Apple’s Asia Suppliers Slash Sales Forecasts as US-China Trade War Bites

An Apple flagship store in Thailand. Image: Shutterstock

Apple’s suppliers in Asia are cutting sales forecasts in anticipation of reduced iPhone sales as the U.S.-China trade war drags on.

Among the hardest hit include Taiwan Semiconductor Manufacturing CO (TSMC) which singlehandedly supplies the iPhone’s core processor chips.

According to the Nikkei Asia Review , TSMC estimates that its revenues during this year’s first quarter will fall by 22% compared to the previous quarter. The world’s largest contract chipmaker now expects revenues to come in at slightly over $7 billion. Year-on-year, TSMC estimates revenues will decline by 9%.

Disappointing iPhone Sales

Bernstein Research analyst Mark Li has blamed this on poor sales of the iPhone with shipments of the high-end smartphone expected to fall by about 13%, a trend that started late last year:

We think the current major slowdown at TSMC is mainly due to lackluster iPhone sales, and we forecast that TSMC could only grow some 0.5% for all 2019, but would resume growth of around 9% for 2020.

Besides the trade war, TSMC executives also blamed declining demand for premium smartphones and global economic uncertainty.

Another Apple supplier that is reeling from the trade war pain is Nidec which is the sole source of the iPhone’s vibration motor. The Japanese-based firm expects its full-year operating profits to decline by over 25%. This is the first time that Nidec is expecting a fall in full-year operating profit in six years. It is also the first time in nine years that Nidec will register a drop in sales.

Huawei to Dethrone Apple

This is not the only piece of bad news for Apple this week. On Monday CCN.com reported that Chinese smartphone maker is set to overtake Apple as the second-largest handset manufacturer behind Samsung. While the iPhone’s production volumes are falling, Huawei is expected to increase those numbers to 225 million smartphone units compared to Apple’s 189 million.

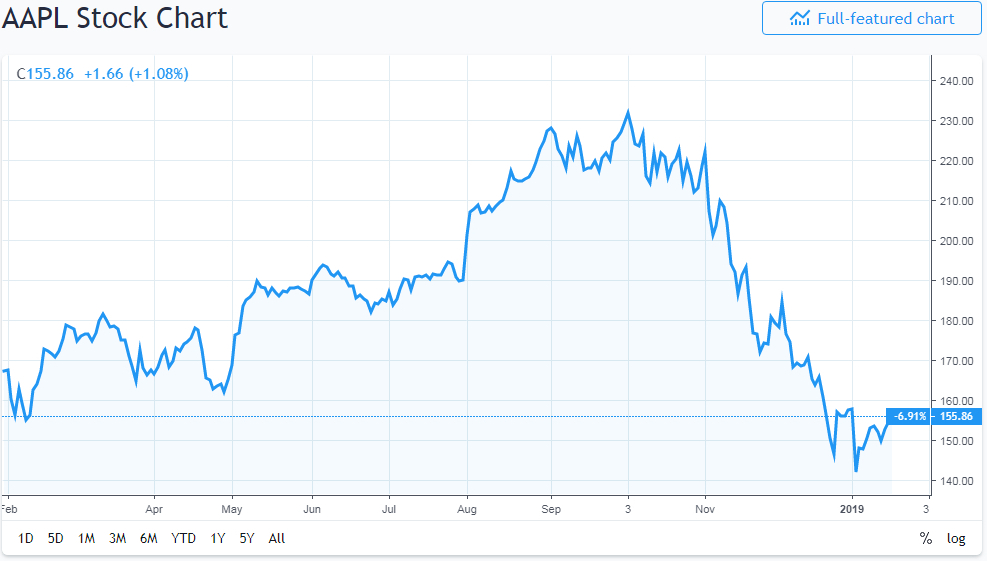

Fears of dampening demand for the iPhone, Apple’s biggest revenue generator, have also seen the company’s stock fall from its record high reached last year in early October. Consequently, Apple has since then its crown as the largest U.S. public firm by market cap, an honor that now belongs to online retailer Amazon.

Compared to other big technology stocks, Apple has disappointed as it is the only one in the FAANG family that hasn’t appreciated. Since the year began, Netflix has gone up by 33%, Amazon 9%, Google 5% and Facebook by 3%. Currently, Apple’s shares are trading at around $155, below the monthly high of nearly $159.