Bitcoin Price: These Charts Prove BTC Will Suffer a Brutal Crash

Bitcoin price charts betray an undeniable truth: BTC is teetering on the brink of a brutal crash. Crypto investors should diversify - now! | Source: Shutterstock

By CCN.com: Thinking of buying bitcoin at current prices? Think again. The cryptocurrency has surged so far, so rapidly, that its rally is already starting to crater. While the coming implosion will exert pain across the entire market, it should present new opportunities that savvy investors can leverage to enhance the long-term value of their holdings.

One profitable opportunity that we’re monitoring is the flow of capital out of bitcoin and into altcoins. With the capital outflow, the Bitcoin Dominance Index should plunge to a level that favors other cryptocurrencies.

In short, the bitcoin price teetering on the brink of a brutal crash, and you should protect yourself by diversifying your crypto portfolio.

Bitcoin’s Parabolic Burst Looks Eerily Similar to the 2018 Bear Market

The hype surrounding the crypto market king over the last few weeks has made many people forget that a vicious correction is always lurking around the corner. With the fear of missing out (FOMO) gripping market participants, we are very likely approaching a point of maximum financial pain.

A look at the chart above reveals that the current parabolic burst appears to be a mini version or a fractal of the 2018 bear market.

In both scenarios, we see sudden meteoric ascents. After that, volume dwindles as buyers start to lose interest. At the same time, sellers begin to distribute positions to lock in gains. In addition, the daily RSI flashes overheated signals as it moves in extreme overbought territory.

Face it: the writing on the wall tells us that bitcoin is headed for a deep and painful correction. This should be beneficial to other crypto assets.

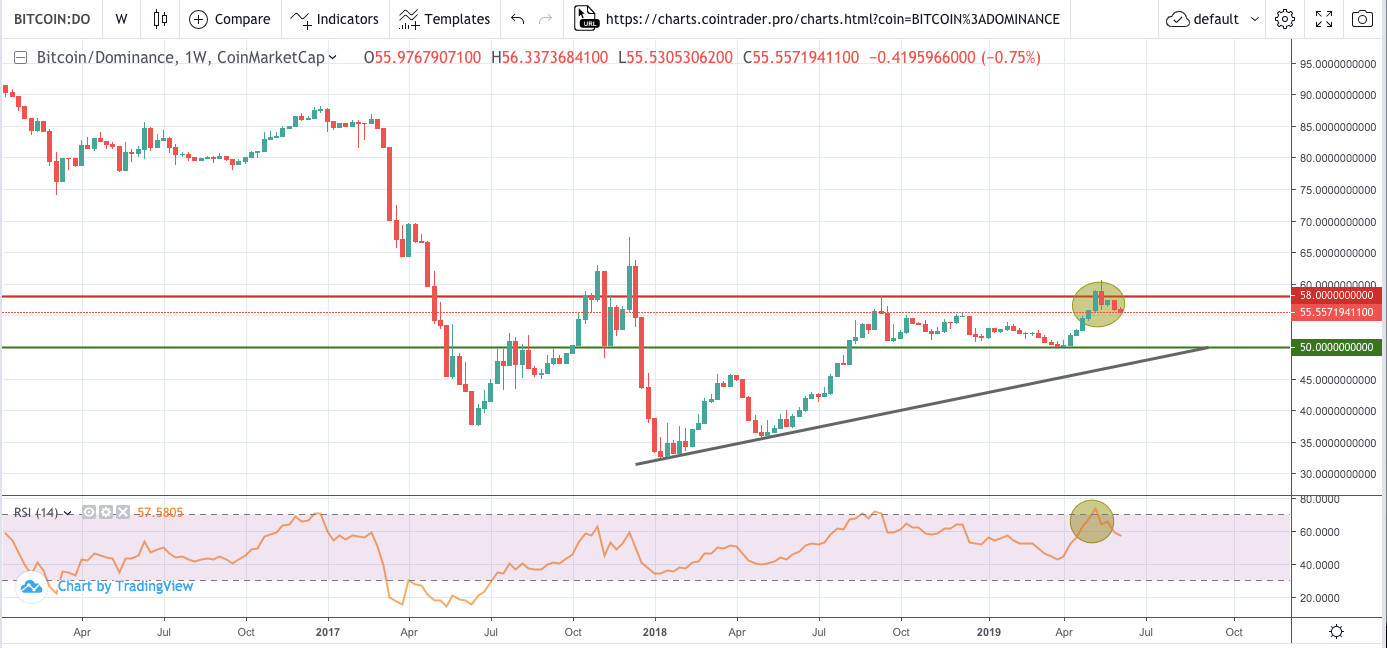

Bitcoin Dominance Index Teeters at Unsustainable Level

With bitcoin almost ready to fall hard, we expect a correction in the Bitcoin Dominance Index, which measures BTC’s share of the overall crypto market cap.

This index is used by many active traders as a reference for protecting their bitcoin holdings. If the index is on the way down, traders exchange their bitcoins for other cryptocurrencies such as Litecoin or Cardano. This enables them to grow their bitcoin stack by selling the altcoins at a later time once BTC corrects.

The weekly chart of the index shows that it has topped off at 58 percent. The index is also trading close to overbought territory. With these conditions, we expect it to plummet to its closest support of 50 percent. The last time the index fell to this level (March 2019), other crypto tokens skyrocketed against bitcoin.

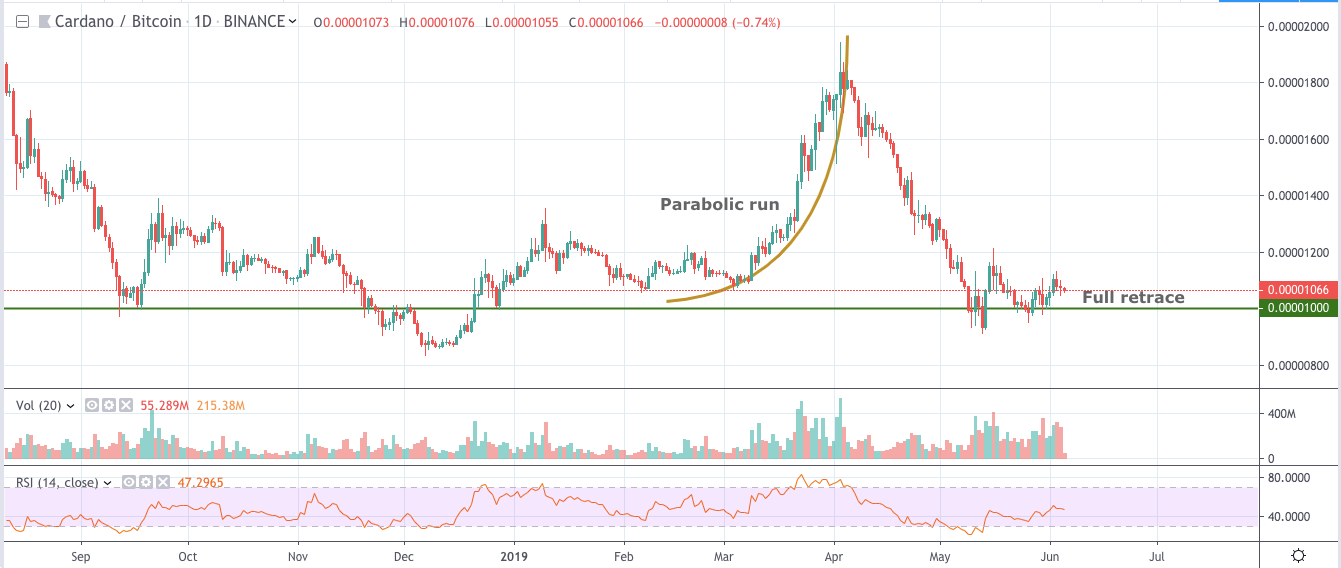

For instance, Cardano pulled off its own parabolic run against bitcoin as it rose from a price of 0.00001 BTC at the start of March to 0.00001944 BTC within a month to almost double its value. In Litecoin’s case, the price rose from 0.0012 BTC in March to 0.00189 BTC by the start of April. You can see similar cases in other cryptocurrencies.

Many Altcoins Have Fully Retraced

Amid bitcoin’s parabolic run, other cryptocurrencies have suffered as market participants dumped their altcoin holdings in favor of bitcoin. Now that the disbelief rally is fading, we expect participants to do the exact opposite: dump BTC in favor of other cryptocurrencies.

This strategy makes sense considering that many altcoins are now at a point of maximum financial opportunity against bitcoin.

This Cardano chart is a good example of how many altcoins are currently performing against bitcoin. Most have fully retraced and are ready for bottom-picking. They are trading at a point where the risk-reward ratio is highly favorable, even if you’re skeptical about their long-term prospects.

Bottom Line: Sell Your BTC Now, Buy More Later

As bitcoin corrects, it will likely trigger the injection of capital into other cryptocurrencies. Traders will preserve value and grow their bitcoin holdings by buying altcoins that largely missed out on the early-year rally. Alt-season is coming; make sure you stay ahead of the herd.

Disclaimer: This article is intended for informational purposes only and should not be taken as investment advice.