-ranked NEM dropped by nearly 17%, forcing its price below $0.50. Monero managed to decline just 3%, making it one of the market’s better performers. The IOTA price was not so lucky; it plummeted by 18%.

Tenth-place ethereum classic fell 8% to $14, while OmiseGO–one of Tuesday’s top movers–plunged 21% to $10 even.

Featured image from Shutterstock.