Binance, in One-Two Punch to Rival Exchanges, Readies Margin Trading

Binance has given its traders a peek into its upcoming margin trading platform, and its native cryptocurrency BNB soared by a double-digit percentage. | Source: Shutterstock

By CCN.com: Cryptocurrency exchange Binance has given followers a peek into its margin trading screen, and its native cryptocurrency BNB surged as much as 10% in response. Speculation about Binance’s expansion into margin trading has been swirling for a while.

True to the company’s style, they took to Twitter to reveal a screenshot of the upcoming margin trading user interface, posing the question to followers: “Dark mode or Light mode?” According to a report in TechCrunch , the new feature will be rolled out “soon.” With the screenshot comes a warning that while margin trading can deliver “higher profits,” there are also “greater risks.”

Investors Celebrate Binance Coin (BNB)

That’s the beauty of being a private blockchain company. You can tease major announcements like this without any regulatory backlash because BNB is a utility token and not a security.

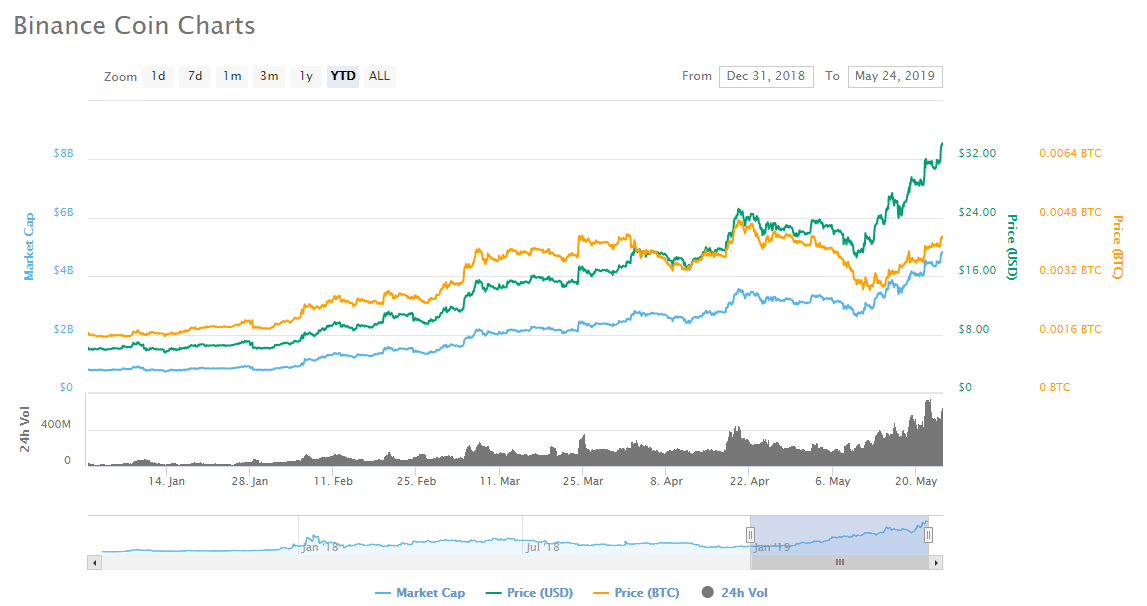

Binance Coin (BNB) soared roughly 10% on the heels of the development while the broader crypto market also trades in the green. The seventh-biggest cryptocurrency by market cap has shown resilience to the exchange’s $40 million bitcoin hack and is trading at a fresh high of more than $30.

Until now, Arthur Hayes’ BitMEX has been ruling the roost on bitcoin margin trading. Earlier this month, Hayes tweeted that the exchange set a record with trading volume of $10.03 billion over a 24-hour period, thanking both volatility and “wonderful traders.” Not to be outdone, Binance CEO Changpeng Zhao is looking to capture some of that market share.

Meanwhile, popular U.S.-based crypto exchange Coinbase is also exploring the possibility of adding margin trading to the platform for individual investors. Coinbase reportedly already supports margin trading for institutional investors for up to three-times leverage. Nothing could put a fire under the feet of CEO Brian Armstrong to expand to this feature individual investors like one of his company’s chief rivals, Binance, doing it first.

While the details of Binance’s margin trading business are scant, it has the potential to usher in more sophisticated traders to the crypto trading space – possibly to more jurisdictions. According to BitMEX’s website :

“Persons that are located in or a resident of the United States of America or Québec (Canada) are prohibited from holding positions or entering into contracts at BitMEX.”

Given the slow pace that a crypto regulatory framework is unfolding in the U.S., it’s unclear if Binance plans to support margin trading here.

Binance Presses On

The remarkable thing about Binance making a margin trading push is that it is so soon on the heels of the recent bitcoin hack. Granted, the 7,000 bitcoins or so lost were only a small percentage of the company’s BTC holdings. Nonetheless, it was a major blow that could have ended in one of two ways – crippling the exchange and CZ or propelling them further. Binance is nothing if not an example of how to press forward in the midst of adversity.

Disclaimer: CCN.com reached out to Binance via email but did not receive a response in time for publication. This story will be updated when we do.