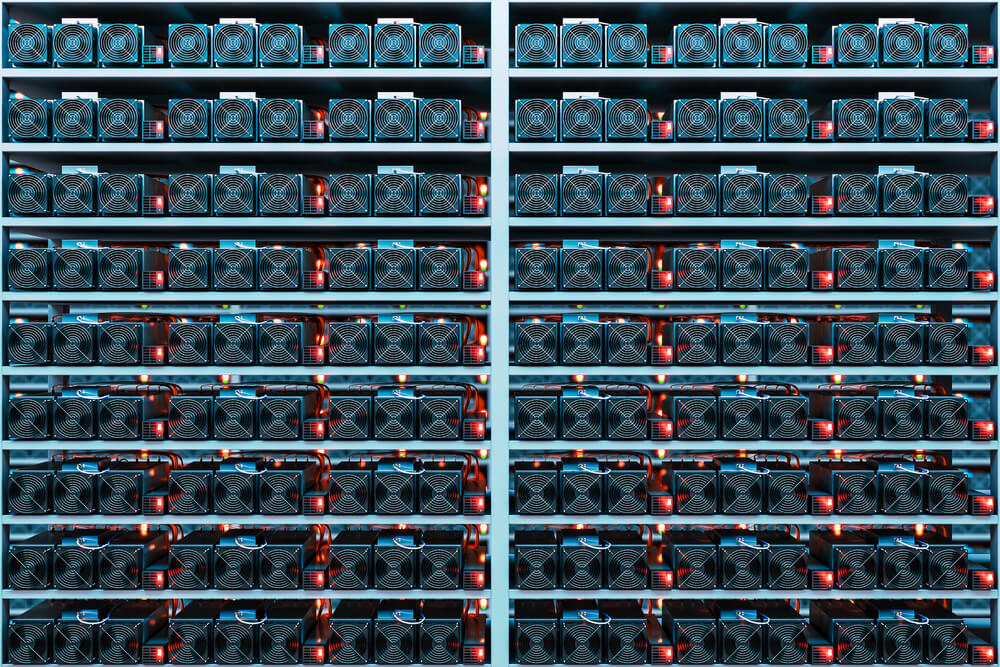

Profitable Bitcoin Mining? Big Miners are Squeezing Out Dorm Room Rigs

Profits elude fledgling bitcoin miners, while institutional bitcoin miners continue to rake it in.

Mega bitcoin miners like Bitmain and Bitfury are threatening to squeeze the smaller players out of the picture, according to a Bloomberg report . As a result, expect to see some consolidation in the bitcoin mining space and a possible paradigm shift where institutional players increase their influence with every earned bitcoin.

With the bitcoin price hovering at approximately $8,000, bitcoin miners, who solve complicated equations to produce more BTC and earn a reward, are barely eeking out a profit at these levels. This leaves the business of the little guy, such as the bitcoin miner operating from a college dorm room or parent’s house, directly in the line of fire to be quashed, or acquired.

“It’s totally different this year than last year. The bitcoin mining industry was this mysterious dark cottage industry, and it’s about to grow up and about to have elements of institutional scalability at all levels,” according to Bill Tai, chairman of the board at at Toronto-based Hut 8 Mining, quoted in Bloomberg.

Bloomberg calls it an “inflection point” for bitcoin miners.

Survival of the Fittest

Hut 8’s Tai paints a dismal picture for the smaller miners, suggesting they’ll drop off the map while only a handful of the biggest operations will be left standing.

Hut 8 Mining is a backer of Bitfury Group, the latter of which is based in Amsterdam and makes bitcoin mining rigs. They’ve mined 1 million bitcoin, according to the Bloomberg report. In the best of times, which would be December 2017, there was more demand for Bitfury’s machines than there was supply, as they fielded $1.9 billion in requests. Nonetheless, the major bitcoin mining operations continue to expand and take more territory.

Smaller bitcoin mining shops won’t be able to continue to compete with their larger peers for many reasons, not the least of which is they must invest in their equipment while the Bitfury and Bitmain’s of the world make their own. But it’s not just the equipment that runs the investment requirement up, it’s also the energy bill.

Incidentally, Wall Street analysts recently suggested that the surplus natural gas produced in Texas’ Permian Basin that would otherwise be burned instead be used to generate power for bitcoin mining operations. But the bitcoin price would have to persist at approximately $19,000 for more than a decade for that to work.

Virginia Beach-based digital mining facility Bcause, which is in the midst of an expansion, says its clients make money with the bitcoin price higher than $9,000-$10,000. Bcause Founder Tom Flack predicts consolidation in the space up ahead.

With fewer, larger players controlling the bitcoin mining sphere, it thrusts the 51% attack phenomenon into the spotlight. Digital Asset Research’s Lucas Nuzzi said miners have as much as 30% of bitcoin already. And if the pendulum swings any further, “it has the potential of being dangerous from a security standpoint, since a single entity could use its power in terms of hashrate to disrupt the network,” he told Bloomberg.

A 51% attack can occur when a single entity is able to control more than half of the computing effort.

Featured image from Shutterstock.