Bitcoin Exchange HitBTC Allegedly Bilks Traders in High-Stakes Token Swap

Major Bitcoin exchange HitBTC allegedly bilked crypto traders during a token swap for a lesser-known Ethereum token that recently made a major rally. | Source: Shutterstock

By CCN.com: If you Google the words “HitBTC” and “scam” together you get a lot of interesting results. The notable Bitcoin exchange appears very legitimate when you use it, but – at least in this reporter’s opinion – the anecdotes that come out of this place sometimes border on the disturbing. CCN.com received a tip from an alleged victim of their latest antics, in which they purportedly managed to bilk the entirety of their userbase out of MaxiMine, an ERC-20 token which has recently pumped by leaps and bounds.

Trader: HitBTC Failed to Swap MXM Crypto Tokens

Around the beginning of the month, MXM pumped by over 100%. Our source says this was right around the time that MXM issued a new smart contract. Holders of the old token were meant to be converted to the new contract, and crypto exchanges were issued tokens based on the amount they held.

MaxiMine explained the situation with HitBTC in a tweet:

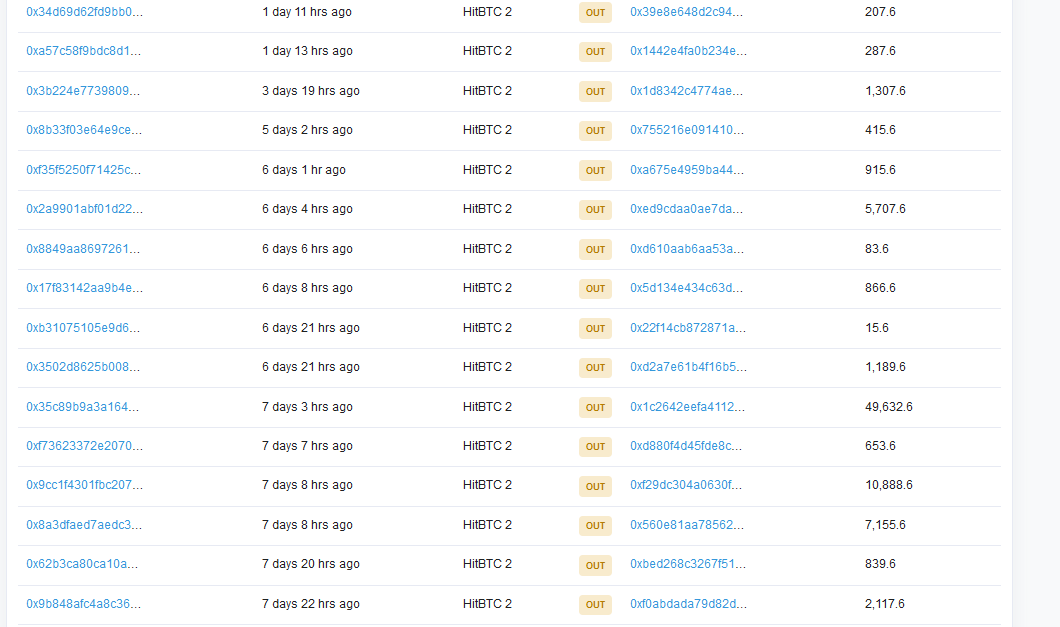

We can see from the blockchain that HitBTC does indeed hold over 280,000 MXM tokens under the new contract. None of these have moved since the exchange received them.

Our source says he’s only lost about $80 in MaxiMine, but knows of people who lost thousands of dollars. He attempted to withdraw his tokens because HitBTC shut down the MXM markets. This gave users only one option to continue trading them: withdraw and trade somewhere else (like CoinBene.) However, the tokens issued to HitBTC users are no longer valid MXM tokens. Granted under the old contract, they have no value whatsoever.

Over 140,000 MXM Crypto Tokens Lost So Far

Blockchain data verifies the story, supposing we had any doubt in our source. We can see on the Ethereum blockchain that, since the swap, numerous withdrawals have processed on the old contract . One transaction for nearly 50,000 MXM, worth about $7,000 at the height of the recent bull run, was processed about a week ago . The address sending these transactions belongs to HitBTC. Over 140,000 tokens have been sent using the old contract by HitBTC since the token swap took place.

We’ve reached out to HitBTC for comment, but they’ve never been proactive about responding to our press inquiries.

Since the pump, several crypto exchanges have listed MXM. But back in February, only HitBTC and CoinBene were listing it, and the price was less than a penny. At that time, HitBTC was processing only a fraction of the MXM overall volume.

MaxiMine promoters were initially proud of their listing on HitBTC, reporting on it last year:

HitBTC has not commented publicly on its delisting of MXM. The exchange has routinely participated in other software updates, apparently without a hitch. Just recently they supported a change in the TUSD smart contract, joined on as an official EOS block producer, and updated their Bitcoin ABC nodes.

However, according to our source and Twitter complaints, HitBTC is not receptive to feedback regarding the MXM boondoggle. The company allegedly banned numerous traders for asking after their tokens. Additionally, and this is important, the Bitcoin exchange has never explained why it suddenly delisted a market during its bull run.

Our source told CCN.com:

“The reason I chose to buy at HitBTC is because they were listed as an MXM partner, so I felt I could trust making my transactions there. Their blanket refusal to fix this just further shows they are not competent and should not be trusted with anyone’s money.”

HitBTC had several hours to respond to our inquiries before the publication of this post. This reporter advises any HitBTC users to take this information under advisement when deciding whether to continue using the exchange and to conduct research before depositing coins anywhere.