Bitcoin Nothing More Than a ‘Lottery Ticket’: Harvard Economist

Former IMF Chief Economist and current Harvard University Professor of Economics and Public Policy Kenneth Rogoff believe that bitcoin and other cryptocurrencies currently amount to little more than “lottery tickets” at this moment in time. Writing in the Guardian on Monday, Rogoff stated that while some believe that cryptocurrencies have had their day and are on an irreversible downward slide, it is actually difficult to say with certainty that their value will actually fall to zero.

In his view, several questions exist about the ability of large economies to successfully embrace cryptocurrency, which means that outside of joint regulatory action, national-level adoption of cryptocurrencies will likely be pushed only by weak pariah states like Iran, Somalia, Venezuela, and North Korea. This he says, makes it difficult to predict the eventual fate of this asset class.

Rogoff Raises Questions about Bitcoin

In the article, Rogoff calls into question the very intrinsic value of bitcoin, stating that its generally held status as “digital gold” is unsustainable because unlike real gold, it has no application outside of a monetary setting, and the massive energy consumption required to keep it functioning is substantially less efficient than a central banking system.

According to him, large economies will not tolerate cryptocurrencies in their current state much longer because of their capacity to facilitate money laundering, and yet if their anonymity/pseudonymity is stripped away, they will lose their mass appeal, which effectively places bitcoin in a catch-22 position. As a result, Rogoff believes that the long-term use and adoption of cryptocurrency in its current form lie outside of large, regulated economies, which essentially will make it the preserve of a group of failed states like Venezuela, which has made several headlines with its plan to revitalize its devastated economy with the petro.

Raising further question about the future of bitcoin, Rogoff said:

“Regulators are gradually waking up to the fact that they cannot countenance large expensive-to-trace transaction technologies that facilitate tax evasion and criminal activity. At the same time, central banks from Sweden to China are realising that they, too, can issue digital currencies…When it comes to new forms of money, the private sector may innovate, but in due time the government regulates and appropriates.”

In Rogoff’s opinion, what this will lead to is essentially a lottery scenario where bitcoin’s long-term value is likely to be closer to $100, but may possibly also be $100,000 for a plethora of reasons that are difficult to even visualise at the moment. Explaining why even a widespread public belief in bitcoin as a store of value is not enough to hold its value over time, he stated:

“Economists (including me) who have worked on this kind of problem for five decades have found that price bubbles surrounding intrinsically worthless assets must eventually burst. The prices of assets that do have real underlying value cannot deviate arbitrarily far from historical benchmarks. And government-issued money is hardly a pure social convention; governments pay employees and suppliers, and demand tax payments in fiat currency.”

Ultimately he said, it is government actions that will determine whether bitcoin and other cryptocurrency assets can achieve general trade and retail adoption or whether cryptois destined to become the dystopian currency for dark net websites selling illegal goods and services and failed states with collapsed economies.

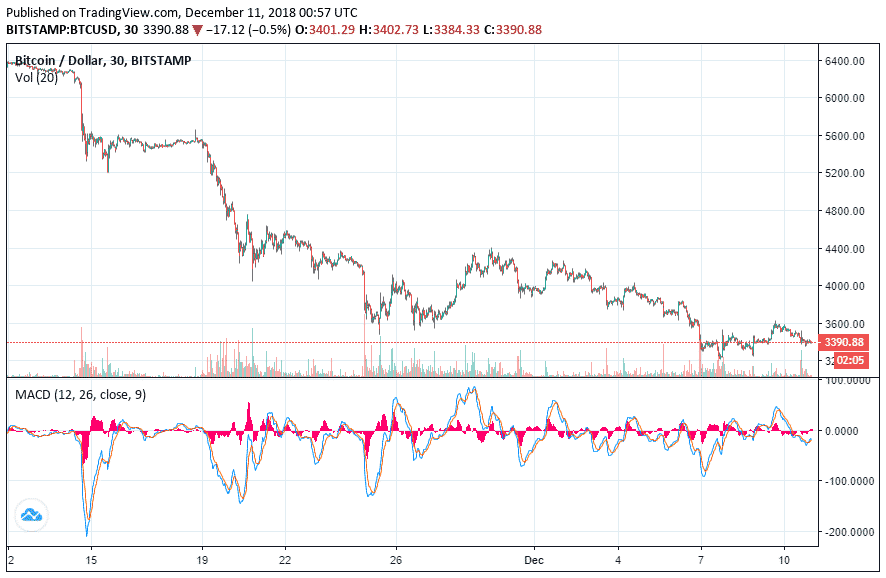

Featured Image from Shutterstock. Charts from TradingView.