Bitcoin is for Suckers – Fight Me

Bitcoin is one of the dumbest places to put your hard-earned money, and I've got the data to prove it. | Source: Shutterstock

By CCN.com: There are countless reasons why bitcoin and cryptocurrencies rank among the biggest bubbles in history and the dumbest places to put your hard-earned money.

Bitcoin Investors Don’t Consider Volatility

Bitcoin return or cryptocurrency return compared to stock market return means nothing unless one considers volatility.

Volatility is risk.

The fatal mistake investors make is that they look at bitcoin, cryptocurrency, or stock market performance in a vacuum, when they must always be viewed in context with risk.

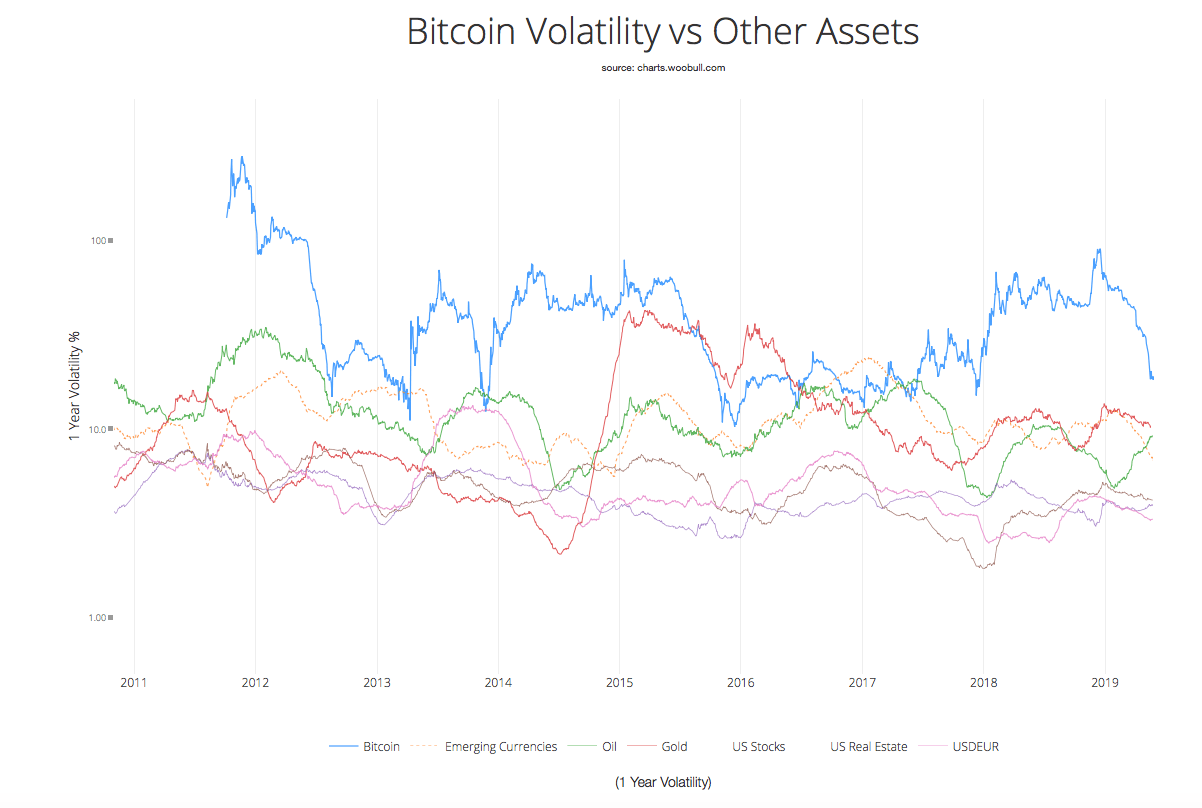

This is a chart comparing 1-year volatility percentages across all investments (and I wouldn’t call cryptocurrency an “investment.” I call it gambling).

With brief periodic exceptions for oil, gold, and emerging currencies, Bitcoin has always been exceedingly more volatile than every asset class, including the stock market.

Crypto Is Way More Risky Than the Stock Market

How volatile is Bitcoin, and why does it matter?

We measure risk/volatility using standard deviation.

Over the past five years, the S&P 500 – a stock market bellwether – has delivered an average annual return of 11.5 percent, with a standard deviation of 11.25. That means that, in any given year, the S&P 500 has a 95 percent chance of returning between -11 percent and +34 percent.

Over the past five years, the Grayscale Bitcoin Investment Trust has delivered an average annual return of 60 percent, with a standard deviation of 81. That means that, in any given year, Grayscale’s Bitcoin fund has a 95 percent chance of returning between negative ~100 percent and +222 percent.

In any given year, you have a 95 percent probability of a return that could run the gamut from tripling the value of your Bitcoin investment to more or less losing it all.

Compare that to the likelihood of only an 11 percent loss in the stock market from year to year, with the possibility of a 34 percent return.

Las Vegas Offers Better Returns Than Bitcoin

A person is better off going to Las Vegas and gambling the same amount they’d otherwise put into Bitcoin, or any other cryptocurrency, at the craps table. Over the long term, the expected return would be only negative 1.41 percent.

And a craps dealer won’t lose his password:

Your Cryptocurrency Could Be Worth Anything Tomorrow – or Nothing

Why on earth would anyone sell something in exchange for Bitcoin, when the value of that cryptocurrency literally changes moment to moment?

You might sell something for $9,000 in Bitcoin, and moments later, it’s worth $8,200.

Bitcoin fell 85 percent from after a ridiculous parabolic rise. In 2011, it fell 94 percent over five months.

For those who say it could also go higher, why take that risk?

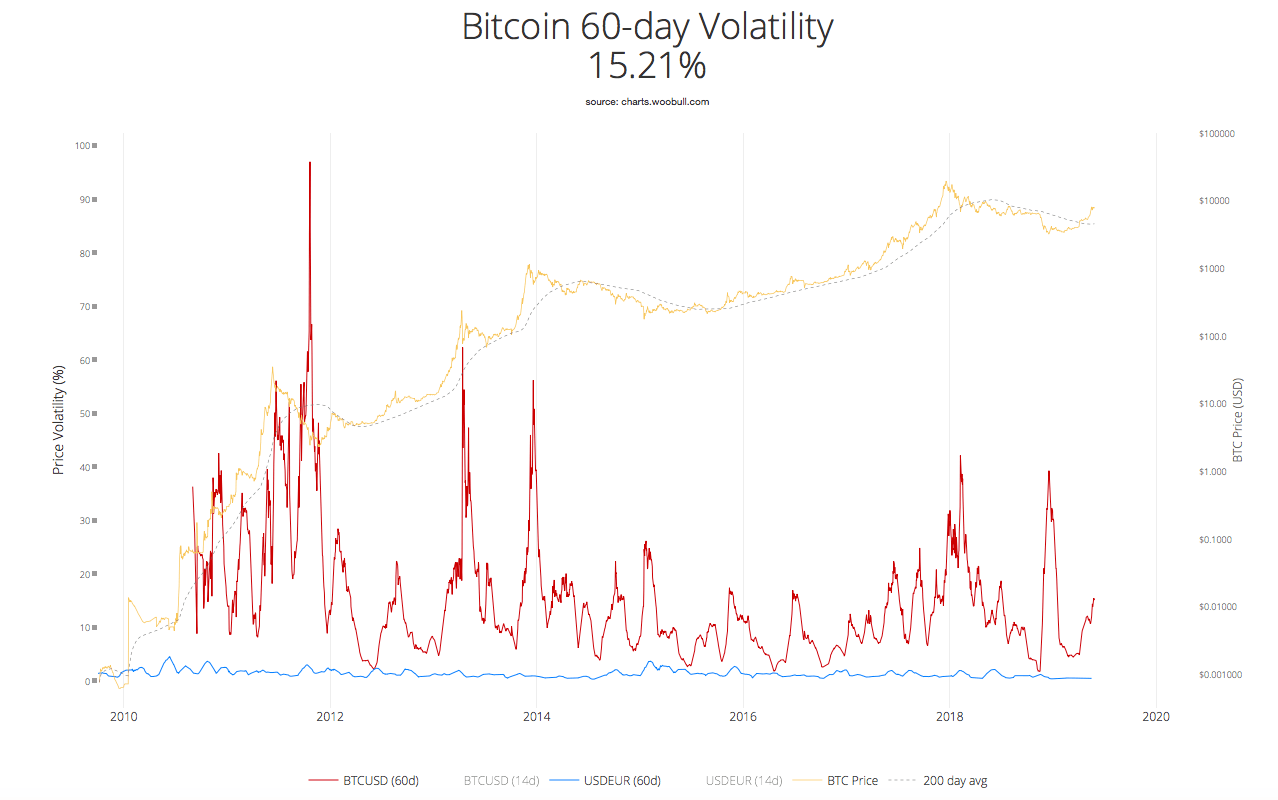

The US Dollar’s volatility hovers around 1 percent. Bitcoin’s volatility has been 15 percent in just the last 60 days.

I’d rather sell something and know that the value of the dollar will remain roughly the same for quite some time.

Bitcoin is for suckers. Fight me.